It’s better days ahead for Canadian cannabis name Indiva Ltd (Indiva Ltd Stock Quote, Charts, News, Analysts, Financials TSXV:NDVA), according to Echelon Capital Markets analyst Andrew Semple who delivered an update to clients on the company on Monday. Semple said Indiva’s growth prospects are good and the company should end 2022 on a profitable note.

London, Ontario-based Indiva delivered a corporate update on Monday where management lowered its guidance for the upcoming second quarter, saying product delivery delays are likely to result in a sequential decline in net revenue from Q1 to Q2.

“Excluding the impact of these delays, net revenue would have been higher on a sequential basis, as per the Company’s previous guidance. The Company maintains its guidance for higher sequential and year-over-year net revenue growth in the second half of 2022, driven by new product introductions,” Indiva said in a press release.

“The Company also remains on track to begin the commissioning and implementation of automation in processing and packaging at its production facility in London, Ontario in the second half of 2022,” Indiva said.

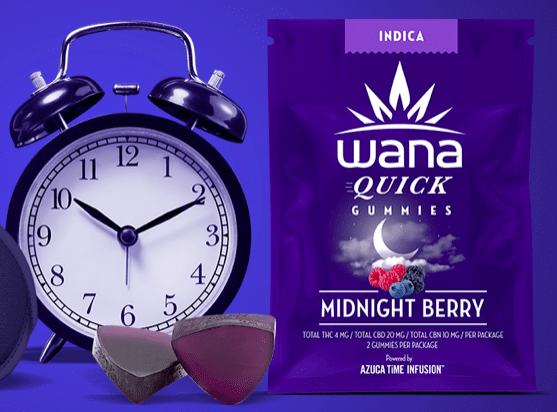

Indiva, which has edibles brands including Bhang Chocolate, Wana Sour Gummies and Jewels Chewable Tablets, has seen its share price tumble over the past year and a bit, along with the rest of the cannabis space, heading for a past-12-months loss of about 48 per cent.

But Semple sees better times ahead for company and stock, reiterating in his report a “Speculative Buy” rating for NDVA and $0.50 per share target price, which at the time of publication represented a projected one-year return of 194 per cent.

“We have moderated our near-term estimates as the Company navigates supply chain and delivery appointment delays, though changes to estimates are largely confined to revenues with only relatively minor changes to margins and adj. EBITDA beyond Q222. Our long-term estimates remain essentially unchanged, as we believe the near-term headwinds were beyond management’s control and have little read-through to the Company’s new product launches,” Semple wrote.

Semple said Indiva has new products to launch across Canada which will drive revenue growth over the second half of 2022, with, according to the company, strong initial orders from the Ontario Cannabis Stor for its new Grön Pearls gummies, set to launch in July in Ontario and in additional provinces in late Q3 2022. The company said it has confirmation from the OCS for an additional 25 SKUs, putting its total at 60 SKUs across six different brands.

Semple said the company’s “continued innovation” in the edibles category should allow it to keep its leadership status in that market, while the analyst said he’s also encouraged by the company’s expansion into vapes, an underrepresented category, according to the analyst.

“These product launches, alongside the implementation of automation across processing and packaging functions at the Company’s production facility should propel revenue growth through H222 and help Indiva return to profitability,” Semple wrote.

Semple has revised his estimates to reflect the announced supply chain and delivery delays, calling now for $8.2 million in 2022 Q2 revenue (previously $9.6 million) and an adjusted EBITDA loss of $0.5 million (previously a loss of $0.2 million). The consensus calls for the Q2 are $9.6 million in revenue and negative $0.2 million in EBITDA.

For the full 2022 year, Semple is estimating $43.7 million in revenue (previously $45.7 million) and $1.1 million in adjusted EBITDA (previously $1.6 million).

The analyst said he’s monitoring Indiva’s liquidity after the reduced Q2 outlook, noting the company reported a cash balance of $2.4 million as of March 31, 2022, a number he called healthy. Semple said Indiva can likely self-finance growth this year, although he’s also assuming the company will raise $5 million of debt capital at a ten per cent coupon before the year end to give it some added flexibility.

“Despite the slight reduction in projected revenues, we still believe that Indiva will return to positive adjusted EBITDA in Q322 and report a profitable full 2022 year. Our forecasts remain dependent on Indiva deploying automation equipment at its production facility in Q322, and the successful roll out of new products in Q322,” Semple wrote.

Share

Share Tweet

Tweet Share

Share

Comment