You gotta own Tesla, this fund manager says

The stock may be bouncing around too much for anyone’s liking but Tesla (Tesla Stock Quote, Charts, News, Analysts, Financials NASDAQ:TSLA) is one stock that should really be in your portfolio, says Shane Obata of Middlefield Capital, who argues whether you call it a car-maker or a tech company Tesla is still a very attractive bet in the electric vehicle space.

“We’ve had pretty good success as a holder of Tesla. We continue to like the name. The valuation is very high and we’re aware of that as a potential risk, but we think that Tesla has multiple different reasons why it’s in this leadership position,” said Obata, portfolio manager at Middlefield, who spoke on BNN Bloomberg on Friday.

Tesla shares are falling hard in recent trading sessions as the general market continues to take a beating on fears of slowing economic growth, rising interest rates, inflation as well as geopolitical concerns. All that has played out in an over-sized way for growth stocks which have certainly lost their appeal with investors over the past half-year.

Names like Amazon, Meta and Apple are all down significantly, as is Tesla, which is now down almost 35 per cent since early November. Still, the gains to the stock over the past two years have been phenomenal, and shareholders have plenty to be happy about, as TSLA is up about 400 per cent since May of 2020.

But Obata believes the good times aren’t all in the rearview mirror, since Tesla’s dominance in the EV industry will keep it in the driver’s seat for a while yet.

“I’m not going to come out and tell you that it’s a tech company because they make cars but at the same time they do have what we think is the best tech around,” he said. “They’re fully vertically integrated to make electric vehicles and we think that’s really panning out. As you can see, their recent results have been better than expected — deliveries continue to ramp up with new facilities coming online and they’re ramping production there. And they’ve been able to keep control of costs which has been very impressive and I think that speaks to the vertical integration.”

“In terms of demand, I think it’s one of those companies that you can raise prices and that’s not really going to faze the end consumer. The end consumer for Tesla is … [a buyer of] a higher end or more expensive car, and so I think consumers really, really enjoy the product,” he said.

Tesla reported revenue up a huge 81 per cent in its latest quarter, the company’s Q1 2022, delivered on April 20. Tesla’s topline of $18.756 billion beat analysts’ consensus estimate at $17.80, while EPS of $3.22 per share was well above the Street’s call for $2.26 per share.

“The first quarter of 2022 was another record quarter for Tesla by several measures such as revenues, vehicle deliveries, operating profit and an operating margin of over 19 per cent. Our outstanding recourse debt has fallen below $0.1 billion at the end of Q1. Public interest in a sustainable future continues to rise, and we remain focused on growing as fast as is reasonably possible,” the company said in a press release.

Quarterly profitability, a long-term bugaboo for Tesla as it struggled over the years to deliver product on time and to cut costs while scaling up, was impressive, with Q1 year-over-year adjusted EBITDA growth of 173 per cent to $5.023 billion. Free cash flow grew from $293 million a year ago to $2.228 billion, as well.

Like manufacturers the world over, Tesla is dealing with supply chain issues, and it hasn’t helped investor confidence of late that its main car factory in Asia is in Shanghai, where COVID-19 has hobbled production in recent months.

Nevertheless, the pace of Tesla’s expansion has been a sight to behold, having opened up just in the past few years so-called gigafactories for cars in Nevada, Berlin and Austin, Texas, along with the Shanghai location.

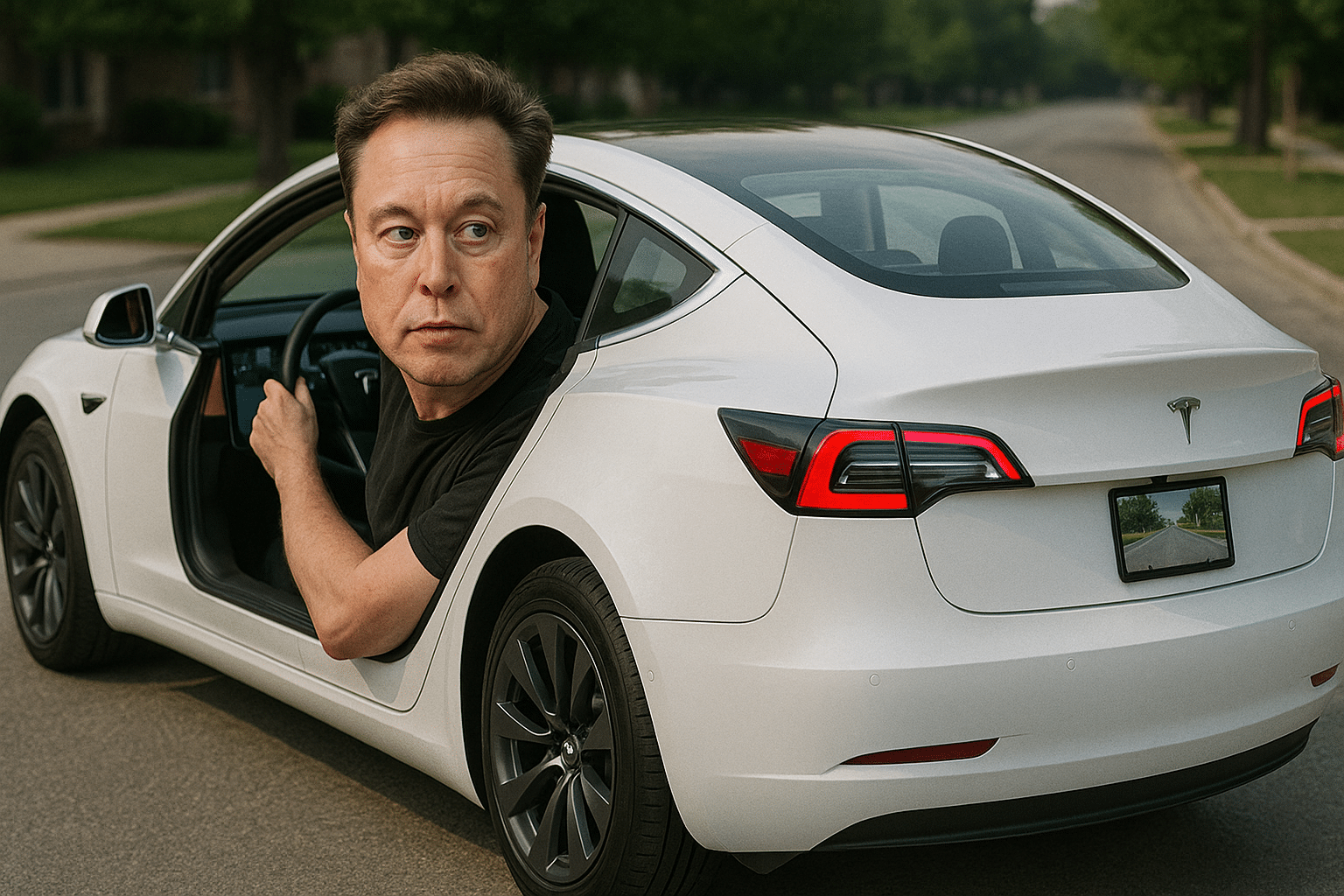

Obata thinks buying Tesla stock is not only a bet on the company and its superior tech but on mercurial CEO Elon Musk, who despite having an urge to put on more hats including a current attempt at taking over social media company Twitter continues to perform admirably.

“The technology, they’re viewed as having a big lead there, and then autonomous driving is still far away but we think that is something that Tesla should do fine in as well as competitors such as Waymo. The company has a lot of things going for it,” Obata said.

“I can understand people who are a little bit apprehensive to step in as a buyer, but it’s a difficult stock to sell because you’re betting against the execution of the company and also against Elon Musk, who is pretty clearly a genius who is running multiple businesses right now and doing it successfully somehow,” he said.

Staff

Writer