Eight Capital analyst Christian Sgro remains vocal in his support for Voxtur Analytics (Voxtur Analytics Stock Quote, Chart, News, Analysts, Financials TSXV:VXTR), maintaining his “Buy” rating and target price of $2/share for a projected return of 60 per cent in an update to clients on Tuesday.

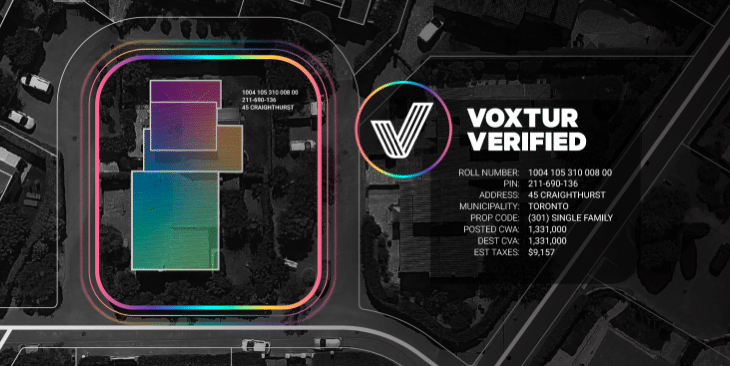

With its headquarters located in Toronto, Voxtur Analytics (previously known as iLOOKABOUT Corp) offers data analytics to simplify tax solutions, property valuation and settlement services throughout the lending lifecycle for investors, lenders, government agencies and servicers.

Sgro’s latest analysis comes after the company released its fourth quarter financial results, which Sgro noted to be at the high end of management guidance.

“We now model revenue at the upper limit of the guided $170-190 million range given management’s confidence in the outlook and numerous opportunities scaling through the balance of the year which represent upside to current guidance,” Sgro said. “With respect to margins, we have tempered our adj. EBITDA estimates consistent with commentary however expect significant GM% expansion through the year as software solutions scale.”

Voxtur’s Q4 was headlined by $38.8 million in revenue for a 57 per cent sequential increase paired with $12.6 million in gross profit, which came in slightly below the Eight Capital expectation of a 35.7 per cent margin, though Sgro expects near-term margin improvement as scalable software revenues comprise a larger proportion of forward revenue.

Meanwhile, the company reported a breakeven adjusted EBITDA, which came in ahead of the Eight Capital estimate of a $1.2 million loss.

“2021 was a formative year for Voxtur, as we concentrated on revenue development through creative data-driven alternatives to established products in the valuation, title, and property tax spaces,” said Jim Albertelli, CEO of Voxtur in the company’s May 2 press release. “We expanded our data set, added synergistic technologies, and focused on cross-selling opportunities. Due to our investment in growing our sales pipeline and technologies, we expect considerable revenue growth from new clients in 2022.”

The company wrapped up 2021 with $95.9 million in revenue for a 368 per cent year-over-year increase, and Sgro forecasts the company to break into nine figures with a projection of $189.8 million in 2022 for a near doubling, though the figure comes in well below the consensus projection of $230.1 million. Looking ahead to 2023, Sgro forecasts revenue of $227.1 million for a 20 per cent year-over-year increase.

From a valuation standpoint, Sgro forecasts the company’s EV/Revenue to drop from the reported 6.8x in 2021 to a projected 3.5x in 2022, then to a projected 2.9x in 2023.

Sgro also expects the company’s adjusted EBITDA to turn positive in 2022 at a $6.4 million estimate for a 3.4 per cent margin compared to the consensus expectation of $23.8 million and a 10.3 per cent margin. Looking to 2023, Sgro forecasts $27.4 million in adjusted EBITDA with a 12.4 per cent margin, and he also introduces an EV/EBITDA multiple of 24x.

Voxtur’s stock has produced a 5.1 per cent return since the start of the calendar year, though it has dropped slightly since hitting a peak of $1.63/share on April 18.

Share

Share Tweet

Tweet Share

Share

Comment