Lately, the market has been tough all around but perhaps not so bad as the pounding taken over the past eight months by COVID vaccine company Moderna (Moderna Stock Quote, Charts, News, Analysts, Financials NASDAQ:MRNA), which has seen its share price drop more than 70 per cent of its value over that period.

But investors looking for a cheap pickup in the Pharma vaccine space should probably go for Pfizer (Pfizer tock Quote, Charts, News, Analysts, Financials NYSE:PFE) over Moderna, according to Paul MacDonald, chief investment officer at Harvest Portfolios Group, who likes the diversified offerings of Pfizer compared to Moderna’s more limited prospects.

“[Moderna’s] chart really has come full circle. They were one of the early companies to actually develop an mRNA vaccine for COVID and so that was just a tremendous short-term win, not just for society but for the company,” said MacDonald, speaking on BNN Bloomberg on Thursday.

Used to making the news for its vaccine breakthroughs which have supported the world’s fight against COVID-19, biotech company Moderna is in the headlines this week for a different reason as newly appointed CFO Jorge Gomez has stepped down after only a day on the job, with the company saying Gomez’ former employer, dental products company Dentsply Sirona disclosed an internal probe related to financial reporting.

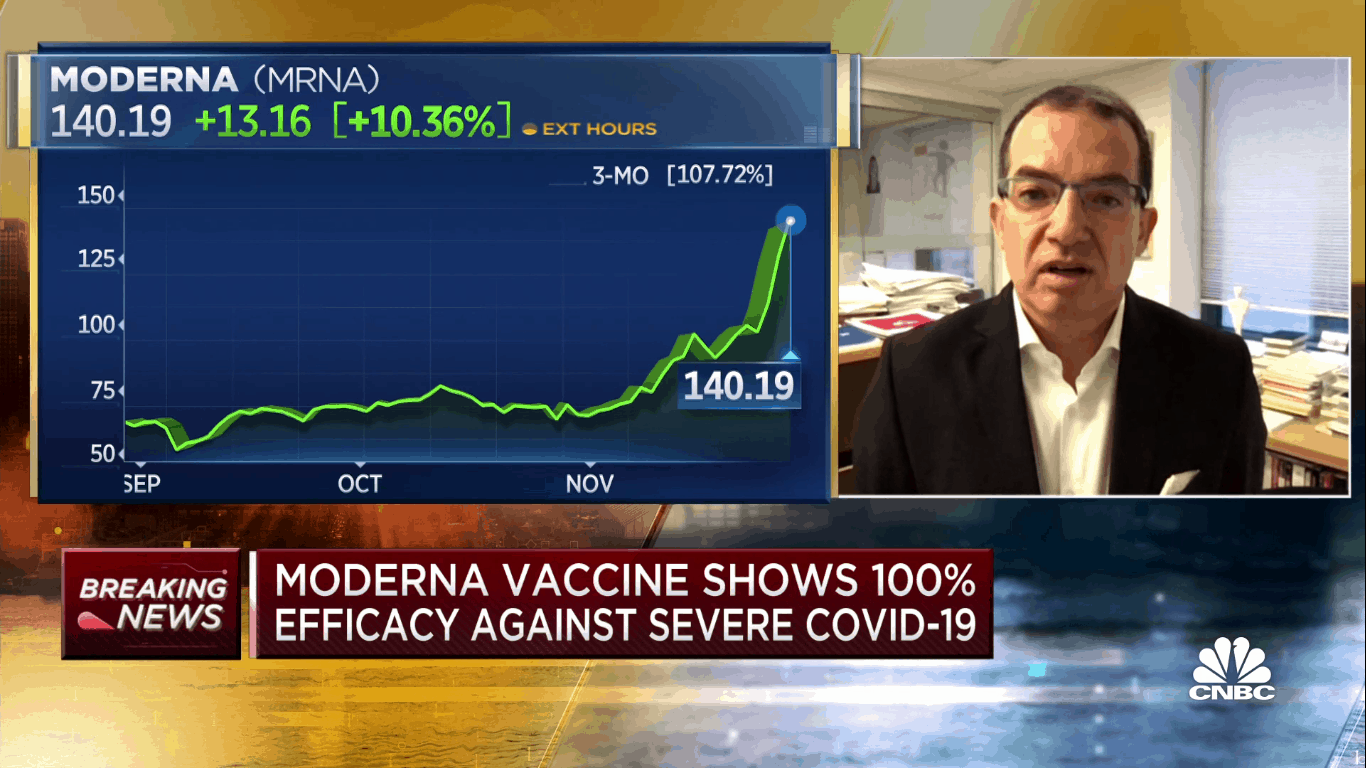

It’s another bump in the road for Moderna whose stock has made a quick turnaround from market darling to goat, rising from less than $20 per share in the early days of COVID to as high as $450 by last July. From there, MRNA has been dropping fairly steadily and currently trades around the $130 per share mark.

MacDonald said the up-and-down over the past two years is a result of Moderna’s small stable of products on offer, which after the COVID vaccine are not enough to rely upon for future growth.

“Will these [pharma] companies make a lot of money from [COVID]? The answer is absolutely they did, but I put that in past tense because we’re really coming from pandemic to endemic and so we’re starting to really see those revenues tail off over the next the next really two years,” he said.

“When I think about a Moderna, it was a really high-multiple stock that has very short term cash flows,” MacDonald said. “The question is what do you do with it now that it has corrected. They do have a Phase 3 [clinical trial] coming out on the flu and they’ve got some other mRNA vaccine-related early stage trials that they’re doing. But that cash cow does start to wind down from COVID in late 2023 and 2024.”

Last week, Moderna delivered a bang-up quarter, with sales more than tripling year-over-year and earnings soaring to $3.66 billion compared to $1.2 billion a year earlier. First quarter revenue was $6.7 billion compared to just $4.62 billion expected by analysts, while adjusted EPS was a full $8.58 per share compared to the $5.21 per share estimate from the Street. $5.9 billion of that topline came from COVID vaccine sales, however, which shows how fully the company’s business is linked to COVID-19.

MacDonald says Pfizer’s pipeline along with its strong M&A activity of late should be attractive to investors.

“Pfizer has a much more diversified business,” said MacDonald. “But out of all of the various companies, whether it’s Eli Lilly, Regeneron or even a Gilead that had some wins on COVID, early on from treatments, unquestionably the gold standard is Pfizer and not just from a vaccine perspective but also from PAXLOVID, their treatment that really is a massive cash flow win.”

“What I really like about what they’re doing — which I really haven’t seen a whole lot of in Moderna — is the CEO at Pfizer is making acquisitions. They’ve made a number of $5-$15 billion acquisitions just in the past four or five months, really building out that pipeline from these cashflow wins, out 2025 to 2027,” he said. “So, we would prefer not to have the type of rockets and torpedoes that you get with a Moderna. I think you’re getting a better mRNA franchise with Pfizer, you’re getting all the other benefits of that diversity and a management team that is starting to execute on that pipeline of acquisitions at a time when a lot of these companies are beat down.”

Pfizer announced on Tuesday an agreement to buy Biohaven, a Pharma company that makes NURTEC ODT, a migraine therapy that has been approved for acute and episodic migraine in adults. Pfizer has offered to pay $11.6 billion for Biohaven, saying the acquisition will expand the company’s Internal Medicine pipeline.

“NURTEC ODT, which is already the #1 prescribed migraine medicine in its class in the United States, coupled with Biohaven’s CGRP pipeline, offers hope for patients suffering from migraine worldwide,” said Nick Lagunowich, Global President for Pfizer’s Internal Medicine segment, in a press release. “We believe Pfizer is uniquely positioned to help the portfolio reach its full potential given our leading scale and capabilities, including comprehensive field force engagement with Primary Care Physicians, specialists and health systems delivering the right information at the right time.”

Share

Share Tweet

Tweet Share

Share

Comment