The stock has fallen off a cliff but Desjardins analyst Jerome Dubreuil thinks the selloff went too far on LifeSpeak Inc (LifeSpeak Stock Quote, Charts, News, Analysts, Financials TSX:LSPK). In a report on Friday, Dubreuil maintained a “Buy” rating on LSPK while slashing his target price from $13/share to $6/share for a projected return of 700 per cent at the time of publication.

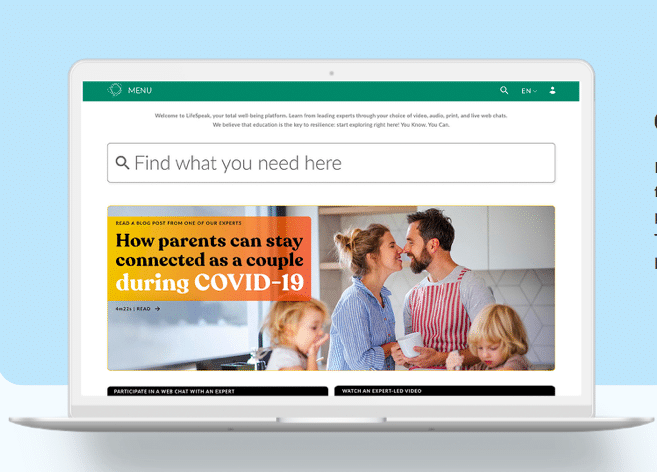

LifeSpeak shares rallied on Friday but the drop over the past month has been severe, taking the stock from $6.00 to $1.00 in short order. Toronto-based LifeSpeak provides software-as-a-service solutions for mental health and total well-being education for mid- and enterprise-sized organizations. The company also creates videos, podcasts, tip sheets, quizzes, tailored articles, and expert-led educational resources for mental health, as well as training and development for employees and managers.

Dubreuil’s updated analysis comes after LifeSpeak released first quarter financial results for the 2022 fiscal year. The quarter was adversely impacted by significantly reduced recognizable revenue related to one LifeSpeak client, which at one point was considered the largest client in LifeSpeak’s embedded solutions platform, with that contract now being extended to August 31.

“In light of a very tough day for LSPK shareholders, we see no valid reason for a sell-off of this magnitude (-74%). While an issue with one contract can generate concerns about the prospects for overall retention metrics, LSPK has not yet given up on the contract (less than five per cent of ARR) and expects 2022 results to land ‘at or near the lower end’ of its guidance,” Dubreuil said.

According to Dubreuil, the ongoing contract renegotiation produced a negative impact of less than $2 million, which Dubreuil believes to show the rest of the business being relatively healthy.

“LSPK sees a decent chance that the contract can be renewed,” Dubreuil said. “One data point is not enough evidence of a material impact on the entire business model, which we believe the share price currently reflects.”

Despite an increase in the number of enterprise clients in the quarter, LifeSpeak’s revenue of $8.7 million came in well below the Desjardins projection of $10.5 million, though it still represented a 77 per cent year-over-year increase. ARR also came in at a miss at $51.1 million compared to the $55.1 million estimate set out by Desjardins, though it is still a 144 per cent year-over-year increase from the $21 million in ARR from the first quarter of 2021.

Meanwhile, the company also took hits on its margins, as the gross profit of $7.4 million for an 85.3 per cent margin missed the 88.3 per cent margin target set by Desjardins, as well as being short of the 91.8 per cent margin reported in the opening quarter of 2021. The company’s adjusted EBITDA came in at $382,000 for a 4.4 per cent margin, well off the Desjardins forecast of $1.7 million and a 16.3 per cent margin, as well as being well off from the $1.9 million and 38 per cent margin reported in the same quarter of 2021.

“The first quarter of 2022 marked a period of significant transition for LifeSpeak as we evolved into a more diverse company on the strength of our recent acquisitions and the ongoing contributions from our core business,” said Michael Held, CEO and Founder of LifeSpeak in the company’s May 12 press release. “While we experienced an isolated delay in a renewal with an embedded solutions client, our underlying first quarter financial results were consistent with the strength and resilience of the business. As we look ahead, we anticipate continued organic growth supported by our enterprise and embedded business, as well as accelerated cross-sell opportunities within our large existing portfolio of clients.”

The most recent financial results prompted changes to Dubreuil’s financial projections, lowering his 2022 revenue target from $66.1 million to a new estimate of $56.6 million for a potential year-over-year increase of 142.9 per cent. Looking ahead to 2023, Dubreuil has lowered his projection from $96.6 million to $83.3 million, good for a potential year-over-year increase of 47.2 per cent.

In terms of valuation, Dubreuil forecasts a decrease in the company’s EV/Revenue multiple from the reported 5.2x in 2021 to a projected 2.1x in 2022, then to a projected 1.5x in 2023.

Dubreuil’s reductions and revisions also extend to his adjusted EBITDA forecast, lowering his 2022 estimate from $22.1 million to $13.8 million for an implied margin of 24.4 per cent. For 2023, Dubreuil has lowered his projection from $40.4 million to $31.5 million, implying a wider margin of 37.8 per cent.

From a valuation perspective, Dubreuil forecasts the EV/adjusted EBITDA to drop from 18.3x in 2021 to 8.8x in 2022, then dropping again to a projected 3.8x in 2023.

LifeSpeak has lost 84.1 per cent of its stock price since the start of 2022, with an 80.7 per cent drop in the last month.

Share

Share Tweet

Tweet Share

Share

Comment