Kinaxis is still our Top Pick, says National Bank

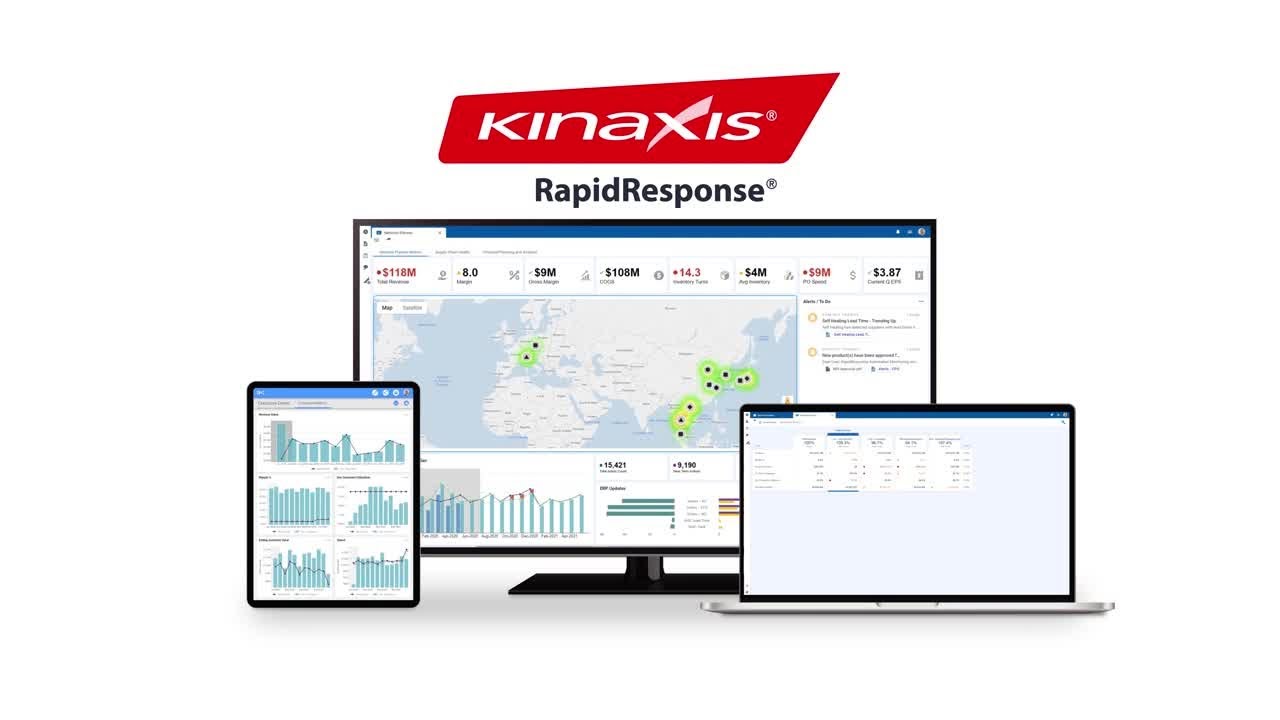

Canadian software company Kinaxis (Kinaxis Stock Quote, Charts, News, Analysts, Financials TSX:KXS) is still one to watch, according to National Bank analyst Richard Tse, who recently reiterated his Top Pick status for KXS, saying the company’s runway is large and the market for its supply chain management solutions is still growing.

Kinaxis hosted its Kinexions supply chain innovation conference last week, with a focus how the challenges in the space over the past couple of years have spurred companies to adapt and innovate. National Bank’s Tse was in attendance and he recounted some of the highlights of the sold-out, in-person event in a client report on May 12.

“The overall takeaway was that this name firmly remains one of our Top Picks. And while it’s been some time since we’ve attended this event, having attended consecutive past Kinexions going back to when Kinaxis was a private company, we can confidently say the runway continues to be long and wide. Perhaps it was because of the euphoria of the attendees being able to participate in a live conference, but we think it had more to do with the foundation laid by Kinaxis and its unique platform that’s setting it up for more scale,” wrote Tse in his report.

Tse laid out a number of key reflections on Kinaxis, starting with the observation that the digital transformation still has a long way to go in supply chain management. Tse quoted a stat from an Accenture presentation at Kinexions which said that 92 per cent of companies polled still have Excel spreadsheets as an essential part of the Supply Chain Planning process. Tse reflected that for many companies getting over the hump of holding onto their internally-built worksheets is now becoming more urgent.

“For the [conference] attendees, it would seem that many are recognizing the continuing iteration of those internally-built worksheets as unsustainable with supply chains becoming more complex and that more insight is being asked which often is beyond the scope of those internally-built solutions,” he said.

Tse also spoke about Kinaxis’ new Planning.AI solution that can automatically detect and respond to problems in concurrent planning, available now in limited release as Demand.AI and Supply.AI modules. Tse said the new Planning.AI tool has the potential to extend the company’s reach into new markets.

“From what we saw at the breakout sessions for this solution (at capacity – standing room only), there’s a lot of interest in Planning.AI, again, due in large part to the limitations of internally-built worksheets when it comes to providing any equivalent capability,” Tse said.

Tse also spoke of Kinaxis’ clientele, which has been traditionally enterprise-level but seems to now be broadening to mid-sized companies who are more aware of the supply chain planning market than previously assumed. As well, Tse pointed to Kinaxis’ historically disciplined capital allocation and the high esteem the company garners on the world stage. Finally, Tse noted as a last big takeaway that the company is making a shift to add more cloud capabilities to its mix, a move which the analyst said is still unclear in the way it will play out and its impact on cash flows.

“We continue to believe KXS’s valuation does not fully value a ‘normalized’ financial run rate looking ahead, particularly given what we estimate to be a market share of less than 5 per cent. With our expectations for accelerating momentum beyond the current pandemic, we reiterate our Outperform rating with a $250 target based on our DCF which implies EV/Sales of 13.7x on our F2023 estimates (unchanged),” Tse wrote.

At press time, Tse’s maintained $250 per share target price represented a projected one-year return of 89.6 per cent.