Raymond James analyst Rahul Sarugaser likes the first quarter results from cannabis play Indiva Limited (Indiva Limited Stock Quote, Chart, News, Analysts, Financials TSXV:NDVA). Sarugaser maintained an “Outperform 2” rating and $0.60/share target price for a 140 per cent return in an update to clients on Thursday.

London, Ontario-based Indiva Limited is a licensed producer and distributor of medical cannabis products made of psychoactive drug flowers and oils extracts within the Canadian cannabis market.

Sarugaser’s latest update comes after the company released its first quarter financial results for the 2022 fiscal year.

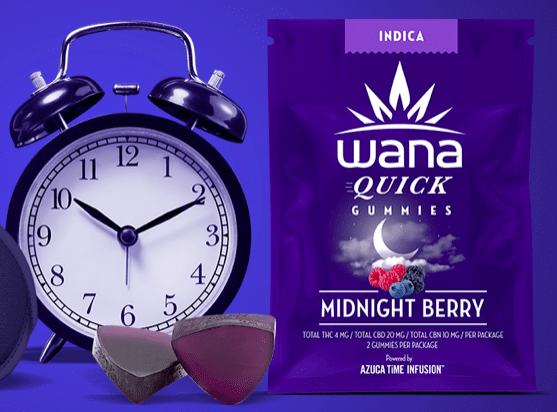

“NDVA is on the cusp of launching several new brands, materially expanding its exposure to the broader cannabis market and, we expect, materially reducing the company’s reliance on the Wana gummies brand, which accounts for more than 80 per cent of NDVA’s sales,” Sarugaser said. “This enhanced optionality we view as a big positive.”

Indiva’s financial quarter came in with topline revenue of $9 million to beat the Raymond James estimate of $8.3 million, though the figure did represent a 5.3 per cent sequential decrease. However, Sarugaser noted the decrease to be minimal compared to some of the industry’s larger players who experienced 20 to 30 per cent sequential drops.

Despite the revenue beat, Sarugaser noted that Indiva fell three places in terms of its overall market share, with its 2.1 per cent share as of the end of the quarter dropping Indiva to 14th behind Weed Me, The Valens Company and Entourage Health.

Meanwhile, the company reported an adjusted EBITDA loss of $0.3 million, which was in line with the Raymond James estimate of a $0.2 million loss while being a slight improvement on the previous quarter loss of $0.5 million.

The company’s net income came in at a $3 million loss for the quarter, producing a beat in relation to the $6 million loss projected by Raymond James, though it also presented a shift from the $1.8 million loss reported in the previous quarter.

All told, the company exited the quarter with $2.4 million in cash available compared to $21.2 million in debt, representing slight shifts from the $2.5 million in cash and $21.5 million in debt reported in the previous quarter.

“We are pleased to report very strong year-over-year revenue growth in the first quarter of 2022, and continued gross margin improvement compared to fiscal 2021. According to data from Hifyre Inc., Indiva continues as the dominant national market share leader in edibles,” said Niel Marotta, President and Chief Executive Officer of Indiva in the company’s May 19 press release. “Looking forward, we have many new products and brands to introduce in 2022, as we leverage our distribution across all 13 provinces and territories in Canada. Specifically, Indiva will continue to delight its customers and clients and drive margin-accretive top line growth in 2022.”

Looking ahead to the rest of 2022, Sarugaser indicated that the company will launch a suite of value-priced, non-traditional edibles products licensed from Grön, with first shipments to the OCS expected in July. The company is also expecting to launch a suite of differentiated flavoured vape products licensed from Dime Industries, which will mark Indiva’s initial entry into the vape category.

“While this is a new category for NDVA, its facilities are well-equipped for formulating extracts and fill cartridges,” Sarugaser said. “The company indicates that less than $50k of CAPEX will be required to tool up its vape manufacturing lines.”

In addition, the company will be launching its own Indiva Life brand, which will combine in-house products like stuffed cookies, THC lozenges, new chocolate offerings and numerous pre-roll products.

“We view the sum of these new brand and product introductions as very positive, and we expect these efforts—NDVA’s entry into the vape category, in particular—to drive material Rev. growth during 2H22,” Sarugaser said.

After finishing 2021 with $31 million in revenue, Sarugaser continues to forecast $42 million in revenue for Indiva in 2022, good for a potential year-over-year increase of 35.5 per cent. Looking ahead to 2023, Sarugaser continues to forecast a jump to $70 million in revenue for a potential year-over-year jump of 66.7 per cent.

From a valuation perspective, Sarugaser forecasts the company’s EV/Revenue multiple from the reported 1.5x in 2021 to a projected 1.1x in 2022, then dropping to a projected 0.7x in 2023.

Meanwhile, Sarugaser continues to forecast a loss of $1 million for 2022 before turning positive in 2023 at a projected $7 million for a forecasted 10 per cent margin, while also introducing an EV/EBITDA multiple of 6.4x for 2023.

Indiva Limited’s stock price has dropped by 40 per cent since the start of 2022, dropping off after an early peak of $0.38/share on January 6, closing today at a 2022 low of $0.21/share.

Share

Share Tweet

Tweet Share

Share

Comment