Beacon Securities analyst Ahmad Shaath is looking to renew his optimism on Greenlane Renewables (Greenlane Renewables Stock Quote, Charts, Analysts, News, Financials TSX:GRN). Though he maintained a “Buy” rating in an update to clients on Monday, it came with a lowering of the target price from $1.75/share to $1.30/share for a projected return of 76 per cent.

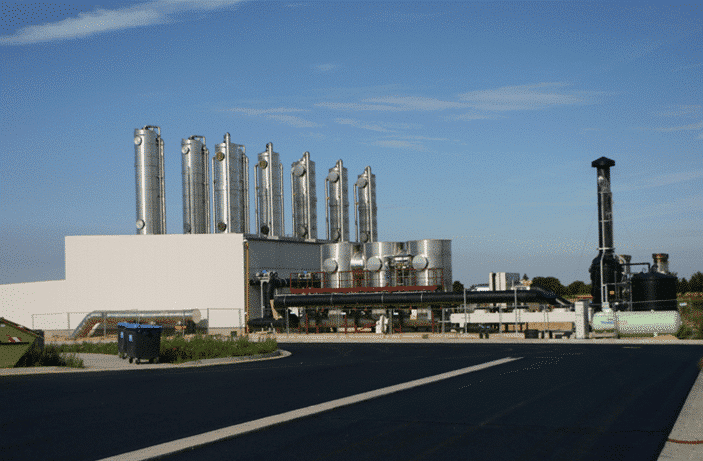

Founded in 1986 and headquartered in Burnaby, B.C., Greenlane Renewables designs, develops, sells and services a range of biogas upgrading systems, which remove impurities and separate carbon dioxide from biomethane in raw biogas created from anaerobic decomposition of organic waste at landfills, wastewater treatment plants and farms. The result is renewable natural gas that can be fed into the grid or used as vehicle fuel.

Shaath’s latest analysis comes after Greenlane Renewables released first quarter financial results for the 2022 fiscal year, which he noted to be in line with consensus, but below Beacon forecasts.

Greenlane’s fiscal quarter was headlined by $16.3 million in revenue to be in line with consensus but beneath Shaath’s forecast of $17.2 million as the report accounted for two months of contributions from AirDep at approximately $0.9 million, as well as a sequential drop in upgrade projects, which Shaath explained to be a function of normal ebbs and flows of the business on account of fewer contract wins.

Meanwhile, the company’s adjusted EBITDA was breakeven to again be in line with the consensus, though Shaath had estimated $0.2 million for the quarter. After taking into account Strategic Initiatives the company had left out, adjusted EBITDA became a $0.3 million loss in the quarter, with Shaath attributing the miss to higher expenses, lower revenue and a slightly lower gross margin.

All told, the company increased its sales pipeline from $850 million to $900 million, produced a sales backlog of $35.7 million, and ended the quarter with $24.7 million in cash available against zero debt.

“Despite challenging macro market conditions including the conflict in Eastern Europe, supply chain disruptions and inflationary pressures, we continue to see strong demand for RNG generally and for our products specifically,” said Brad Douville, President and CEO of Greenlane in the company’s May 12 press release. “We have been reminded that energy security is paramount and an issue that must be and can be solved at the same time as the climate crisis. RNG has an important role to play in both. Our first quarter of 2022 was marked by another strong set of results with revenue generated during the period the second highest in Company history and our sixth consecutive quarter of positive Adjusted EBITDA. To match the rapid growth of the RNG industry and of Greenlane, we continue to build the Company and strengthen the team by reinvesting prudently in the business to maintain product and market leadership.”

The release of the quarterly results has prompted Shaath to shift his 2022 projections for the company, lowering his revenue target to $69.3 million for a potential year-over-year increase of 26 per cent. Looking ahead to 2023, Shaath maintains a revenue target of $77.3 million, suggesting a year-over-year increase of 11.5 per cent.

In terms of valuation, Shaath forecasts the company’s EV/Sales multiple to drop from the reported 1.6x in 2021 to a projected 1.3x in 2022, then dropping to a projected 1.1x in 2023.

Meanwhile, after reporting positive adjusted EBITDA of $1.1 million in 2021, Shaath forecasts a loss of $0.5 million in 2022 before another positive turn in 2023 at a projected $1.5 million for a potential margin of 1.9 per cent.

From a valuation perspective, Shaath reported an EV/EBITDA multiple of 78.9x in 2021 and after a negative forecast for 2022 he forecasts a multiple of 57.9x in 2023.

Shaath also forecasts a slight drop in the company’s gross margin from the reported 25.5 per cent ($14.1 million) in 2021 to a projected 24.5 per cent ($17 million) in 2022, only to widen to a projected 26 per cent ($20.1 million) in 2023.

“Q1/FY22 was the first quarter post GRN’s decision to withdraw its gross margin guidance, and gross margin came in below the low end of the now-defunct guidance (25 per cent) but generally in line with our expectations,” Shaath said. “In the current inflationary environment, cost controls are difficult but through our conversations with GRN management we do not feel that gross margins will dip much below the old target.”

Greenlane Renewables has seen its stock price drop off by 43.1 per cent since the start of 2022. After starting the year trading at $1.30/share, the stock has gradually dropped ever since, punctuated by a 36.8 per cent drop since April 4 to its present 2022 low of $0.74/share.

Share

Share Tweet

Tweet Share

Share

Comment