Echelon Capital Markets issued on Monday a trio of Top Picks for the second quarter of the year, with healthcare as a common thread and all three having been previously named to Echelon’s Top Pick list for the Q1 2022.

We start with Calian Group (Calian Group Stock Quote, Charts, News, Analysts, Financials TSX:CGY), a stock which has come a long way in recent weeks, but analyst Amr Ezzat calls Calian a quality operator with a solid track record of value creation which should yield further upside over the next 12 months.

“CGY has all the bells and whistles an investor would seek out in a quality company,” wrote Ezzat in a Monday report to clients. “The stock has roughly doubled in the last three years, as management transitioned its philosophy and growth strategy from what was a “steady Eddie” operator with stable revenues/earnings, to one seeking to capitalize on growth in a more aggressive fashion. We argue that the Street has consistently underestimated valuation by failing to recognize the accretion potential of M&A on Calian’s earnings and more importantly on its valuation.”

Ottawa-headquartered Calian delivers business and technology services to sectors such as healthcare, communications, learning and security. The company showed strong earnings momentum over the first quarter of its fiscal 2022 (ended December 31), according to Ezzat, with EBITDA margin expansion. The Q1 EBITDA was $14.0 million compared to $10.4 million a year earlier, with EBITDA margins going from 9.0 per cent to 10.8 per cent.

Ezzat also pointed to Calian’s acquisition of Computex Technology Solutions, a US-based provider of IT and cyber solutions, bought for $38 million and first announced in January, with the deal closing last month. Ezzat said the purchase will expand the breadth of Calian’s IT and cyber offerings and help diversify its customer base by adding 1,100 customers in healthcare, oil and gas and manufacturing.

”Through this acquisition, Calian has taken a significant step in achieving further expansion into the US market. We estimate Computex has LTM revenues and EBITDA of ~$75 million and ~$7 million, respectively. Of the ~$75 million in annual revenues that we expect the acquisition to add, ~$30 million is recurring in nature. We estimate Computex is a 9-10 per cent EBITDA margin business and foresee cost synergies to expand margins by 200-300bps within a year,” Ezzat said.

With the update, Ezzat maintained his “Buy” rating and $85.00 target on CGY, which at press time translated to a projected one-year return of 24.6 per cent.

Next up is in-home monitoring and chronic disease management services company Quipt Home Medical Corp (Quipt Home Medical Stock Quote, Charts, News, Analysts, Financials TSXV:QIPT), which has been hit like much of the healthcare sector over the past year, its share price down about 28 per cent over the past six months.

Echelon analyst Stefan Quenneville says Quipt is well-positioned at the intersection of the US home care and durable medical equipment (DME) markets, which are expected to grow by seven and six per cent, respectively, through 2028 due to demographic shifts towards an aging population. Along with the organic growth tailwinds, Quenneville pointed to the DME market in the United States where there are over 6,000 suppliers, the majority of which are very small players and thus serve as ample targets for Quipt.

“Quipt remains a Top Pick as we remain bullish on the home care focussed durable medical equipment (DME) industry and the Company’s positioning in an M&A sweet spot. While the fragmented DME market provides ample opportunity for accretive acquisitions, Quipt has achieved a regional scale that would make it an attractive target for one of the handful of larger national players,” Quenneville wrote in a Monday report to clients.

On a comps basis, Quenneville also likes QIPT, which he sees to be currently trading at 5.7x EV/EBITDA versus the median for its peers at 8.7x. Quenneville reiterated his “Buy” rating and $11.25 target, which at press time represented a projected return of 103 per cent.

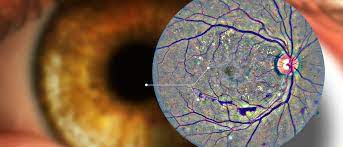

Last on the list is DIAGNOS Inc (DIAGNOS Inc Stock Quote, Charts, News, Analysts, Financials TSXV:ADK), which is a Montreal-based AI company commercializing its image enhancement and analysis platform for early detection, triage and monitoring of diabetic retinopathy (DR), the leading cause of blindness. The stock has drifted lower over the past year but Quenneville sees lots of upside as the company’s platform has received validation through a deal with New Look Vision and the announcement last August of an MOU with EssilorLuxottica/GrandVision, the world’s largest eye care company.

“The technology, which is currently being rolled out across New Look Vision locations in Quebec as well as in various clinics and medical networks in Mexico, is gaining acceptance and recognition as a next generation commercial diagnostic tool, particularly in the optical retail segment. As such, the Company appears poised to secure agreements with an increasing number of optical retailers, networks of healthcare facilities, private and public payors, and strategic partners such as pharma and equipment manufacturers,” Quenneville wrote in a Monday report.

Quenneville said the timeline and scale of the EssilorLuxottica deal are uncertain at the moment but that concluding the deal would be a game-changer for DIAGNOS. At the moment, Quenneville is assuming in his analysis a 50 per cent probability that the deal will be concluded, with technology rollout to 4,000 locations over 24 months starting mid-2022. The analyst has reiterated his “Speculative Buy” rating and $1.55 target price, which at press time represented a projected one-year return of 520 per cent.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment