Magnet Forensics has a 51 per cent upside, says Laurentian

Ahead of first quarter earnings next week from Magnet Forensics (Magnet Forensics Stock Quote, Charts, News, Analysts, Financials (TSX:MAGT), Laurentian Bank Securities analyst Salman Zia Rana delivered an update on the company on Thursday where he reiterated his “Buy” rating and C$35.50 target price, saying the Q1 should show signs of normalized profitability from the Canadian cybercrime company.

Waterloo-based Magnet Forensics has digital investigation software for enterprise and public safety organizations, with its tools used by over 4,000 public and private sector customers around the world. Set to deliver first quarter results on May 5, Magnet’s share price has been on quite a ride over the past year where it shot up from C$25 last June to over C$60 by September before falling just as quickly. The stock is currently trading back around the C$25 mark, but Rana sees upside from here.

“Following a period of healthy EBITDA margins in the 26 per cent to 39 per cent range during the pandemic owing to significant curtailment of S&M and R&D expenses, which augmented scale benefits as well, we expect Q1/22 to show initial signs of normalization post-COVID,” Rana wrote.

Rana said the Q1 should see Magnet’s revenues continue to shift to a term license model, with the analyst calling for $18.5 million in revenue, which would represent a 26.5 per cent year-over-year increase, and the analyst is expecting 23.1 per cent organic revenue growth in the mix. By segment, he is calling for: about $1.0 million in revenue from Perpetual License, which would be down 22.0 per cent year-over-year; $4.3 million from Term License, up 40.0 per cent; $11.2 million from Software Maintenance and Support, up 28 per cent year-over-year; and $2.1 million from Professional Services, representing a 30.0 per cent year-over-year increase. (All figures in US dollars except where noted otherwise.)

On earnings, Rana is calling for the quarter to feature adjusted EBITDA of $2.6 million, representing a 14.1 per cent margin, which would be a the lower end of management’s provided 14-16 per cent range going forward.

“In particular, we expect G&A and S&M expenses to be relatively higher in 1H as compared to 2H owing to an expected increase in on-boardings, as well as MAGT’s in-person User Summit being held in April, with the company also no longer eligible for SR&ED tax credits which will result in higher R&D expenses. We note scale benefits in light of MAGT’s operating leverage will become more and more evident as 2022 rolls on,” Rana said.

Rana said Magnet’s balance sheet is supportive of further M&A, estimating the company’s net cash position at $109.4 million, inclusive of lease liabilities and with minimal debt. Add to that an amended $25-million credit facility that carries a two-year period, Rana estimate’s Magnet to have about $143.1 million in dry powder.

Looking further ahead, Rana thinks Magnet Forensics will generate full 2022 revenue and adjusted EBITDA of $93.4 million and $11.2 million, respectively, and 2023 revenue and EBITDA of $120.1 million and $14.6 million, respectively. At the time of publication, Rana’s retained C$35.50 target represented a projected one-year return of 50.9 per cent.

“MAGT currently trades at 6.8x NTM EV/Revenue versus comps trading at an average of 4.0x, on a higher sales growth + EBITDA margin estimate,” Rana wrote.

The analyst said that from the Q1 report he is looking to hear about a number of pieces of the Magnet puzzle, including among others any takeaways and lead generation opportunities from this year’s MAGT’s User Summit, news on Magnet’s R&D pipeline, an account of quarterly revenue mix by customer segment, thoughts from management on further M&A and plans on the further leveraging of existing partnerships.

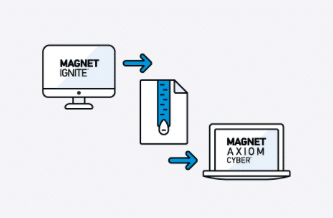

Magnet announced earlier this month the launch of Magnet IGNITE triaging solution, which allows businesses to perform rapid scans of target endpoints for malicious activity so that they can decide how to deploy their forensic analyses.

“When enterprises suffer cyber attacks, it is imperative that they react both quickly and efficiently to minimize down time and the monetary and reputational damages that come with it,” said CEO Adam Belsher in a press release. “Magnet IGNITE is a strategic first-step for enterprises to turn to in their post-incident plans that can provide a quick and early assessment to pinpoint the systems involved with malicious or insider activity. With this information in hand, security teams can save time and resources by only performing full forensic analyses on impacted endpoints.”