Rob Goff of Echelon Capital Markets likes the look of VSBLTY Groupe Technologies (VSBLTY Groupe Technologies Stock Quote, Charts, News, Analysts, Financials CSE:VSBY), initiating coverage on Monday with a “Speculative Buy” rating and target price of $1.75/share.

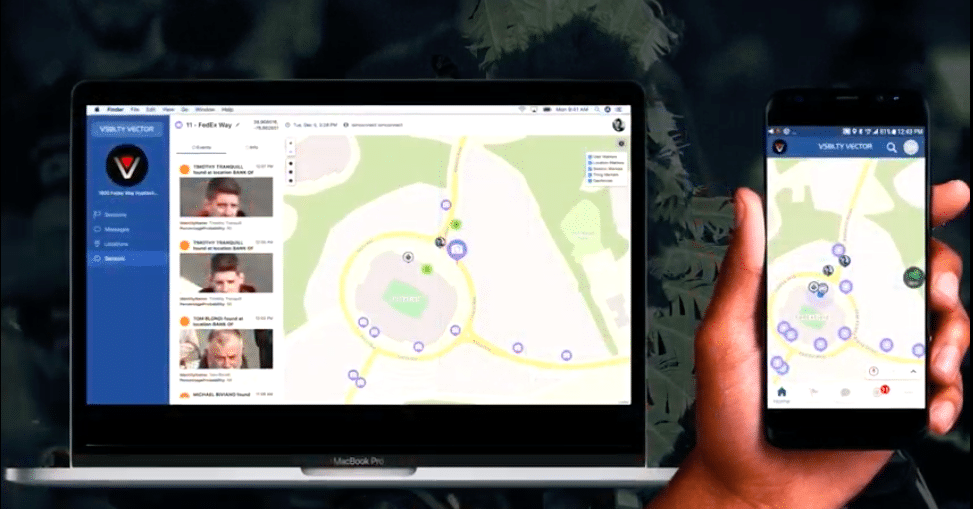

Vancouver-based VSBLTY provides software for security and retail analytics tech, including proactive digital displays and place-based media networks with SaaS-based audience measurement and security software that uses artificial intelligence and machine learning.

In Goff’s view, VSBLTY offers clear potential for going well beyond its present $110 million capitalization, given its positioning within the AI sector and the scope of environments its software is helping to revolutionize. All told, Goff believes VSBLTY’s total addressable market will be somewhere in the neighbourhood of $300 billion within the next four years, with its partnerships helping to de-risk the investment.

“We see the Company’s execution on its current pipeline of projects supporting upside beyond our initial PT, while additional upside exists where current marquee deployments lead to scaled expansion into additional markets,” Goff said in his report. “The global strength of existing partners and their unique alignment provide confidence in further project wins.”

Goff projects the company’s revenue/adjusted EBITDA split to be $63.5 million/$9 million in three years, followed by a five-year guideline of $131.3 million/$35 million, in which he projects 85 per cent of the company’s revenue to come from existing contracts, and that’s before considering the company’s involvement with Austin GIS, which Goff views as a potentially transformational initiative for VSBLTY.

“We see the addition of many large-scale deployments across its retail and burgeoning security pipeline that are not in our forecasts, which could support another layer of upside beyond our PT,” Goff said.

By leveraging some of its bigger partners, Goff believes VSBLTY can pioneer large-scale IaaS solutions to showcase its machine learning, computer vision, and data analytics software, with retail and security applications being primary targets.

“Looking ahead, we see a clear bullish case for IaaS deployments where users realize end-to-end solutions that are immediately accretive against variable operating expense (opex) structures and IaaS partners take on implementation, integration, operating, and financing risks,” Goff said.

Looking ahead, Goff points to a number of endorsements the company has received for its services from large industry partners, including Anheuser-Busch, HCL Technologies, Tech Mahindra, WestRock, and WPP.

“Notably, none of these partnerships reflect one-off contracts but rather aligned initiatives and visions surrounding scaled, data-rich, smart retail and security deployments, where we see high prospects for expansions into additional global geographies,” Goff said. “In addition to these big players, we highlight several other key partners and their associated projects with VSBLTY, helping to weave a diversified opportunity set for the Company to deliver against its lofty potential.”

Goff forecasts a tripling of the company’s revenue to end 2021, moving from $600,000 to $1.8 million. He then projects more exponential growth into 2022, with the $8.6 million estimate producing a projected year-over-year increase of 378 per cent.

In terms of DCF valuation, Goff projects the company’s EV/Revenue multiple to drop from the 2020 figure of 201.3x to 67.5x to end 2021, then dropping to a projected 14.2x in 2022 to put it ahead of the target of 40x, and catching up to the peer group average of 8x.

Meanwhile, continued investment and development has the company’s adjusted EBITDA projections continuing to trend negative, with Goff projecting losses of $7.7 million in 2021, and $7.5 million in 2022.

For valuation context, the peer group average for 2021 EV/adjusted EBITDA is 13.3x and 11x for 2022, though Goff simply lists NM for VSBLTY’s multiples in that category.

VSBLTY, which began trading on the CSE in February, 2019, has seen its share price drop by 14.9 per cent over the past year and is down 35.1 per cent since the start of 2022. November 12, 2021, saw VSBLTY reach a 52-week high of $1.89/share, the peak of a climb from its 52-week low of $0.45/share on May 25. At press time, Goff’s $1.75 target represented a projected one-year return of 146.5 per cent.

VSBLTY has made a pair of board-level additions over the last week, adding Insight Out president and founder Steve McMahon to its Advisory Board on February 24, then announcing the addition of David Roth, CEO of The Store-WPP and Chairman of WPP BAV, to its Board of Directors this morning in an effort to further strengthen its leadership.

“Brands will pay retailers for the increasingly available data about shopping and purchase behaviour that reveals predictive patterns,” said Jay Hutton, CEO and Co-founder of VSBLTY in the company’s March 1 press release. “The addition of David to an already solid Board ensures that we will increase our management strength, reach and ability to help key brands take advantage of the most important innovation emerging throughout the retail landscape—brands influencing customers’ buying decisions right at point of sale.”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment