The first impressions look good on fourth quarter numbers from Canadian fintech company Mogo Inc (Mogo Inc Stock Quote, Charts, News, Analysts, Financials TSX:MOGO). That’s according to Eight Capital analyst Adhir Kadve who reiterated his “Buy” rating on the stock in an update to clients on Wednesday.

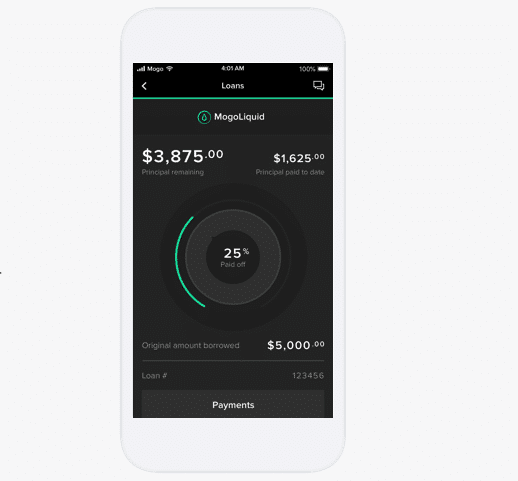

Vancouver-based Mogo, which offers digital financial solutions through its Mogo app including a prepaid platinum Visa card, bitcoin buy and sell, personal loans and mortgages and a free stock-trading app, MogoTrade, announced its Q4 2021 results on Wednesday, showing record revenue of $17.0 million, which was up 70 per cent year-over-year.

“Building on this strong core, we continue to invest in building the leading next gen digital wealth platform in Canada,” said founder and CEO David Feller in a press release. “During Q4, we launched our first version of MogoTrade – the centrepiece of our digital wealth strategy. We expect this will be an important driver of member growth and engagement as we move towards a full launch of this product in Q2 2022 and advance our mission to give members the best digital tools to help them achieve financial freedom while also making a positive social impact.”

The fourth quarter saw Mogo’s subscription and services revenue jump by 135 per cent from a year earlier to $10.7 million, while for the 2021 year the segment was up 80 per cent to $34.4 million. Adjusted EBITDA for the Q4 was a loss of $3.7 million compared with positive $1.1 million a year earlier, with management saying the drop was due to investments in the company’s platform and products. For the year, Mogo’s EBITDA loss was $11.1 million compared to a gain of $11.6 million in 2020.

Operationally, the company launched MogoTrade over the quarter and acquired a 39 per cent stake in crypto exchange platform Coinsquare, while since the quarter’s end Mogo announced a strategic investment in NFT Trader and formed Mogo Ventures as its strategic investment arm. Mogo reported ending the fourth quarter with $193 million in cash, digital assets and investments.

Looking at the Q4 numbers, Kadve said the top and bottom were better than expected, with the total revenue of $16.9 million coming out ahead of Eight Capital’s $15.9 million estimate and the Street consensus at $16.0 million. The adjusted EBITDA loss of $3.7 million was also better than Kadve’s negative $4.7 million estimate as well as the consensus $4.0 million.

By segment, Mogo’s $6.3 million in Loan Interest Revenue (up 16 per cent year-over-year and up six per cent sequentially) was better than Kadve’s estimate at $6.1 million, while Subscription and Services revenue at $10.7 million (up 135 per cent year-over-year and up 13 per cent sequentially) was also better than Kadve’s $9.8 million. On guidance for 2022, Mogo management called for revenue between $75 and $80 million versus the current Eight Capital and Street estimates of $78.3 million and $77.1 million, respectively.

“Mogo kept its guidance for F22 intact but noted that it expects improving Adj. EBITDA margins during H2/F22. The platform’s total membership has increased by 86k to 1.9 million,” said Kadve in his update.

“Operationally, the company launched its new free stock-trading app – MogoTrade – in the current quarter (in a phased rollout) and expects the full rollout of the app in Q2/F22. Recall that MogoTrade is a major product initiative for Mogo – and one we think can likely continue to drive user growth onto the platform and thus gives Mogo the ability to cross-sell into its broader suite of products,” he said.

Kadve said he will be revisiting his forecast on Mogo after hearing from management on the Wednesday afternoon conference call. On Mogo’s new trading platform, Kadve said it’s a major product initiative for the company and one that the analyst thinks can likely continue to drive user growth onto Mogo’s platform and thus lead to cross-selling opportunities.

“We value Mogo using a sum-of-the-parts valuation. We ascribe a value of $11.00/share to Mogo’s FinTech business based on a 10x F22E Sales multiple and we ascribe $5.00 to Mogo’s investment in Coinsquare, yielding a target price of $16.00/share,” Kadve wrote.

Mogo’s share price spiked in early 2021 but has mostly been sliding since, registering a 2021 return of negative 11 per cent and now down about 19 per cent year-to-date. At press time, Kadve’s $16.00 target represented a 12-month projected return of 419 per cent.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment