Montreal-based AI company DIAGNOS (DIAGNOS Stock Quote, Chart, News, Analysts, Financials TSXV:ADK) has seen its share price head lower over the past year but Echelon Capital Markets analyst Stefan Quenneville is keeping the faith, maintaining a Top Pick status for ADK and a “Speculative Buy” rating in an update to clients on Tuesday.

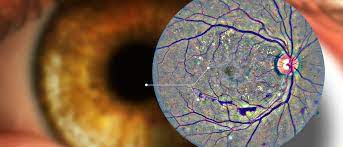

Founded in 1996, DIAGNOS is an artificial intelligence company that has developed an image enhancement and AI analysis platform for early detection of diabetic retinopathy (DR), with the company currently in the commercialization stage with its CARA AI platform.

Quenneville’s updated analysis comes after DIAGNOS released its third quarter results for the 2022 fiscal year, which Quenneville noted to include some misses related to the pandemic and a slower rollout of the CARA AI platform to New Look stores in Quebec.

“While these delays lead us to temper our forecasts for the coming quarters, we highlight that the company reiterated its guidance that it expects to become cash flow positive by the end of FQ123 (end of June 2022), as we continue to anticipate a potential transformational deal with EssilorLuxottica in the coming months that could be a major upside catalyst for the stock,” Quenneville said.

The proposed deal with EssilorLuxxotica, for which a memorandum of understanding was signed in August and would see the company’s CARA AI platform rolled out into EssilorLuxxotica locations worldwide, has been delayed longer than Quenneville initially expected.

According to Quenneville, EssilorLuxxotica’s deal with GrandVision, which closed in the third quarter of 2021, has been more complex and challenging than expected, as regulators required the combined companies to divest certain European retail locations for competitive reasons.

“While the timeline and scale of a potential deal remain uncertain for now, concluding a deal with EssilorLuxottica would be a game-changer for ADK given the sizeable financial opportunity and the industry validation of its technology platform,” Quenneville said.

DIAGNOS reported fiscal Q3 revenue of $130,000, with the figure representing 60 per cent sequential growth and a 67 per cent year-over-year increase. At the same time, the topline missed on the Echelon Capital Markets estimate of $181,000.

Despite the revenue miss, other financial information came out relatively in line, with cost of goods sold coming in at $237,000 in relation to the Echelon estimate of $250,000, while selling, general and administrative expenses of $493,000 were right around the Echelon projection of $500,000. Meanwhile, the company’s adjusted EBITDA loss of $600,000 was just a touch behind the Echelon estimate of a $570,000 loss.

DIAGNOS also announced it had secured a $590,000 in debt financing in the form of eight per cent convertible debentures issued via private placement at $10,000 per debenture, which have three-year terms and consist of one convertible debenture and 2,500 warrants with exercise prices of $0.38 and $0.33, respectively.

A few weeks ago, the company completed an audit which showed its quality management system continues to comply with the ISO 13485 standard and applicable regulatory requirements for medical devices, an annual procedure done in compliance with Health Canada and the U.S. Food and Drug Administration to continue the commercialization process for its CARA technology.

“I would like to take this opportunity to thank our employees for their hard work in this important process,” said Andre Larente, President of DIAGNOS in the company’s February 10 press release “Our clients expect our healthcare solutions to perform in compliance with the highest quality standards and DIAGNOS is able to meet their expectations.”

Quenneville projects solid financial prosperity for the company, forecasting growth to $500,000 in revenue in 2022 for a year-over-year increase of 67 per cent, then soaring to a projected $7.9 million in revenue in 2023.

Accordingly, Quenneville’s EV/Sales multiple takes a sharp dive in that time, plummeting from the reported 60.2x in 2021 to a projected 3.4x in 2022, then to a projected 1.3x in 2023. The projected multiple performance compares favourably to DIAGNOS’s peer group, which is expected to drop from 27.5x in 2021 to 10.5x in 2022, then to a projected 6.6x in 2023.

Meanwhile, after three consecutive years of losses, Quenneville forecasts the company’s EBITDA to turn positive in 2023 at $2.2 million, implying a margin of 27.8 per cent.

Quenneville introduces an EV/EBITDA multiple in 2022 at 22.1x before dropping to a projected 3.9x in 2023, both years significantly outdoing the peer group projections of 75.7x in 2022 and 57x in 2023.

DIAGNOS’s stock price has dropped by 56.5 per cent over the last 12 months, and 20.6 per cent since the start of 2022. One year can make a big difference for a stock, as its price of $0.62/share from March 3, 2021 was a 52-week high, contrasted with its present position of $0.27/share, which is a 52-week low. Along with his “Speculative Buy” rating and Top Pick status on ADK, Quenneville has reiterated a 12-month target price of $1.55/share which at press time represented a projected return of 474 per cent.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment