Tantalus Systems has tons of upside from here, says Beacon

Building out its customer base is what it’s all about at this stage for power and utilities solutions provider Tantalus Systems (Tantalus Systems Stock Quote, Chart, News, Analysts, Financials TSX:GRID). So says Beacon Securities analyst Gabriel Leung who reiterated his “Buy” rating and target price of C$4.00 on Tantalus in an update to clients on Tuesday (All figures are in US dollars unless otherwise noted).

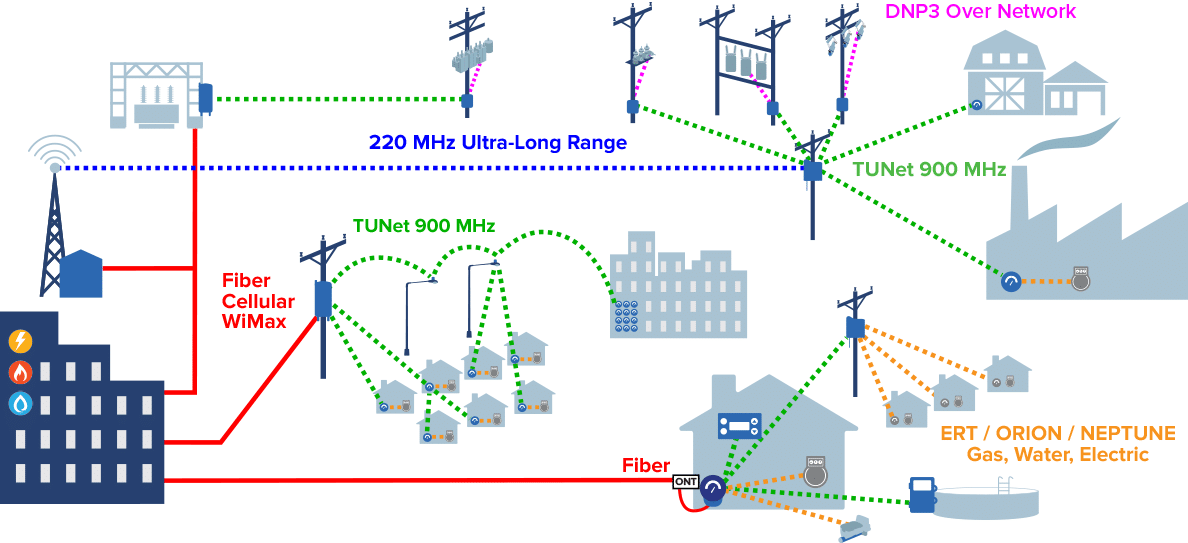

Founded in 1989, Vancouver-based Tantalus develops and delivers mission-critical, smart grid solutions for public power and electric cooperative utilities to automate their distribution grids. The company has roughly 120 employees and currently over 200 utilities for customers, representing about four million addressable end points.

Leung’s latest update comes after Tantalus released preliminary fourth quarter financial results along with an outlook for 2022.

“While Q4 results were short of our expectations due to headwinds beyond the company’s control, we are encouraged to see the increase in Tantalus’ utility customer base, which represents multi- year, multi-million revenue opportunities (both for hardware and software deployments),” Leung said.

For the quarter, Tantalus projects revenue to be between $7.6 million and $7.7 million, falling below the Beacon estimate of $9.1 million, though the company noted ongoing COVID-19 challenges and supply chain delays, which pushed $1.2 million in revenue further back into the 2022 calendar year.

Meanwhile, the company is expecting its adjusted EBITDA to be a loss of between $800,000 and $1.2 million, compared to the $331,000 loss Beacon had projected.

Overall, Tantalus ended the year with 210 utilities on-board and 2.8 million endpoints deployed, with another 1.6 million endpoints to deploy in the future within the existing user community.

Tantalus received a positive boost to its prospects last week, having completed the acquisition of Congruitive, which helps utilities automate its operations through its Congruence.IQ software that enables the interoperability of a range of devices through an emerging IEEE standard.

“This acquisition serves as a further demonstration of Tantalus’ purpose-driven mission to help utilities become sustainable from an enhanced financial, operational and environmental perspective,” said Tantalus President and CEO, Peter Londa in a February 1 press release. “Having C.IQ as part of our solution allows us to help public power and electric cooperative utilities prepare for the impact that an increasing number of EVs and roof-top solar panels will have on the reliability of their distribution grids.”

Looking ahead, Leung is projecting a modest jump to $33.6 million in revenue in 2021, marking potential year-over-year growth of 1.8 per cent before moving to a projected $39 million in 2022, representing potential year-over-year growth of 16.1 per cent.

Meanwhile, Leung projects negative overall adjusted EBITDA of $800,000 for 2021 after reporting $2.6 million to the positive in 2020, then rebounding to a projected $200,000 loss in 2022.

Leung is calling for GRID’s EV/Sales multiple to remain at 1.9x in 2021 before dropping to a projected 1.6x in 2022.

Tantalus will celebrate one year of trading on the Toronto Stock Exchange on Wednesday. The stock was at its highest point last February at (C) $3.45/share. Since then, GRID has dropped by about half and is presently at a 52-week low of about (C) $1.70/share. At press time, Leung’s $4.00 target represented a projected one-year return of 131 per cent.

Disclosure: Tantalus Systems is an annual sponsor of Cantech Letter.

Geordie Carragher

Writer

Geordie Carragher is a staff writer for Cantech Letter