Dialogue Health Technologies is a double, says Desjardins

Desjardins analyst David Newman thinks people will start talking about Dialogue Health Technologies (Dialogue Health Technologies Stock Quote, Chart, News, Analysts, Financials TSX:CARE), maintaining a “Buy” rating and target price of $10/share for a projected return of 98.8 per cent in an update to clients on Wednesday.

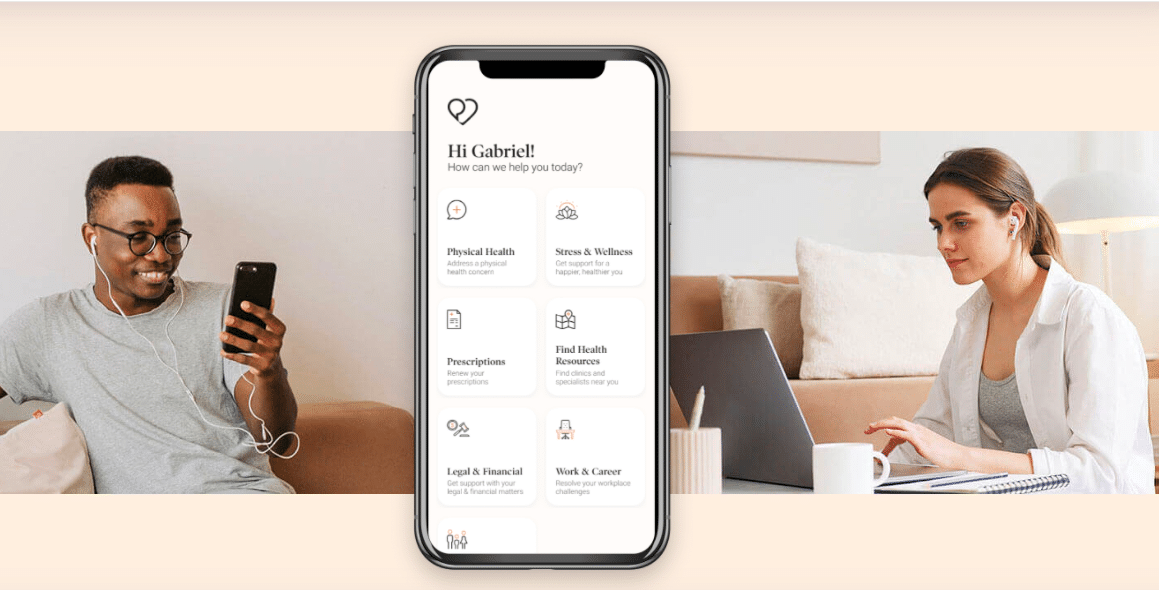

Founded in 2016 and headquartered in Montreal, Dialogue Health offers a digital healthcare and wellness platform to over 2,000 customers in Canada and Germany, including on-demand access to medical care through its Integrated Health Platform hub focused on physical, mental and wellness, as well as EAP and OHS services.

Newman’s updated analysis comes after Dialogue agreed to terms with Scotiabank to become its new employee assistance program (EAP) provider, the company’s biggest contract win to date.

We estimate the contract should contribute about C$2 million in ARR which, coupled with the recent Sun Life EAP and iCBT expansion (about C$2–3 million ARR), should lift Dialogue’s ARR to about C$87–88 million,” Newman said. “Moreover, it serves as a major proof point for Dialogue’s EAP platform, which is resonating with very large and credible customers. To service Scoabank’s large employee base, CARE will accelerate the development of its virtual call centre technology, which it could leverage with future customers.”

The contract, which begins on April 1, will cover Scotiabank’s 38,000 employees across Canada, with revenue recognition beginning in the second quarter of 2022. All told, Scotiabank has approximately 90,000 employees worldwide, with total assets reaching $1.2 trillion.

Scotiabank recently announced it was planning to expand its MH coverage from $3,000 to $10,000, which covers clinical counsellors, iCBT, psychologists and wellbeing support for employees and their dependants in Canada.

Dialogue replaces LifeWorks as Scotiabank’s EAP provider, the second significant win for the company in recent months following an expansion to its agreement with Sun Life on its EAP iCBT programs.

“Support from two of Canada’s leading employers and insurance partners provides strong evidence that Dialogue’s EAP and the Integrated Health Platform (IHP) are rapidly gaining share and momentum,” Newman said. “We believe employers prefer its virtual, modernized and integrated platform to traditional EAP offerings as it drives higher employee engagement and satisfaction.”

According to Newman, the Scotiabank agreement is an indicator that Dialogue is ready to deliver on its commitment of pursuing larger EAP clients and their subsequent organic growth opportunities.

“This agreement represents a significant milestone for Dialogue and an important validation from one of Canada’s largest employers and most esteemed companies,” said Cherif Habib, Chief Executive Officer of Dialogue in the company’s February 22 press release. “Today’s announcement is further evidence that our strategy of building a platform of fully-integrated health and wellness services is resonating with Canadian employers. We would like to thank Scotiabank for partnering with us on our common journey to improve the well-being of Canadians, and look forward to future opportunities to deepen our collaboration.”

In his analysis on February 16, Newman made revisions to his financial projections for Dialogue based on the company’s performance in the fourth quarter of the 2021 fiscal year, lowering his overall revenue target for the year from $69 million to $68 million. He has also lowered his 2022 revenue projection from $98 million to $95 million, though the new figure still implies a year-over-year increase of 39.7 per cent.

Newman also lowered his expectations for the company’s gross margin in the same analysis, with the margin now set at 42 per cent for 2021 (gross profit still at $29 million) compared to 42.1 per cent previously. Looking ahead to 2022, Newman lowered his gross profit estimate from $43 million to $42 million, though the gross margin estimate increases from 44 per cent to 44.5 per cent.

On the other side, Newman projects increased losses in adjusted EBITDA, as he now forecasts a $21 million loss for 2021 compared to the initial $20 million loss projection. Turning to 2022, Newman now projects a $15 million loss compared to the initial $8 million loss estimate.

Overall, Newman believes there will be opportunities for Dialogue to cross-sell its offerings through its new Scotiabank agreement.

“We believe that while Scotiabank is using other providers for these services (likely CloudMD’s MindBeacon or LifeWork’s AbiliCBT for iCBT, and TELUS Health for PC), Dialogue’s integrated health offerings under a PMPM model would be more compelling versus a fee-for-service model, where employees have to pay out-of-pocket for third-party support then claim back under their MH coverage,” Newman said.

Dialogue’s stock price has dropped by 64.9 per cent over the last 12 months, with a further drop of 30.8 per cent since the start of 2022. Dialogue’s stock price has been diving since hitting a high of $19.49/share on April 6, shortly after it began trading on the Toronto Stock Exchange, with its low of $5/share coming on February 8.

Geordie Carragher

Writer

Geordie Carragher is a staff writer for Cantech Letter