VitalHub scores another customer win, Eight Capital reports

Eight Capital analyst Christian Sgro continues to see value in VitalHub (VitalHub Stock Quote, Chart, News, Analysts, Financials TSXV:VHI), maintaining a “Buy” rating and target price of $5/share for a projected return of 67 per cent in an update to clients on Wednesday.

Founded in 2015 and headquartered in Toronto, VitalHub develops enterprise case management and operational workflow software solutions for hospitals, regional health authorities, mental health, long term care, home health and community and social service sectors in Canada, the United Kingdom and the United States.

Sgro’s latest update comes after VitalHub secured another contract victory, licensing its TREAT case management platform to Strides Toronto, an organization that provides a range of mental health services to youth across Toronto. The win comes after a long RFP, Sgro said.

“VitalHub shares have been resilient in the face of small cap valuation compression and we believe that a favourable macro backdrop and continued execution will drive a valuation re-rate higher over time,” Sgro said.

The five-year agreement, which Sgro believes will boost VitalHub’s ARR in its opening quarter of 2022, will see the TREAT platform implemented to support and enhance Strides’ programs, including services for child and youth mental health, early intervention and community support, community engagement and development and autism across Toronto’s 25 core service providers.

“Management highlighted a trend of amalgamations in the community and social services sector with similar needs to upgrade legacy systems, which we view as an opportunity for cross-sell in the region,” Sgro said.

In addition, TREAT will also support Ontario’s Ministry of Children, Community and Social Services’ Child and Youth Mental Health Business Intelligence solution, which enables standardized data collection, integration, analysis, and presentation of information about the delivery of core services.

“This is further validation of TREAT being the leading case management system in Canada with the ability to support large scale implementations while supporting unique government reporting requirements,” said Dan Matlow, CEO of VitalHub in the company’s January 19 press release. “We are seeing a trend of amalgamations in the community and social services sector and we believe we are strongly positioned as organizations upgrade their solutions as a result.”

“It will enable us to meet our goals of using technology to enhance our clients’ experiences and increase the efficiency of workflows so that employees can dedicate themselves to serving clients, which is their passion,” added Janet McCrimmon, CEO of Strides Toronto. “VitalHub’s depth of experience and responsiveness provide us with confidence that we’ve selected the right technology and partner.”

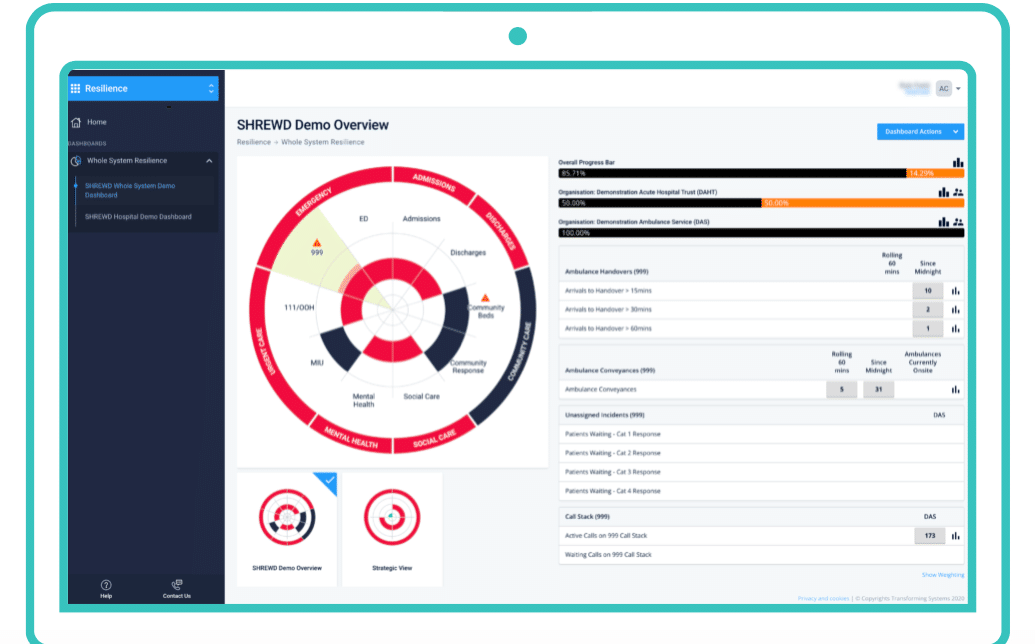

The Strides Toronto agreement is VitalHub’s third customer win in as many weeks to begin 2022. On January 6, VitalHub announced a licensing deal with the Royal Berkshire NHS Foundation Trust for use of VitalHub subsidiary Intouch with Health’s patient flow platform to build on the partnership with the Trust already using VitalHub’s SHREWD platform.

They followed that up with another win overseas, with the January 13 announcement of a three-year licensing agreement with Staffordshire and Stoke-on-Trent Integrated Care Systems, where the ICS will deploy the SHREWD Resilience and SHREWD COVID-19 modules, properties of VitalHub subsidiary Transforming Systems, across its network.

When compared to the first quarter of the company’s 2021 fiscal year, Sgro expressed confidence in the number of early wins for VitalHub in 2022, supporting his expectation of 15 per cent organic growth across the business, along with a $1 million ARR growth estimate.

Sgro has held VitalHub’s financial projections as is, as he expects the company to finish 2021 with total revenue of $24.5 million for a 77.5 per cent year-over-year increase, just a shade off the consensus expectation of $24.6 million. Sgro then projects revenue for 2022 to increase to $29 million for an implied year-over-year increase of 18.5 per cent, with the total matching the consensus estimate.

Looking at EBITDA, Sgro’s estimate of $4.5 million also matches the consensus, though Sgro’s implied margin of 18.5 per cent is a tick higher than the 18.4 per cent expected by the consensus. Sgro then projects a margin increase to 20.9 per cent with $6.1 million in EBITDA, though those figures are slightly below the consensus estimates of $6.4 million and a 22.1 per cent margin.

Overall, Sgro is confident in VitalHub’s direction moving forward and he expects further mergers and acquisitions to serve as the company’s next growth catalyst.

“VitalHub is benefitting from greater brand recognition and increasingly from opportunities to cross-sell products across its broad base of business globally,” Sgro said. “We have strong confidence in VitalHub’s continued top-line and margin expansion, all augmented by a disciplined M&A strategy.”

VitalHub’s stock has experienced a drop of 8.1 per cent over the last 12 months, and a 10.3 per cent drop since the start of 2022. The company reached a 52-week high of $3.71/share on June 3, a gain from its 52-week low of $2.72/share on February 26.

Geordie Carragher

Writer

Geordie Carragher is a staff writer for Cantech Letter