Quipt Home Medical is a double, says Leede Jones Gable

Douglas Loe of Leede Jones Gable is more bullish on Quipt Home Medical Corp. (Quipt Home Medical Stock Quote, Charts, News, Analysts, Financials TSXV:QIPT), maintaining a “Buy” rating while raising his target price from C$12/share to C$14.50/share in an update to clients on Tuesday.

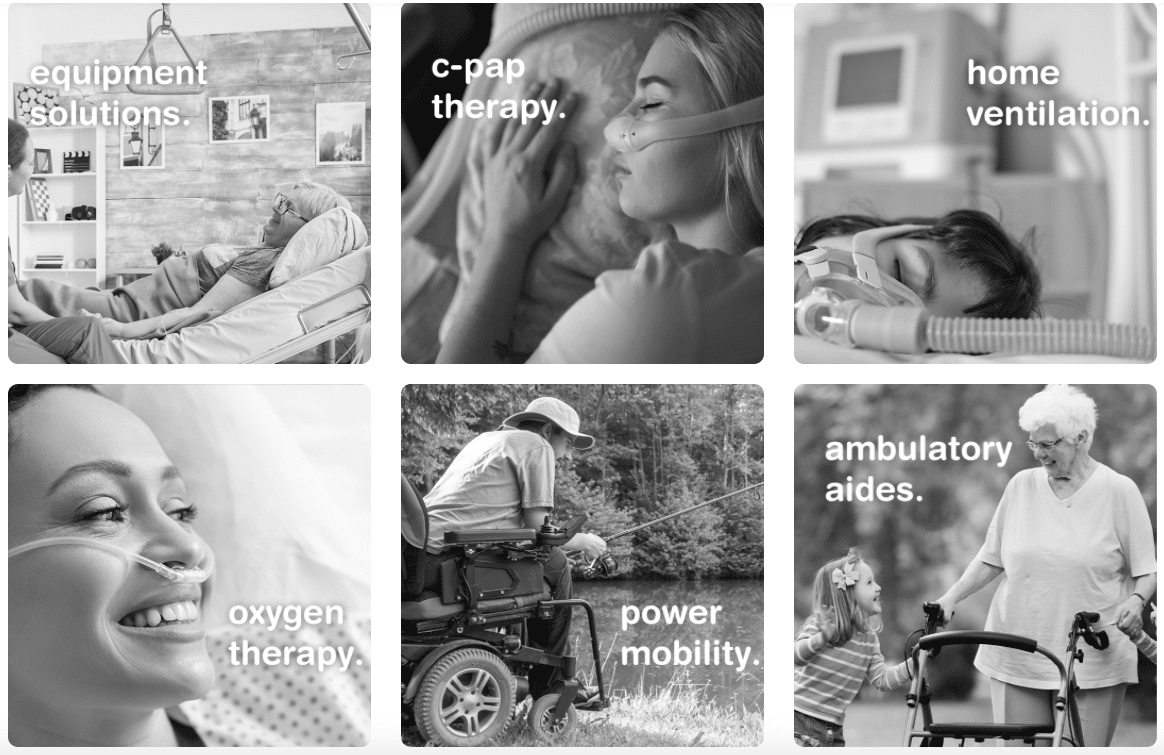

Founded in 1993, Quipt Home Medical (previously Protech Home Medical) is a durable medical equipment firm focused on delivering respiratory care devices into home healthcare markets, presently providing service to approximately 170,000 patients in 19 states across the US.

Loe’s latest analysis comes after the company officially closed the acquisition of At Home Health Equipment, an Indiana-based provider of home medical equipment and supplies intended to offer diverse healthcare options, including wheelchairs, walkers, transport chairs, knee walkers and rollators.

“We are impressed by Quipt’s ability to supplement its geographic footprint in the US home respiratory medical equipment universe at prudent (in our view) valuations (usually at 1x/4x revenue/EBITDA, as the At Home Health Equipment acquisition just was) and without sacrificing EBITDA margin, even transiently, while integration activities ensue,” Loe said.

It cost Quipt $13.1 million in cash (all report figures in US dollars except where noted otherwise) to acquire At Home Health, which featured trailing 12-month annual revenues of approximately $13 million and $1.6 million in net income, with anticipated Adjusted EBITDA of $2.9 million to produce a 22 per cent margin.

The deal is notable in that it adds another 15,000 active patients to the Quipt network, making Indianapolis Quipt’s single largest market.

“This is a significant acquisition as it creates the largest single market for us in a very attractive region allowing us the ability to strengthen our overall interconnected healthcare network in the state of Indiana. Our operating engine and proven ability to integrate acquired assets allows us to continue the strong pace of closing larger strategic acquisitions during this exciting growth period,” said Greg Crawford, Chairman and CEO of Quipt in the company’s January 4 press release. “This acquisition is very powerful as it services the significant metro hub of Indianapolis, and we plan on quickly integrating their business operations and leveraging Quipt’s payor contracts across our existing Midwest locations.”

Loe’s target price adjustment was the byproduct of the company’s sustainably positive growth-by-acquisition strategy.

“Quipt re-iterated that it expects its annual revenue/EBITDA run rate to be in the US$180M-to-US$190M & US$38M-to-US$43M range, respectively,” Loe said. “We are confident that the firm’s track record on pace of acquisitions in the US home respiratory medical equipment distribution space can be sustained during our forecast period.”

Other acquisition activity for Quipt over the last three months included the execution of a November 22 letter of intent to acquire an arm’s length private respiratory care company servicing seven U.S. states with a trailing 12-month annual revenues of approximately $14 million, $1 million in net income, and positive Adjusted EBITDA, as well as the strategic acquisition of a privately held biomedical services company in the southeastern United States with a trailing 12-month annual revenues of approximately $1.5 million, and $225,000 in net income.

With At Home Health Equipment getting incorporated into Quipt’s overall revenues, Loe has revised his financial projections for the company, elevating his revenue forecasting to $146.2 million in 2022 (previously $133.2 million), marking a potential year-over-year increase of 43.9 per cent. Meanwhile, Loe projects 2023 revenue to be $162 million, an increase of 10.8 per cent.

Loe has also slightly altered his EBITDA projection for 2022, elevating it to $31.4 million for a 21.5 per cent margin, compared to his previous outlook of $30.3 million and a 22.7 per cent margin. 2023 sees another slight jump to a projected $34.8 million, with the margin remaining constant at 21.5 per cent.

From a valuation standpoint, Loe sees the company’s EV/EBITDA multiple dropping from the reported 12x in 2020 to a projected 8.6x in 2021, then dipping again to a projected 5.9x in 2022.

Meanwhile, after projecting EPS of $0.39/share (previously $0.32/share), Loe introduces a P/E multiple projection in 2022, setting the bar at 15.6x.

“Our model assumes that Quipt’s acquisitions can continue to operate as semi-autonomous equipment distribution operations in their respective geographies with minimal organizational disruption, and the firm’s acquisition history has revealed strong EBITDA/margin growth, both during and before our coverage history, that we expect to continue,” Loe said.

Quipt’s stock price has crept up by 15.3 per cent over the last year, breaking into double digits with a 52-week high of C$10.08/share on February 10. At press time, Loe’s new C$14.50 target represented a potential 12-month return of 105 per cent.

Geordie Carragher

Writer

Geordie Carragher is a staff writer for Cantech Letter