What’s the story on Enghouse Systems?

After a surge over the first half of 2020, Enghouse Systems (Enghouse Systems Stock Quote, Charts, News, Analysts, Financials TSX:ENGH) has had a rough go of it over the past 18 months, bringing the stock back down to pre-pandemic levels. The shorter-term prospects may continue to be bumpy but portfolio manager Darren Sissons thinks investors will do well by Enghouse over the long stretch as its growth by M&A strategy has a proven track record.

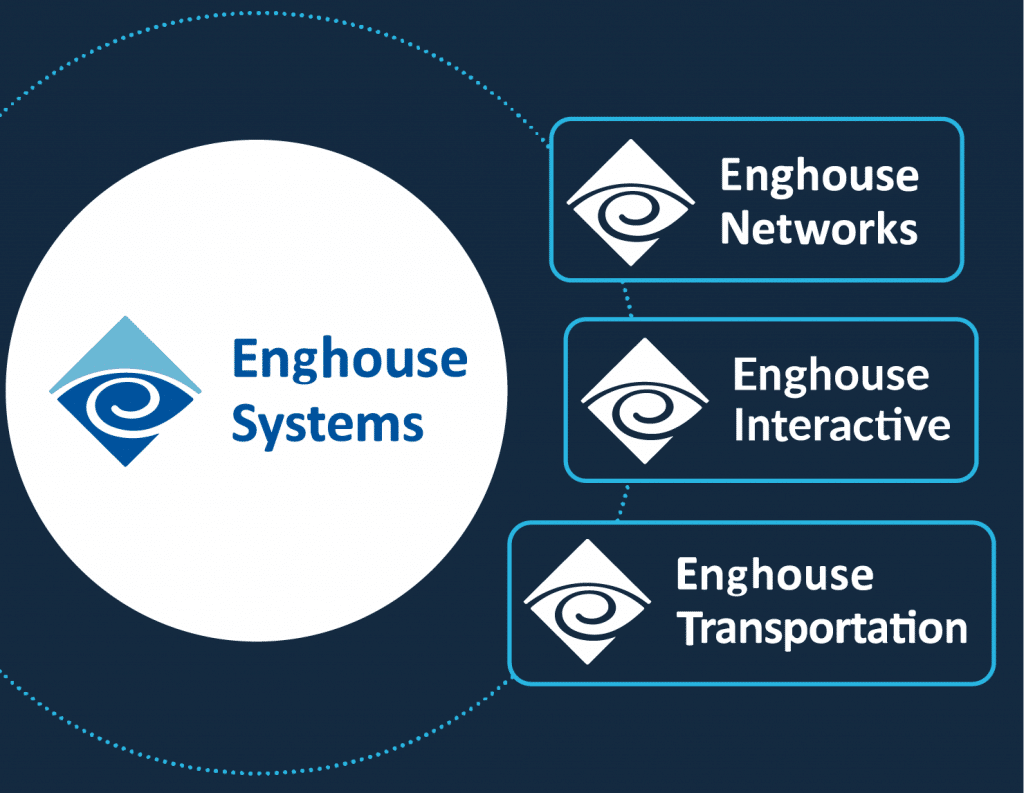

Enghouse, a Canadian software company with enterprise-level solutions, saw its share price take off in the early days of COVID-19 as investors bet on the company’s strengths in remote work and communications including Enghouse Interactive and Vidyo, the latter of which was a 2019 acquisition bolstering the company’s video software solutions and visual communications capabilities. Enghouse also acquired Canadian video software company Espial, which brought with it a SaaS-based multi-tenant IP video platform, another example of Enghouse’s prowess in acquiring businesses that mesh well with the company’s own offerings while extending ENGH’s reach to new customers and clients.

Sissons says Enghouse exhibits a distinctly Canadian approach to tech M&A, one which seeks out smaller, sometimes niche acquisitions to provide the needed cash from operations to fund further acquisitions.

“Canada for various reasons tends to embrace the tuck-in acquisition model and so you’ve got Constellation Software, you’ve got OpenText and you’ve got Enghouse,” said Sissons, vice-president and partner at Campbell, Lee & Ross, who spoke on BNN Bloomberg on Tuesday.

“And by and large, those companies have done very well,” he said.

It’s been slow going over the past year, however, as Enghouse, a $3-billion market cap company, has seen its growth stalled in the wake of oversized gains during 2020. The company’s most recent quarterly numbers came in September where ENGH’s fiscal third quarter 2021 revenue was $117.6 million compared to $131.3 million a year earlier. For the past three quarters, the topline was $354.1 million compared to $382.9 million for the same nine-month period a year earlier.

Enghouse chalked up the lower revenue to tough comparables.

“The decrease reflects exceptional revenue in the comparative period as a result of COVID-19 related demand. Similar to the second quarter of 2021, the comparatively higher revenue last year was driven primarily by the previous year’s significant increase in our Vidyo business that has now returned to levels that are more consistent with pre-COVID volumes. Revenue for the quarter was also negatively impacted by $6.2 million as a result of foreign exchange as the Canadian dollar strengthened against the U.S. dollar and Euro,” said Enghouse in a September 9 press release.

Also for the fiscal Q3, Enghouse’s net income was $21.2 million, down from $26.0 million a year earlier, and adjusted EBITDA was $41.7 million compared to $45.6 million a year earlier. At the same time, the company ended the quarter with $187.8 million in cash and equivalents, leaving it some wiggle room to make further acquisitions as well as rewarding shareholders with a special dividend.

“Enghouse continues to prioritize its long-term growth strategy over quarter-to-quarter results, investing in products while ensuring continued profitability and maximizing operating cashflows. As a result, Enghouse continues to replenish its acquisition capital, while returning $83.2 million in special dividends to shareholders and annually increasing its eligible quarterly dividend,” the company said.

Enghouse has made a few acquisitions so far this year in Lisbon-based Soceidade Altitude Software, Amsterdam-based Nebu and Paris-based Momindum SAS, but Sissons says ENGH’s CEO Stephen Sadler may be reticent to buy in the current climate where prices for tech assets are high.

“The model is buy an inexpensive company and tuck it in, and I think one of the challenges for the model right now is that valuations particularly in tech are very, very steep. Sellers are looking for premium dollars to sell their businesses,” Sissons said.

“So in that context, Steve Sadler — who previously was obviously very instrumental in the OpenText story and prior to that the Geac Computer story — he’s a well known value buyer, so he may be just sitting back and perhaps taking a pause on the buying, hoping for better opportunities moving forward, given his track record. And that I suspect is the issue,” he said.

“Companies that continually do more deals, obviously, that is what drives the revenue story. So, if you’re looking for a longer term growth story then I think that Enghouse is at a reasonable level, particularly if it’s one of those underperformed over time, particularly in the last year,” Sissons said.

Year-to-date, ENGH is currently down almost 15 per cent, while since the start of 2020 the stock is up nine per cent.