Greg McLeish of Leede Jones Gable is feeling secure about Plurilock Security (Plurilock Stock Quote, Charts, News, Analysts, Financials TSXV:PLUR), initiating coverage on Wednesday with a “Buy” rating and target price of $1.00/share for a projected return of 156 per cent.

Founded in 2018 and headquartered in Victoria, B.C., Plurilock Security is an identity-centric cybersecurity solutions provider to government, institutions and businesses. The company operates two distinct business divisions, a Technology segment which builds and operates Plurilock’s own proprietary products and a Solutions segment which offers security consulting services and resells cybersecurity industry products and technologies to meet customer needs.

McLeish said Plurilock finds itself in the middle of a growing industry, with global spending on cybersecurity products and services expected to grow at a 15 per cent CAGR from 2021 to 2025.

“The growing cyber threat, particularly ransomware attacks, continues to have a massive impact on organizations across all industry verticals,” McLeish said. “According to the Identity Theft Resource Center (ITRC), the number of data breaches publicly reported so far this year has already exceeded the total for 2020, putting 2021 on track for a record year.”

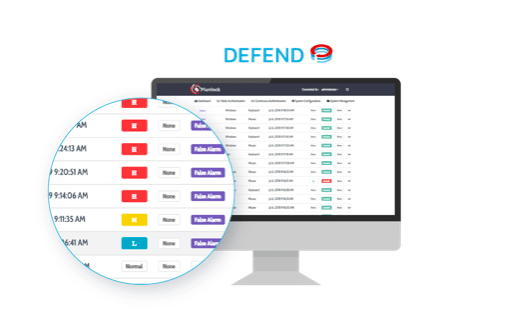

Plurilock’s two branded products, named Plurilock DEFEND (an enterprise continuous authentication platform that confirms user identity or alerts security teams to detect intrusions in real time) and Plurilock ADAPT (a standards-based login multi-factor authentication platform), take advantage of the work being done in Plurilock’s Technology division, which includes a multiple-patent-protected technology that can recognize individuals and verify identities using cutting edge behavioral biometric signatures, each generated by applying machine learning in the background to personal behavioral and input patterns, physical location and other contextual data, as users do their normal work.

Meanwhile, the Solutions division, which operates under the Aurora name after Plurilock’s acquisition of Aurora Systems Consulting Inc., supports clients’ business-critical applications with a consultative approach to cybersecurity, combining partner-provided solutions with in-house security services to help clients address their cybersecurity needs. Aurora provides hardware and packaged software and offers both expert professional services and long-term managed services capabilities.

In addition to the Aurora acquisition, McLeish noted company management’s desire to make further acquisitions in the name of offering a broader suite of products, which Plurilock hopes will enhance its ability to be a single-provider solution. Management has an emphasis on adding complementary capabilities to accelerate adoption and sales of core Plurilock technologies and integrating the technologies into its solutions.

Per McLeish, future acquisition targets include enhanced, additional and diversified product offerings and customer lists, strong brands and intellectual property, additional sales channel and partnerships, new revenue streams in adjacent market segments and accretive revenue and costs synergies.

“Many U.S. state and federal agencies have become our customers, validating how integral security is to the structure of government organizations and why our organization is a leader in providing trusted, reliable and simple cybersecurity tools,” said Ian L. Paterson, CEO of Plurilock in the company’s November 26 press release.

“Moving into the end of the year and 2022, we are focused on executing on our stated strategy of acquiring synergistic assets that can help our operation scale while providing our customers with a broader range of options when it comes to protecting their enterprise from cyber threats,” Paterson added.

Plurilock is working toward a ‘land and expand’ sales model, which combines the resale of third-party products with upselling and cross-sales of high-margin services and Plurilock’s own high-margin recurring revenue products.

The company has also worked to bolster its financial position, having completed a previously announced $4.6 million bought-deal public offering of common shares, including the exercise in full of the over-allotment option, with the proceeds going toward general working capital, research and development, marketing and general corporate purposes.

McLeish forecasts a significant jump in the company’s financial picture moving forward, improving its revenue from the reported $479,000 in 2020 to a projected $34.8 million in 2021 before increasing again to a projected $45.9 million in 2022, a potential year-over-year increase of 31.9 per cent. He then projects another jump to $51.7 million in 2023, marking a potential year-over-year increase of 12.6 per cent.

Meanwhile, with the company’s continued research and development, along with cost of goods sold eating a significant percentage of the projected revenue, McLeish forecasts negative EBITDA for the company for the next few years, projecting losses of $4.6 million in 2021, $4.2 million in 2022, and $3.8 million in 2023.

“We are currently valuing Plurilock using a 1.2x multiple to our F2023 revenue estimate. We believe that this multiple is fair as the company currently generates the majority of its revenue for the Solutions Division, which is primarily a value-added reseller of cyber security products. However, Plurilock is focused on upselling and cross selling of its high-margin products and services to its existing client and if the company is successful with this initiative, it will have a material impact on revenue and margins. Once this happens, we believe that a multiple expansion would be warranted,” McLeish said.

Though it has had peak periods throughout 2021, including its high point of $0.82/share on February 16, Plurilock presently trades at $0.40/share on the TSX Venture Exchange, the same way it started the year.

Disclosure: Plurilock Security is an annual sponsor of Cantech Letter.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment