Cresco Labs adds timely acquisitions, Beacon Securities reports

Beacon Securities analyst Russell Stanley continues to be impressed by Cresco Labs (Cresco Labs Stock Quote, Chart, News, Analysts, Financials CSE:CL), maintaining a “Buy” rating and target price of C$20/share in an update to clients on December 10 for a projected one-year return of 100 per cent.

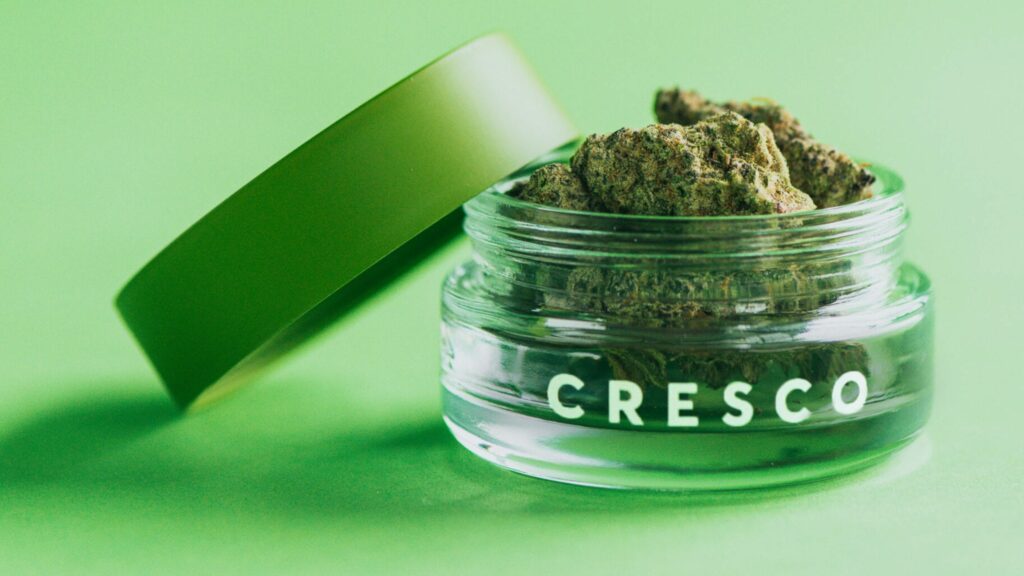

Based in Chicago, Cresco Labs is a vertically integrated cannabis company with cultivation, manufacturing and dispensary/retail facilities across the United States. In total, Cresco has operations in ten states including 20 production facilities and 44 dispensaries.

Stanley’s latest analysis comes after Cresco Labs officially closed the acquisition of Laurel Harvest Labs, a Pennsylvania-based cannabis operator.

“While we have made no material changes to our estimates, we view the closing in line with management’s guidance favourably,” Stanley said. “Given increased optimism for potential legislative action towards adult-use legalization in PA next year, the acquisitions of Laurel Harvest and Cure Penn could prove particularly timely.”

The Laurel Harvest closing comes in quick succession to Cresco’s closing of Cure Penn for $90 million in cash and stock on November 25, with the $80 million cash and stock value (plus an unspecified earnout payable based on certain post-closing milestones) of the Laurel Harvest acquisition only strengthening Cresco’s position in the Pennsylvania market. (All report figures are in US dollars except where noted otherwise.)

“Cresco is already the #1 wholesaler in PA, and in combination with its existing operations and the recently closed acquisition of Cure Penn, the company has expanded its retail presence to nine dispensaries, with licensing for an aggregate of 15,” Stanley said. “Pro forma full development of the remaining licenses in PA, CL would have the sixth largest retail footprint in the state.”

With the acquisition now complete, Cresco obtained 52,000 square feet of indoor grow/processing footprint, with the foundation for another 52,000 square feet already in place. Cresco also picked up one operating dispensary in Montgomeryville, with a second in development in Scranton and licensing for four more locations.

“Between the acquisition of Laurel Harvest and the previously closed Cure Penn acquisition, we are executing our strategy of strategic breadth and depth, focused on the most important states, and positioning ourselves to capitalize on the eventual expansion of the cannabis program in Pennsylvania,” said Charlie Bachtell, Cresco Labs’ CEO & Co-founder in the company’s December 10 press release.

“We are tailoring our strategy to the unique dynamics of each state to maintain our leading market position and increase profitability. It is imperative for us to maximize our retail presence and add a second cultivation facility to optimize product quality, assortment and accessibility to maintain the number one wholesale market share in the state,” Bachtell said.

Stanley continues to project positive financial growth for Cresco Labs, forecasting revenue of $844 million in 2021 before a projected jump into 10 figures at $1.09 billion in 2022 for a potential year-over-year increase of 29.4 per cent. From there, Stanley predicts a further jump to $1.38 billion in revenue for 2023, a potential year-over-year increase of 26.6 per cent.

Stanley also projects a widening adjusted EBITDA margin over the next two years, projecting a margin of 24.2 per cent ($204 million) in 2021, followed by a jump to a forecasted 31 per cent ($338 million) in 2022, then ramping up to a margin of 34.4 per cent ($476 million) in 2023.

From a valuation perspective, Stanley projects continued positive progress for Cresco, as he forecasts the company’s EV/Sales multiple to drop from 4.4x in 2021 to 3.4x in 2022, then to a projected 2.7x in 2023. Stanley’s EV/EBITDA multiple follows a similar track, dropping from a projected 18.1x in 2021 to 10.9x in 2022, then to a projected 7.8x in 2023.

Since the initial release of Stanley’s analysis, Cresco participated in a hearing with the state of Illinois with respect to the legal disputes surrounding the adult-use retail license evaluation and lottery process.

“The eventual issuance of 185 adult-use retail licenses represents a major expansion of the retail base relative to the 110 stores currently in operation (of which 55 are co-located with medical dispensaries),” Stanley said, while indicating that the new licenses would significantly expand the addressable wholesale market. “Cresco is unique for having three of the state’s 22 licensed cultivation/manufacturing facilities (only one other company has more than one), so it is particularly well positioned to benefit from the development of these licenses.”

Overall, with increased optimism for potential legislative action towards adult-use legalization in PA next year, Stanley believes the acquisitions of Laurel Harvest and Cure Penn could prove particularly timely for the company.

Cresco’s stock price has dropped by 38.2 per cent on the Canadian Securities Exchange for the year to date, consistently trending downward after reaching a high of $21.40/share on February 10.

Geordie Carragher

Writer

Geordie Carragher is a staff writer for Cantech Letter