Cargojet pullback makes no sense, this investor says

Portfolio manager Varun Anand has one thing to say to shareholders of Canadian overnight air cargo company Cargojet (Cargojet Stock Quote, Charts, News, Analysts, Financials TSX:CJT) — “I feel your pain.” With the stock now down about a quarter for the year and falling fast in recent weeks, Anand says there’s little reason to be negative on CJT and a airplane hangar-full of good reasons to be owning it.

“We own it in the fund and it’s been a frustrating stock, especially over the last month,” said Anand, vice president and senior portfolio manager at Starlight Capital, who spoke about Cargojet on a BNN Bloomberg segment on Wednesday.

“I put out some feelers to the Street to try to get a grasp of what’s going on. It seems like there might be some quant selling or some kind of algorithmic trading that’s unloading positions, maybe some tax loss selling,” he said.

“But let’s take a step back and look at the actual company. If you compare Cargojet today versus pre-pandemic they are about 50 to 60 per cent ahead in terms of EBITDA, margins are much higher and they’ve been able to actually expand their capacity and their fleet by purchasing more planes. So net net, they’re actually in a better position than they were pre-pandemic yet the stock is actually trading at a lower valuation and to me, it just doesn’t make any sense,” Anand said.

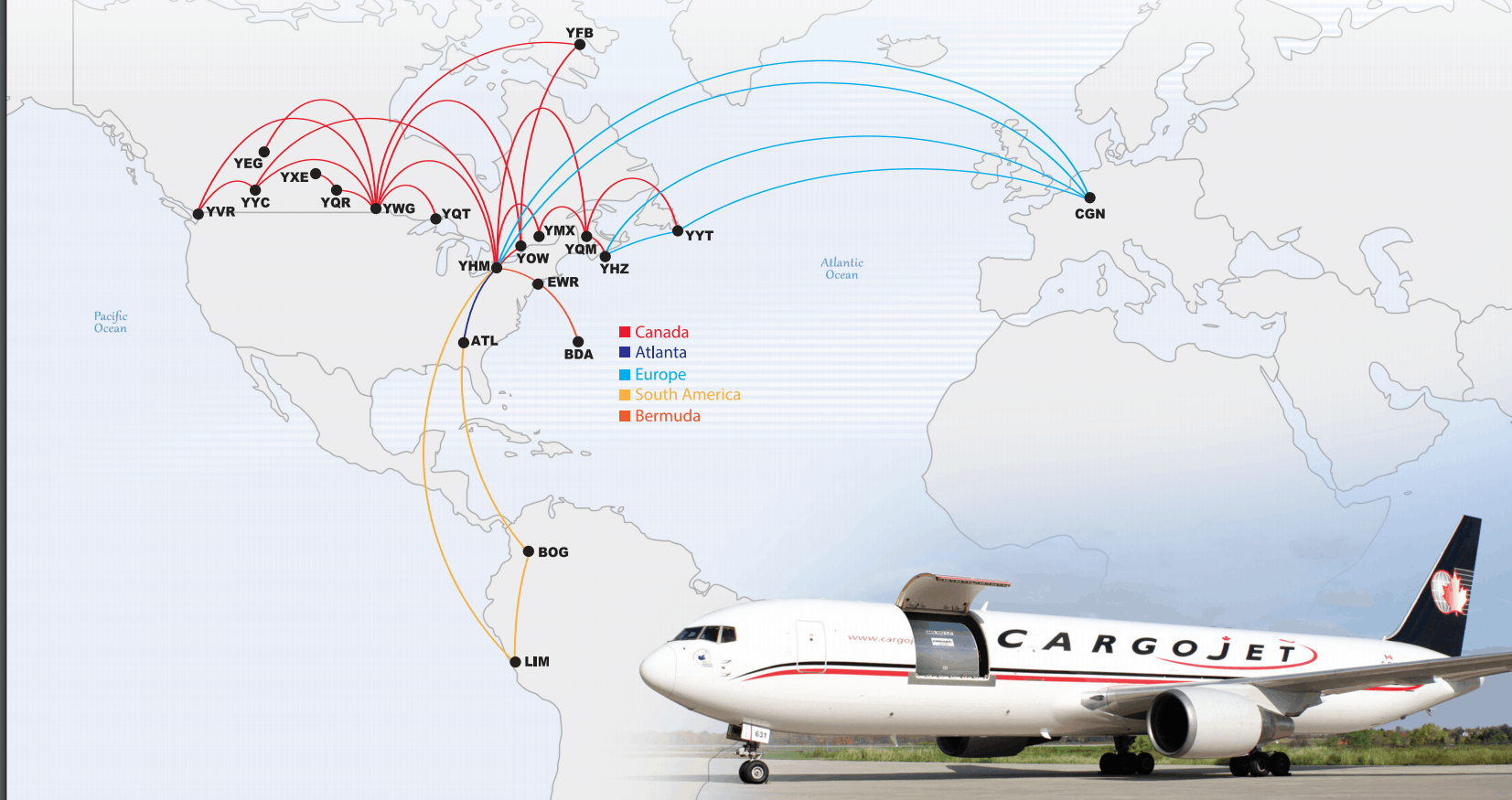

Cargojet was a no-brainer in the early days of COVID-19 as the shop-at-home economy kicked into high gear and the company saw demand for its services grow. Cargojet, which has three business segments in its Domestic Network of overnight shipping, an ACMI (Aircraft, Crew, Maintenance and Insurance) airplane leasing business and an All-in Charter business, also benefitted from a lack of commercial planes in the air over the past two years, making for fewer planes that would normally be taking cargo along the way. In response, Cargojet made the move to acquire more planes and take on more routes to meet demand, including a recent announcement confirming deals to buy three more Boeing 757-200 passenger planes to be converted to cargo.

The company delivered third quarter earnings in November which featured a 17 per cent year-over-year increase in revenue from an already-juiced Q3 2020, while adjusted EBITDA was almost flat at $70.9 million compared to $69.8 million a year earlier.

“Ocean and ground transportation supply-chains remain clogged across the globe creating short-to-medium term opportunities for air-cargo. We are seeing that reflected in our ACMI business and expect this to extend through the upcoming holiday season,” said Dr. Ajay Virmani, President & CEO, in a press release.

“As economies and businesses re-open, Consumers are keen to step out and experience in-person shopping. But our longer-term outlook for e-Commerce remains strong, particularly given the dramatic uplift in digital adoption over the past 18 months,” he said.

Anand said the drop in share price might be due to worries about Cargojet’s expansion efforts and whether they’ll still bear fruit once commercial aviation gets fully up and running again.

“There are some concerns on two things. One is they’re buying more planes and planes are expensive and if they don’t fill them up there’s going to be a drag,” Anand said. “In my opinion, Cargojet has proven their ability to utilize their planes, to get them full and up and running in a short period of time because they are very demand driven.”

“Secondly, it’s been about labour cost inflation, and this is an area where it’s fair to say that pilot fatigue rules as well as just the cost of pilots has crept up, but again that’s commensurate with revenue growth — these guys are doing much higher levels of revenue and we think that’s going to continue as e-commerce continues to get a greater proportion of wallet share as you see Amazon Canada expand, more DHL Express internationally has a tremendous appetite for belly capacity,” he said.

“People think that once travel returns that passenger airlines carrying people to leisure destinations will have more belly capacity to carry freight. But when you look at the number of routes that have been cut globally, I think there’s a tremendous amount that are permanently gone and those that come back are unlikely to make a dent in terms of the amount of space needed for freight and air cargo globally,” Anand said.

“So we like Cargojet here. We think there’s tremendous value especially for long term shareholders,” Anand said.

Cargojet finished 2020 up 108 per cent to $214, with a high of $245 set in November, 2020. Now down around $163 per share, the stock is at a return of negative 24 per cent for 2021.