Eight Capital analyst Christian Sgro remains bullish in his support for Voxtur Analytics (Voxtur Analytics Stock Quote, Chart, News, Analysts, Financials TSXV:VXTR), maintaining his “Buy” rating and target price of $1.50/share for a projected return of 60 per cent in an update to clients on Wednesday.

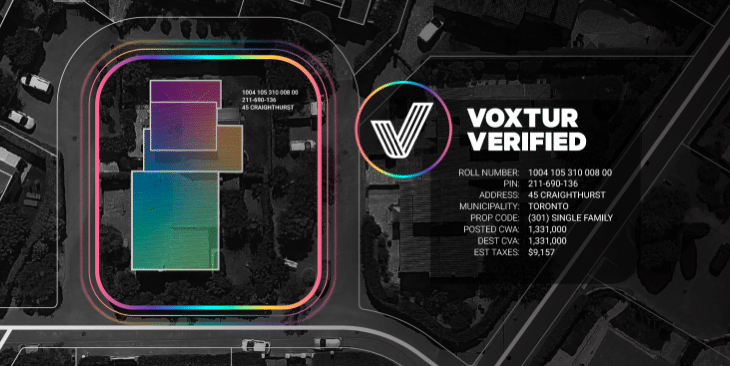

With its headquarters located in Toronto, Voxtur Analytics offers data analytics to simplify tax solutions, property valuation and settlement services throughout the lending lifecycle for investors, lenders, government agencies and servicers.

Previously known as iLOOKABOUT, Voxtur Analytics came about after iLOOKABOUT acquired Delaware-based real estate tech company Voxtur Technologies and title, escrow and Florida-based settlement services company Brightline Title.

Sgro’s latest analysis comes after Eight Capital hosted a day of virtual marketing meetings with Voxtur CEO Jim Albertelli, Executive Chair Gary Yeoman and Jordan Ross, the company’s Chief Information Officer.

“The tone was positive throughout, focused on opportunities across valuation, tax, and title all supported by a large and growing real estate database,” Sgro said.

According to Sgro, Voxtur’s 2022 plans became clearer over the course of the meetings, with a particular emphasis on the company’s Anow platform driving meaningful organic growth and generating more ‘wins’ for the company in the next fiscal year, with an aim to leverage the volumes presented by the recently-acquired Xome Valuations, as well as having MSAs with large financial institutions.

Sgro also noted that the company is working toward an alternative title insurance product that will decrease the costs to consumers for title insurance via a licensed software offering, which is currently in the pilot project stage with major lenders and prospective customers.

Voxtur has also been busy on the acquisition front, having completed a letter of intent to acquire Benutech, Inc. in order to strengthen its SaaS offerings, in particular providing a boost to Voxtur’s “Confirm your assessment” tax solution, which aims to leverage data to provide an opinion on tax assessment.

Most recently, Voxtur officially completed the acquisition of RealWealth Technologies, which has developed a proprietary, investor-centric digital platform intended to change consumer behavior through the democratization of data, content, tools, and fiduciary support, for a total consideration of five million shares, which carry an approximate value of $4.2 million, according to Sgro.

With the acquisition, RealWealth, which serves a base of approximately 60,000 members on its platform, has now been rebranded as VoxturWealth.

“The acquisition of RealWealth by Voxtur brings a new standard of integrity and confidence to real estate management in North America. VoxturWealth will engage feature elements of Voxtur companies to arm owners and fiduciaries with complete, verified data and an ability to make more informed decisions around real estate assets,” Albertelli said in the company’s September 28 press release announcing its initial agreement execution. “We are looking forward to VoxturWealth becoming an invaluable industry resource and see this acquisition as a step forward in our transition to a full-service real estate technology platform.”

On Voxtur’s M&A, Sgro said, “We expect Benutech, Xome and RealWealth to each support profitability as Voxtur continues to build and buy in North America.”

Even without the RealWealth tuck-in acquisition included, Sgro foresees positive growth for Voxtur from a financial perspective, as he projects revenue of $74 million for 2021 to mark a potential 259 per cent year-over-year increase from the $21 million reported in 2020, before a jump into nine figures at a projected $132 million, good for a potential year-over-year increase of 79 per cent.

Meanwhile, after a loss of $1 million in 2020, Sgro expects the company’s EBITDA to turn positive in 2021 at $2.4 million for a three per cent margin, with further anticipated growth to $9 million in 2022, representing a margin of seven per cent.

Sgro’s valuation data also sheds positive light on Voxtur, with the EV/Revenue multiple projected to drop from the reported 22x in 2020 to a projected 6.1x in 2021, then to 3.4x in 2022. Meanwhile, 2022 is the first year where Sgro produces a projected EV/EBITDA multiple for Voxtur, forecasting it to be 49.9x.

According to Sgro, the company is currently trading at a multiple of 3.4x its 2022E EV/revenue, which compares favourably to the Eight Capital target of 6x and the 6.5x multiple of its real estate peers, while also noting that an expanding SaaS mix and continued execution should drive further share price appreciation.

Overall, Sgro remains confident in Voxtur’s future direction, with the root of its confidence coming from the company’s leadership.

“We believe much of the intangible value is rooted in an experienced leadership team and board,” Sgro said. “Mr. Albertelli, Mr. Yeoman, and a high profile board deeply understand end market dynamics and we expect will be able to monetize a large and growing database spanning North American real estate valuations and transactions.”

Overall, Voxtur’s stock price is up 35.8 per cent over the course of 2021, hitting a high point of $1.36/share on March 1.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment