NervGen Pharma’s first data in trial looks good, says iA Capital

Chelsea Stellick of iA Capital Markets is staying bullish on biopharm company NervGen Pharma (NervGen Pharma Stock Quote, Chart, News TSXV:NGEN), reiterating her “Speculative Buy” rating and target price of $6.00/share for a projected return of 156.4 per cent in an update to clients on Monday.

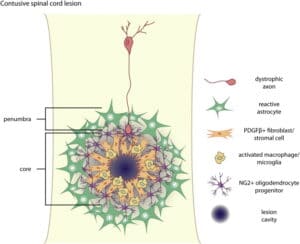

Stellick’s latest analysis comes after the company released interim data from the Phase 1 trial of its NVG-291 product – which is being developed for spinal cord injuries, multiple sclerosis and Alzheimer’s disease – at the Annual Meeting of the American Neurological Association.

The company has completed blinded testing of 25 healthy adults within five cohorts with NVG-291 or a placebo, with the primary adverse side effects being headaches and reactions at the injection sites. Overall, any adverse effects were considered mild and transient, and no effect was observed on vital signs, ECGs, or laboratory assessments.

“Based on these data, we believe it is likely the Phase 1 trial will reach the highest dose level in the upcoming multiple ascending dose (MAD) cohorts, which will be substantially higher than dosages shown to be efficacious in multiple animal models,” Stellick noted.

In addition, Stellick noted that the pharmacokinetic data from cohorts one through four show a more favourable profile in humans than in rodents, including a longer half-life (detectable up to 12 hours post-dose) alongside rapid distribution in the blood.

“These signals are very encouraging since this means NVG-291 is likely to have an even stronger effect in humans than it had in rodents, all else equal,” Stellick said.

Overall, Stellick expects the company to finish with the rest of the Phase 1 trial in the first half of 2022, with the company remaining on track to release top-line data from Phase 1 and initiate Phase 1b/2 in Alzheimer’s Dementia and Spinal Cord Injury, as well as a Phase 2 trial in Multiple Sclerosis.

“These results exceeded our expectations,” said Paul Brennan, NervGen’s President and CEO in the company’s October 18 press release. “It is very promising that NVG-291 is quickly distributed in the blood, the calculated half-life was longer than that observed in rodent studies and, notably, was detected up to 12 hours post-dose. This data increases our conviction that the unprecedented efficacy achieved in multiple preclinical disease and injury models will translate in our upcoming clinical trials with patients suffering from multiple sclerosis, Alzheimer’s disease and spinal cord injury, which we intend to initiate in the second half of 2022.”

In late September, the company announced a partnership with Imeka Solutions Inc., a neuroimaging company that combines artificial intelligence and diffusion imaging to obtain high resolution images of white matter in the brain, with NervGen intending to use Imeka’s technology to generate high resolution data on neural changes to precisely detect where and how NVG-291 changes the brain and spinal cord, with a further plan for the companies to collaborate on grant applications to fund additional research.

The company’s efforts were also boosted by the United States Senate Armed Services Committee’s release of its Fiscal Year 2022 National Defense Authorization Act (FY 22 NDAA) and the accompanying report language related to traumatic brain injury, which called for further investments in treatments like NVG-291 for the treatment of nervous system disorders.

With probability adjustments in play, Stellick is not projecting revenue for the company in any of NVG-291’s intended usage points until 2027, with $106.6 million in potential revenue coming from spinal cord injury treatments, which account for the lion’s share of the revenue projections in 2028 ($412.6 million out of a projected $446 million total), 2029 ($357.6 million out of a projected $504 million total) and 2030 ($315.4 million out of a projected $586 million total), with revenue from Alzheimer’s disease treatments becoming more pronounced in 2029 ($102.4 million) and 2030 ($188.8 million).

Though Stellick acknowledges that the interim data is a great first step in terms of de-risking NVG-291 for clinical use, she is opting to wait for multiple ascending dose data from this trial before re-evaluating the probability of success estimates.

“The preliminary data presented at the ANA over the weekend rules out several possible red flags and is unambiguously positive with respect to future clinical development,” Stellick said. “We are impressed with the preliminary results as it instills further confidence in both the safety and pharmacokinetics of NVG-291, making this positive catalyst in our view the biggest news of 2021 for NervGen. We look forward to the completion of the ongoing sixth (and final) single ascending dose cohort and the initiation of the multiple ascending dose cohorts.”

Overall, NervGen Pharma’s stock price has risen by 14.9 per cent over the course of the year, showing steady growth since bottoming out at $1.30/share on May 31, and is currently trading at $2.54/share, just short of its 2021 high point of $2.58/share from January 27.

Geordie Carragher

Writer

Geordie Carragher is a staff writer for Cantech Letter