Stefan Quenneville of Echelon Capital Markets thinks highly of Cognetivity Neurosciences (Cognetivity Neurosciences Innovation Stock Quote, Chart, News, Analysts, Financials CSE:CGN), maintaining a “Speculative Buy” rating and target price of $1.50/share for a projected return of 134 per cent in an update to clients on Thursday.

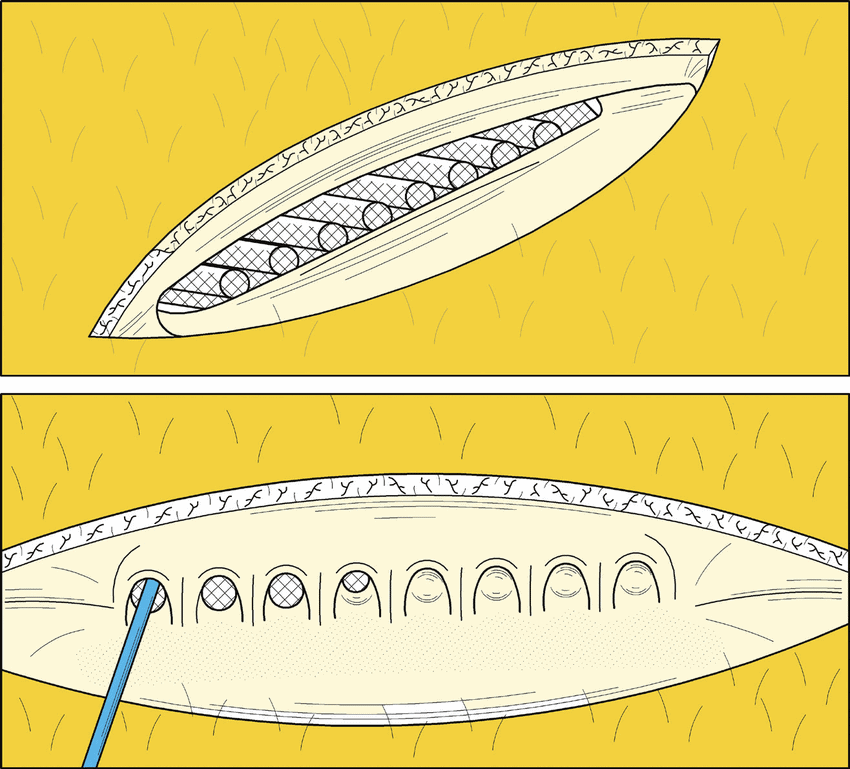

Headquartered in Vancouver, Cognetivity is a digital health company that is using artificial intelligence (AI) to enable early detection of cognitive decline in neurodegenerative diseases such as Alzheimer’s dementia (AD). The company’s primary product is a validated Integrated Cognitive Assessment (ICA) tool, an app-based alternative to pen and paper diagnoses that aims to serve a market of over 50 million people globally over the age of 65 who have AD, with over half of those suffering dying without a proper diagnosis or diagnosed at a point where care providers have limited opportunity to take mitigation steps like behavioural and pharmaceutical interventions.

Quenneville’s latest analysis comes after the company released its second quarter financial results for its 2022 fiscal year, which Quenneville noted to be in line with expectations as it progresses towards US Food and Drug Administration (FDA) approval of its ICA tool, which is expected by the end of 2021.

“This remains a key catalyst for the stock as it would grant the Company access to the large US market, where Biogen’s disease-modifying Alzheimer’s drug, Aduhelm, has begun its commercial launch and Eli Lilly has been granted a Breakthrough Therapy designation for donanemab, its investigational Alzheimer’s therapy,” Quenneville said of the potential FDA approval.

Though Cognetivity did not report any revenue from the quarter, Quenneville noted that was to be expected. The company reported $173,000 in research and development spending in the quarter compared to the Echelon estimate of $150,000; paired with operating expenses coming in at $900,000 (slightly higher than the Echelon estimate of $850,000), the company’s net loss came in at $1.03 million, slightly above the Echelon projection of $1 million.

Cognetivity’s work in its field has not gone unnoticed, as it was recently selected to be part of Silicon Valley’s Plug and Play Health Batch consortium, where leaders in the healthcare space are partnered with smaller firms with the goal of driving innovation and accelerating the commercialization of promising new technologies, while also providing the company the opportunity to explore business development opportunities with American pharmaceutical companies like Pfizer and Eli Lilly.

More recently, the company announced its first commercial agreement for the ICA to be deployed in clinical care in the Middle East, specifically at the Clemenceau Medical Center in Dubai, along with multiple locations throughout the United Kingdom.

“We’re thrilled about the deployment, which will see the ICA form part of a cutting-edge service dedicated to providing world-leading healthcare,” said Dr. Sina Habibi, Cognetivity’s CEO in the company’s September 22 press release regarding the Dubai agreement. “Achieving this feat within a few short weeks of our regional launch proves that we have got it absolutely right in terms of recognising the clinical demand but also creating a world-beating tool whose language- and culture-independence make it rapidly deployable in any new clinical environment. This stands us in very good stead as we continue to pursue our ambitions of large-scale, global commercial rollout.”

In addition, the company has also secured an agreement with Ketamine One, a Vancouver-based wellness company focused on ketamine-assisted treatment of various mental health conditions, to deploy the ICA in five of its 16 locations with the intent of monitoring cognitive performance in patients with treatment-resistant depression and PTSD.

Quenneville forecasts the company to bring in its first revenue in 2022 at $200,000, though the figure is projected to gradually increase through 2025, where Quenneville projects revenue of $18.3 million. Meanwhile, after projecting losses of $3.9 million in 2022 and $3 million in 2023, Quenneville projects the company’s EBITDA to turn positive in 2024 at $1.4 million, followed by another forecasted jump to $8.5 million in 2025.

From a valuation perspective, Quenneville projects the company’s EV/Sales multiple for the first time in 2022 at 18x compared to the peer group projection of 7.9x, with 2023 projecting an identical 5.9x multiple for both Cognetivity and the peer group. Meanwhile, only the peer group EV/EBITDA is projected, with figures of 43.3x in 2022 and 90.3x in 2023.

Overall, Quenneville believes Cognetivity continues to have a bright future as it progresses toward a potential breakthrough.

“The company continues to make commercial progress with the ICA with a number of recent announcements for deployments in leading hospitals and memory clinics,” Quenneville said. “Given the proven efficacy, ease of use and scalability of the test, we continue to view Cognetivity as meaningfully undervalued.”

Cognetivity’s stock price has risen by 6.8 per cent for the year-to-date, reaching a high point of $1.30/share on June 16.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment