Is Kinaxis too risky at these levels?

Canadian supply chain management software company Kinaxis (Kinaxis Stock Quote, Charts, News, Analysts, Financials TSX:KXS) has been a winner of a stock to own over the past couple of years, including more recently when the stock jumped about 40 per cent since June.

But those gains along with some worries about the company’s client base have portfolio manager Darren Sissons sitting on the sidelines for now.

“The company has performed very well, and if you’ve been an owner for a long period of time you’ve been richly rewarded,” said Sissons, vice-president and partner at Campbell, Lee & Ross, who spoke on BNN Bloomberg on Wednesday.

“I really only have two comments on [Kinaxis]. One is that we should have bought it, and I can flag a few friends who have told me to do that,” Sissons said. “But the challenge, really, that I’ve always had is I think it’s quite expensive and I think there’s a relatively small client base.”

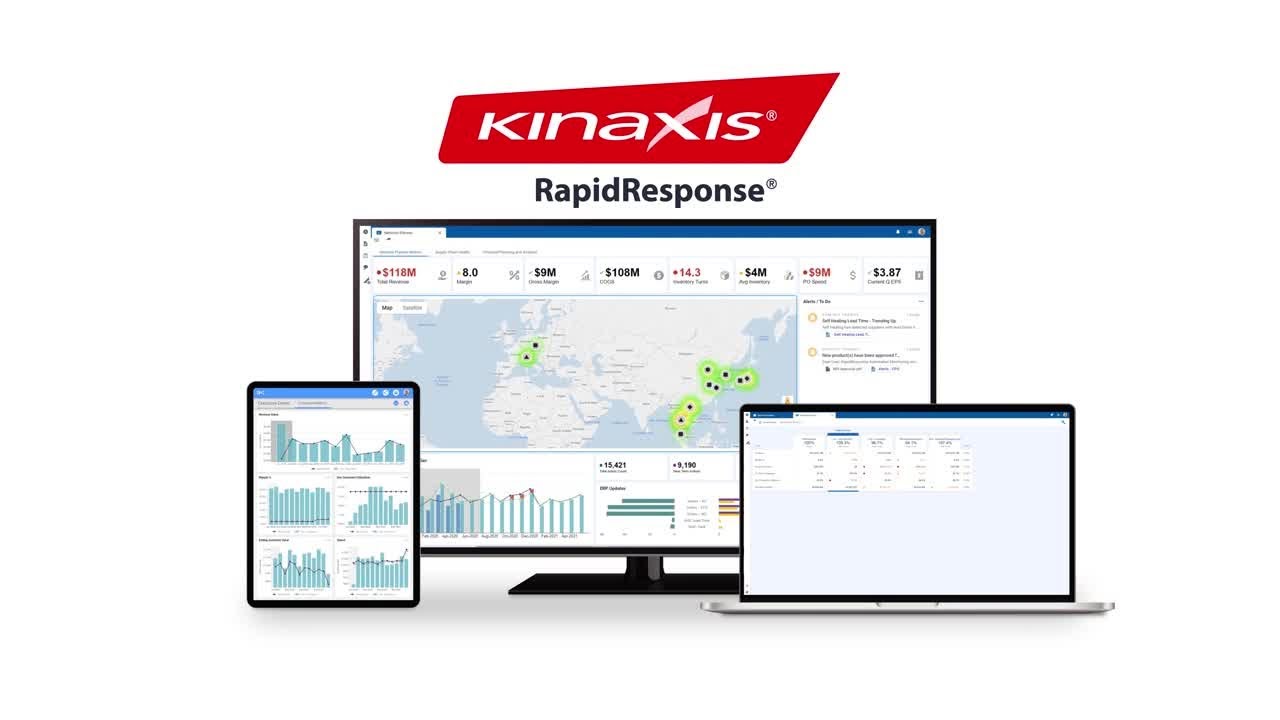

Ottawa-headquartered Kinaxis has the Rapid Response concurrent planning platform that uses artificial intelligence to deliver a range of solutions including sales and operations planning, supply and demand-side planning and inventory management. The company has notched a list of big customer wins over the years from Unilever and car companies like Toyota to Honeywell, Qualcomm and defence giant Raytheon.

Demand for Kinaxis’ products grew over the pandemic as companies looked to firm up their supply chains amid the uncertain business environment. For 2020, the company saw revenue grow by 17 per cent to $224.2 million, with its SaaS-based software segment, the company’s largest, putting on 25 per cent to $148.9 million. (All figures in US dollars.)

“With the continued recovery of a more normal business environment, we expect our current momentum and positive outlook to drive a return to higher growth for 2022 and beyond. Our year-end sales pipeline grew more than 40 per cent from 2019, as manufacturers continue to recognize the urgency in driving hyper-agility in their supply chain,” said president and CEO John Sicard in a fourth quarter 2020 press release in March.

The company touted its growing pipeline as well as its operational organic and inorganic growth over the year, with key acquisitions including AI-based retail and CPG Demand Planning company Rubikloud for $60 million.

What’s happened so far in 2021? Seemingly more of the same, as the company, which delivers third quarter earnings on November 5, has remained upbeat on its growth trajectory.

In Kinaxis’ second quarter report delivered in August, Sicard said the company had experienced three consecutive quarter of strong business momentum.

“With all the well-known disruptions that supply chains have endured over the past year, we are seeing a heightened level of interest in the hyper-agility that only Kinaxis can bring to the planning process,” said Sicard in a press release.

”Compared to the first half of last year, we have won over twice the number of new customers, and our annual recurring revenue is 24 per cent higher than a year ago. We believe that these are excellent indicators of the positive trends in our business and give us even greater confidence in our expectation of a return to higher SaaS revenue growth next year,” he said.

But Sissons is less than sure that Kinaxis is the best place for investors’ money at the moment.

“When there’s a relatively small client base you have a client concentration risk and a revenue concentration risk, and given the valuation I just think that there are better opportunities around,” he said.

“But it’s a quality company, no doubt, and it has performed well. But that risk for us is just a little too great, so we have not chosen to partake in that company,” Sissons said.

Revenue for Kinaxis’ second quarter 2021 was down a slight two per cent from last year to $60.1 million, which broke down to $42.3 million in SaaS sales (up 18 per cent), $620,000 in Subscription term license sales (down 94 per cent), $14.0 million in Professional services (up 13 per cent) and $3.1 million in Maintenance and support (down three per cent).

On earnings, KXS’s Q2 adjusted EBITDA was down 68 per cent to $7.1 million and EPS was down 66 per cent to $0.11 per diluted share. On guidance, Kinaxis management has called for full 2021 revenue of $242-247 million, which would be up from the $224 million generated in 2020. It sees its SaaS business growing by 17-20 per cent for the year.

Last month, Kinaxis announced it had achieved carbon neutrality for the 2020 emissions from its operations. The company’s 2021 Global Impact Report states that of the 3921.21 tonnes of CO2 released through its business in 2020, 2390.41 tonnes were offset through Equinix’s renewable energy credits and the other 1,525 tonnes were offset through purchasing high-quality offsets in wind generation projects in India and the United States and a climate and ecosystems conservancy project in Newfoundland.