Echelon Capital Markets analyst’s Stefan Quenneville continues to see the potential in DIAGNOS (DIAGNOS Stock Quote, Chart, News, Analysts, Financials TSXV:ADK), reiterating his “Speculative Buy” rating, Top Pick status and target price of $1.55/share in an update to clients on Thursday.

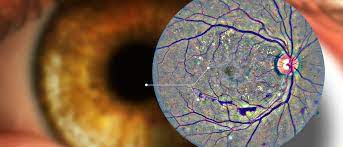

Founded in 1996 and headquartered in Montreal, DIAGNOS is an artificial intelligence company in the commercials of addressing diabetic retinopathy, a leading cause of blindness. Its CARA AI technology, which imports, processes and stores original and enhanced images through computerized networks, is in the process of rolling out in New Look optical retail outlets throughout Canada in the second half of 2021.

Quenneville’s latest analysis comes after DIAGNOS released its operating results for the second quarter of 2022, which Quenneville noted came in ahead of expectations.

“Going forward, the focus for the Company remains on successfully executing the rollout of its CARA AI technology in New Look’s 400+ optical retail outlets in the coming quarters and the finalizing of a deal with industry leader, EssilorLuxottica, which is anticipated by year-end and should be a meaningful catalyst for the stock,” Quenneville said.

The company’s financial results were headlined by $80,900 in revenue in the quarter, marking a seven per cent sequential growth while outpacing the Echelon estimate of $78,000 and producing a 1.4 per cent year-over-year improvement over the same quarter in 2020, with Quenneville noting that its rollout for the CARA AI line of products within New Look stores only got underway in September.

The company’s EBITDA results also beat Echelon expectations, as DIAGNOS reported a $622,000 EBITDA loss compared to the Echelon projection of a $772,000 loss; Quenneville attributes this to the company’s general and administrative expenses coming in below their forecast, with the company reporting $474,000 in expenditures compared to the Echelon projection of $600,000.

To date, DIAGNOS’ platform has been installed in 12 New Look locations in Quebec as the partners work together to optimize the training and operational procedures for the broader rollout; Quenneville expects the process to be completed by mid-November, followed by a progression to a pace of roughly new installations per week, with a goal of approximately 40 locations by the end of the year.

DIAGNOS’ technology is also acquitting itself well on the big stage, having delivered top-tier results at the GAMMA (Glaucoma grAding from Multi-Modality imAges) contest, held in conjunction with The Medical Image Computing and ComputerAssisted Intervention Society 2021 (MICCAI2021) conference.

Out of 566 organizations in total who participated, the company took top honours in two out of three categories, localization of macula fovea in fundus images and segmentation of optic disc and cup in fundus images, and placing eighth in grading glaucoma using multi-modality data.

“We are very proud to have established a strong technical team at DIAGNOS to be able to compete worldwide in the Artificial Intelligence space,” said André Larente, CEO of DIAGNOS in the company’s October 28 press release. “This is a world-class competition. AI-driven analysis of retina Fundus images and OCT (Optical Coherence Tomography) images is the new medical standard in the detection and monitoring of serious vision-threatening diseases. At DIAGNOS, we are investing heavily in R&D and in our strategic alliance with ETS (Ecole de Technologie Supérieure) to maintain our leadership in this space. Delivering top-tier results in this competition demonstrates DIAGNOS’ technical excellence.”

By the numbers, Quenneville has forecasted total revenue of $800,000 in 2022 before booming to a projected $7.9 million in 2023. Meanwhile, after a projected loss of $2.4 million in 2022, Quenneville expects the company’s EBITDA to turn positive in 2023 at a projection of $2.3 million for a margin of 29.1 per cent, as well as yielding a positive EPS projection of $0.03/share.

Quenneville projects the EV/Sales multiple to drop to 5.6x in 2022 compared to the peer group projection of 14.3x, with a further drop to a projected 2.3x in play for DIAGNOS in 2023 compared to 10.2x for the peer group.

The EV/EBITDA multiple tells a similar story, as Quenneville projects DIAGNOS’ initial multiple at 27.7x for 2022 to significantly outpace the peer group projection of 113.1x, with a further reduction to a projected 4.2x for DIAGNOS in 2023 compared to a projected 48.2x for the peer group.

With its Memorandum of Understanding with EssilorLuxottica from August still in place to deploy its CARA AI platform in clinics worldwide via the merged company’s Instruments division, Quenneville firmly believes the deal gives DIAGNOS and its technology validation in the marketplace.

“While the timeline and scale of a potential deal with EssilorLuxottica remain uncertain for now, concluding a deal would be a game-changer for ADK given the sizable financial opportunity and the industry validation of its technology platform,” Quenneville said.

Overall, the stock price for DIAGNOS is down 21.9 per cent for the year to date, steadily declining since hitting a high point of $0.75/share on January 13 and recently bottoming out at $0.43/share on September 21. At press time, Quenneville’s $1.55 target represented a projected one-year return of 237 per cent.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment