Research Capital Corporation analyst Yue (Toby) Ma is standing firm on Perimeter Medical Imaging AI (Perimeter Medical Stock Quote, Chart, News, Analysts, Financials CVX:PINK), maintaining his “Speculative Buy” rating and target price of $4.90/share in an update to clients on Tuesday.

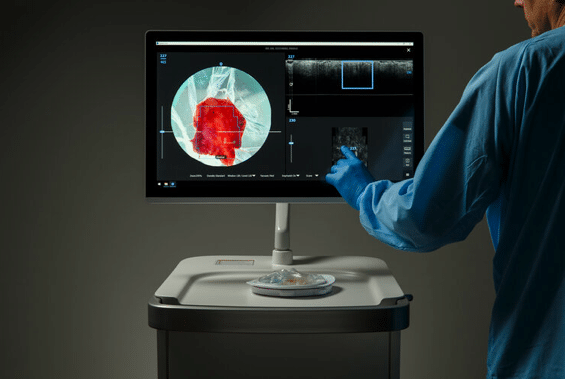

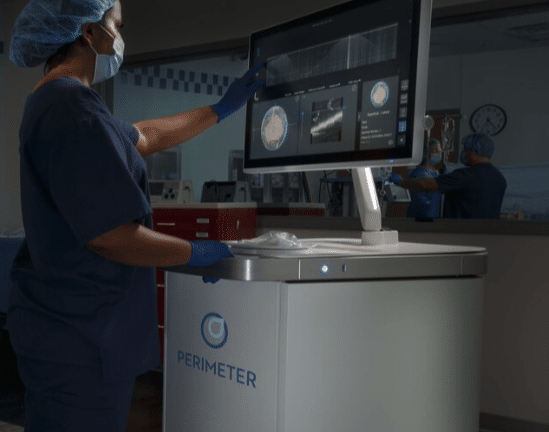

Headquartered in Toronto with its American operations in Dallas, Perimeter Medical is a medical technology company using ultra-high-resolution, real-time, advanced imaging tools to address unmet medical needs. Perimeter Medical is in the process of developing a proprietary, next-gen AI technology product called ImgAssist AI (software as a medical device) to aid surgeons with margin assessment during breast lumpectomy, with an aim to test the ImgAssist AI/Perimeter Optical Coherence Tomography (OCT) combo in lowering risk of re-operations.

Ma’s latest analysis comes after Perimeter Medical announced its second quarter financial results, though Ma notes the financials aren’t as important at this point in the company’s growth trajectory, with an expectation for sales to begin later in 2021.

While the company did not report any revenue for the quarter, it did lower its net income loss to $3.2 million from $4.6 million year-over-year, while reporting cash and cash equivalents of $13.7 million and nearly $900,000 in investments.

The Perimeter OCT system has already been granted Breakthrough Device Designation by the FDA, allowing for accelerated interactions with the FDA during product development and prioritized review of future regulatory submissions.

A randomized, controlled pivotal trial in over 300 breast cancer patients scheduled for lumpectomy is scheduled to begin in September, with results scheduled to be reported in the first quarter of 2022 and FDA clearance of ImgAssistAI, potentially in the second half of 2022, expected to boost use of Perimeter OCT.

“Perimeter OCT is currently in the early launch phase, during which PINK is educating potential prospects (i.e. hospitals) and demonstrating the product,” said Ma in his report. “The company is in late-stage discussions with several large healthcare facilities groups (including MD Anderson and several HCA Healthcare sites) for the first set of Perimeter OCT installations. COVID-19 restrictions and hospital backlogs made the first expected installation behind PINK’s original schedule.”

“We have modeled that PINK would sign its first sales contract in Q3 2021 and complete the installation in the same quarter. The company has recently strengthened its force to support the launch of Perimeter OCT by expanding the sales/marketing/medical affairs teams and hiring a CFO with experience in product launches,” Ma wrote.

Perimeter recently strengthened its force to support the launch of Perimeter OCT by expanding the sales, marketing, and medical affairs teams and hiring a Chief Financial Officer with experience in product launches.

“We believe we have made significant progress this past quarter as we continue to ramp-up our commercialization efforts to bring Perimeter’s innovative, ‘real-time’ imaging technology to our target customers,” said Jeremy Sobotta, Perimeter’s CEO, in the company’s August 30 press release. “Our initial market development managers, under the direction of our Chief Commercial Officer, are actively meeting with prominent surgeons to place Perimeter S-Series OCT in leading healthcare institutions throughout key regions in the U.S.”

“Our medical affairs and marketing teams remain sharply focused on clinical education activities that will support our commercial growth plans and help our customers successfully use Perimeter’s technology with the goal of obtaining better patient outcomes and lowering costs,” Sobotta added. “In addition, we continue to make advancements with the clinical development of our breakthrough-device-designated, ‘next-gen’ Perimeter B-Series OCT with ImgAssist AI, which is aimed at helping breast cancer surgeons reduce re-operation rates. We expect to initiate a randomized, multi-site pivotal study in order to generate data to demonstrate how Perimeter’s technology performs against the standard of care.”

With the expectation of sales beginning in the final quarter of 2021 in place, Ma’s financial metrics for the rest of the 2020s show fairly steady growth potential, with 2022 projecting to be the first year Perimeter cracks seven figures in revenue ($6.1 million) before hitting a ramp that projects the company to reach $43.1 million in revenue by 2026, and a projected $57.1 million by 2030. Notable year-over-year increases include a projected 147 per cent jump from 2022 to 2023 ($14.9 million), a projected 70.7 per cent increase from 2023 to 2024 ($25.5 million), and a projected 37.4 per cent increase from 2024 to 2025 ($35.1 million).

Meanwhile, Ma doesn’t project Perimeter to get into positive EBIT territory until a projected $130,000 in 2024, with eventual projected growth to $20.6 million by 2030. After 2024, EBIT projections spike to $5.7 million and a 16.2 per cent margin for 2025, before more than doubling to a projected $11.9 million in 2026 with a 27.7 per cent margin.

With Perimeter’s crucial trial set to begin in September, Ma is confident in what the eventual results will bring for the company.

“We believe the Perimeter OCT/ImgAssist AI combo represents a paradigm-shifting imaging technology for breast cancer surgery, which should generate fast-growing revenues going forward,” Ma said.

At press time, Ma’s $4.90 target price represented a projected one-year return of 85 per cent. So far in 2021, PINK has been up and then down again and is currently at about even for the year.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment