Kraken Robotics has a 127 per cent upside, says Beacon

Beacon Securities analyst Gabriel Leung believes Kraken Robotics (Kraken Robotics Stock Quote, Chart, News TSXV:PNG) is ready to rise, maintaining his “Buy” rating and target price of $1.00/share in an update to clients on September 13.

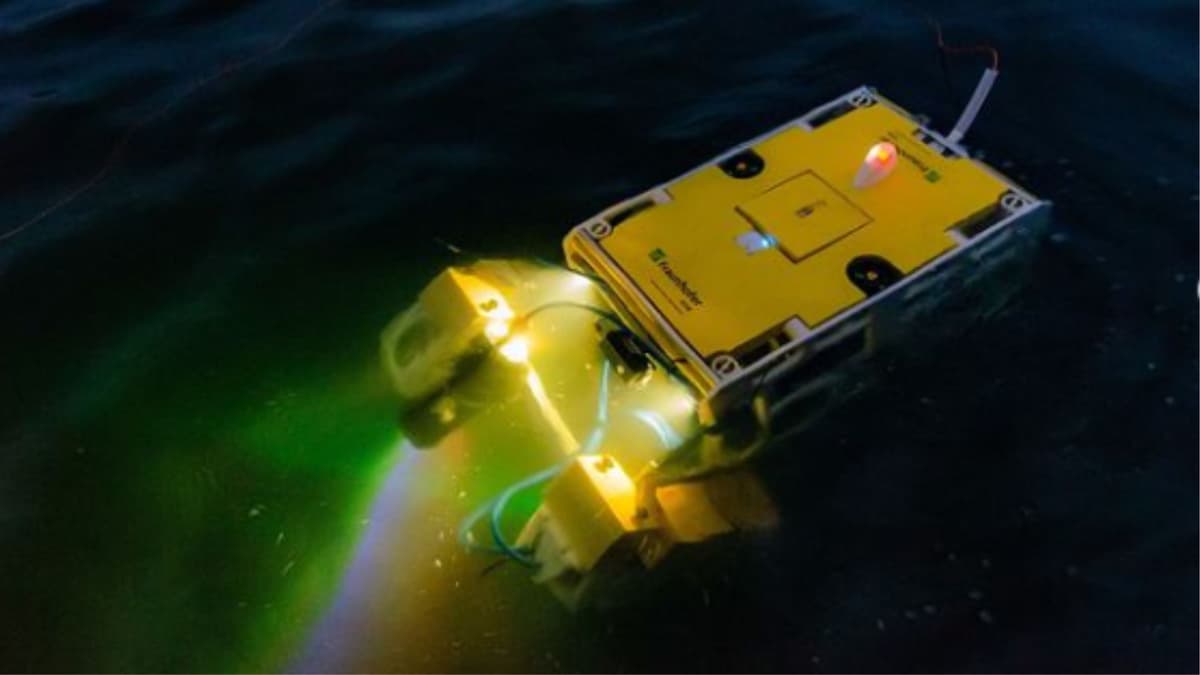

Based in Newfoundland, Kraken Robotics is a marine technology company providing ultra-high resolution, software centric-sensors and underwater robotic systems.

Leung’s latest report comes after Kraken reported its second quarter financial results, which Leung believes set the organization up for a solid second half of the year.

“Despite relatively modest H1 revenue and EBITDA results of approximately $5.6 million and breakeven respectively, the company is calling for full year 2021 revenues and EBITDA to come in at $28–30 million and $3–4.5 million respectively,” Leung said.

The company’s second quarter results were headlined by $1.9 million in revenue, down slightly from the $2.3 million reported in the comparative quarter of 2020, with the company attributing revenue to progress with Kraken’s ongoing order for the Danish Navy.

Kraken also reported negative adjusted EBITDA of $197,000 in the quarter, an improvement from the $400,000 in negative adjusted EBITDA in the same quarter of 2020.

The company also noted it had $7.1 million available in previously awarded funding from government agencies and project funding partners.

Kraken has been busy in recent months, picking up a $600,000 Robotics as a Service (RaaS) contract from Newfoundland and Labrador Hydro in July for a subsea cable survey, as well as an $800,000 contract for an AquaPix MINSAS 120 sonar system for an unidentified Fortune 500 company with activities in the defense sector, with the company expecting to complete the order in the first quarter of 2022.

Most notably, Kraken completed the acquisition of PanGeo, a private Canadian services company specializing in high-resolution 3D acoustic imaging solutions for the sub-seabed with offices in St. John’s, Newfoundland and Aberdeen, United Kingdom.

As Leung reported previously, the $23 million purchase price included $3 million cash payable within 30 days, 12,068,965 shares issued at $0.58/share (Value: $7 million), a two-year, $4 million promissory note with a six6 per cent coupon per annum, with up to 40 per cent of principal payable in stock, and up to $9 million in earn-outs payable after 12 and 24 months. The earn-outs are payable 50 per cent cash, and 50 per cent stock at Kraken’s options.

In addition to the transaction, Kraken’s Board of Directors approved the issuance of one million options to a PanGeo officer in a five-year term, with an exercise price of $0.50/share.

“We are pleased to have completed this acquisition and to welcome the PanGeo employees to the Kraken team,” said Karl Kenny, President and CEO in the company’s August 3 press release announcing the completed acquisition. “Together, we offer a holistic solution of world-leading technologies and services in subsea acoustic and optical imaging, autonomous robotics, and subsea batteries for customers in the defense and commercial markets. We are also excited for the increased exposure to the offshore renewable energy market and believe we can bring technologies to bear that will drive down customer costs, improve safety, and reduce their emissions footprint.”

The acquisition was immediately fruitful, as PanGeo secured $2 million in funding from Canada’s Ocean Supercluster to develop GeoScan, which should produce wider scanning capability and increased efficiency.

Leung’s financial forecasts, in accordance with Kraken management guidance, has Kraken reaching $28.1 million in revenue for 2021, which would be a potential 128 per cent year-over-year increase, before climbing to a projected $37 million in 2022, a potential 31.7 per cent year-over-year increase.

In addition, Leung projects the adjusted EBITDA will swing positive for the first time in 2021 at $3.9 million for a 13.9 per cent margin, then rising to a projected $4.7 million, though the margin would drop to 12.8 per cent.

Leung projects Kraken’s EV/Sales multiple to drop from 6.7x in 2020 to a projected 2.9x in 2021, then dropping to a projected 2.2x in 2022. With EBITDA projected to turn positive in 2021, Leung’s EV/EBITDA multiple projections begin there at 21.2x, then dropping to a projected 17.4x for 2022.

“As noted in our recent reports, we believe the recent acquisition of PanGeo provides the company with a stable source of profitable (and growing) recurring revenues, which should help to smooth out volatility in Kraken’s traditional product-focused business,” Leung said.

Overall, Kraken’s share price has dropped 23.7 per cent for the year to date, reaching a high point of $0.99/share on February 10. At the time of publication, Leung’s target price of $1.00 per share, which is based on 5x the company’s EV/Sales projection for 2022, represented a projected one-year return of 127 per cent.

Geordie Carragher

Writer

Geordie Carragher is a staff writer for Cantech Letter