Crypto company Voyager Digital continues to execute, says Eight Capital

Adhir Kadve of Eight Capital is ready to start a journey with Voyager Digital (Voyager Digital Stock Quote, Chart, News CSE:VOYG), maintaining a “Buy” rating and a target price of C$31.00/share on VOYG in an update to clients on Tuesday.

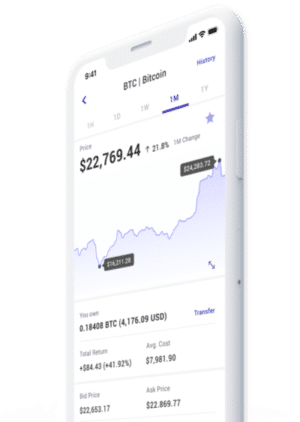

Founded in 2018, digital asset focused agency broker and financial services firm Voyager Digital became a pubco in the opening quarter of 2019 and then over that year added iOS and Android apps to its arsenal and followed up with a desktop launch which it completed at the end of 2020.

Kadve’s latest analysis comes after Eight Capital hosted Voyager Digital CEO Stephen Ehrlich and CFO Evan Psaropoulos for virtual investor marketing meetings, with a focus on the company’s investments into the business, shifting interest revenues to a “staking” model, the rollout of the debit card offering and mergers and acquisitions.

“We continue to believe that VOYG is early days in building out a one-stop financial services platform based on cryptocurrencies,” Kadve said. “We came away incrementally more positive on the company’s ability to execute on a well-defined user acquisition strategy based on increased marketing spend, product rollouts, platform enhancements and geographic expansion which in turn will drive strong revenue growth ahead.”

Kadve notes that company management continues to focus on investing in the business, with key areas being marketing to bring in more users, enhancing its tech stack by hiring additional personnel, and improving its customer service (including the implementation of chat-bots and a call-back phone service), with the company recently announcing that its platform had reached two million Verified Users.

With generating even more users in mind, Kadve also notes that the company’s rollout of its debit card program is ongoing, where users can earn a nine per cent yield on their USDC holdings and use those holdings to pay for everyday purchases.

He also notes that the company may be looking to leverage its partnership with Blockdaemon to move to a staking model for its interest revenue. Also known as a Proof of Stake model, a user’s cryptocurrency assets are staked and earn a yield (or reward) because that cryptocurrency’s blockchain uses those assets to validate and secure all transactions.

The company also added to its portfolio by acquiring Coinify, a cryptocurrency payment platform with a global user base in over 150 countries, with Kadve believing there may be more to come.

“On the back of the recent Coinify acquisition, management continues to see M&A as a strategic option,” Kadve said. “Acquisition targets would be geared towards accelerating geographic expansion into Europe or Canada or to enhance the overall platform via acquiring complementary technology.”

The company has been busy in recent months, making its debut as the primary sponsor on a NASCAR Xfinity Series car in June while also becoming the first sponsor to be paid fully in a portfolio of cryptocurrency, serving as the official cryptocurrency partner for the inaugural Players Symposium for over 100 NFL players held in Las Vegas in July, announcing a partnership with Usio, a FinTech and integrated electronic payment solutions provider, to enable merchants to accept many cryptocurrencies as payment, and announcing an agreement with Market Rebellion to jointly operate a broker-dealer focused on providing online brokerage services for equities, options, and futures.

Most recently, the company announced a marketing partnership with Tampa Bay Buccaneers tight end Rob Gronkowski which will see Gronkowski participating in a series of campaigns designed to bring crypto investing to the mainstream.

“Rob Gronkowski is a great athlete, and an even greater human being. He’s someone we all want to be friends with,” Ehrlich said in the company’s September 8 press release. “I can’t think of a better person to have as our brand ambassador. When people hear something from Gronk, they know they’re getting the real deal. We also know that by working with Gronk, we are going to get our message out there and have a lot of fun.”

The company’s momentum has Kadve projecting big things from a financial perspective, including a revenue jump to a projected $172.6 million for 2021, followed by a potential 178 per cent year-over-year increase to a projected $479.6 million in revenue for 2022. He also projects 2022 to be the year Voyager breaks into positive EBITDA territory at a projected $77.4 million for a margin of 45 per cent, with a boost to a projected $150.9 million in play for 2022, though it comes with a lower margin of 31 per cent. (All report figures in US dollars except where noted otherwise.)

From a valuation perspective, Kadve’s projections have the EV/Sales multiple initially projecting at 12.3x for 2021 before a dip to 4.4x in 2022 and the EV/EBITDA multiple dropping from a projected 27.4x in 2021 to 14.1x in 2022, while the analyst’s P/E projection for 2022 at 14.8x.

Voyager Digital recently delisted from the Canadian Securities Exchange to begin trading on the Toronto Stock Exchange, where its stock price has dropped 18.6 per cent since it began trading there on September 7. At the time of publication, Kadve’s C$31.00 target represented a projected one-year return of 91 per cent

Geordie Carragher

Writer

Geordie Carragher is a staff writer for Cantech Letter