Lightspeed Commerce is just getting started, says National Bank

National Bank Financial analyst Richard Tse has plenty to say about Lightspeed Commerce (Lightspeed Commerce Stock Quote, Chart, News, Analysts, Financials TSX:LSPD), reiterating his “Outperform” rating while increasing his target price to $120.00/share (C$150.10/share) from $110.00/share (C$137.59/share) in an update to clients on August 5.

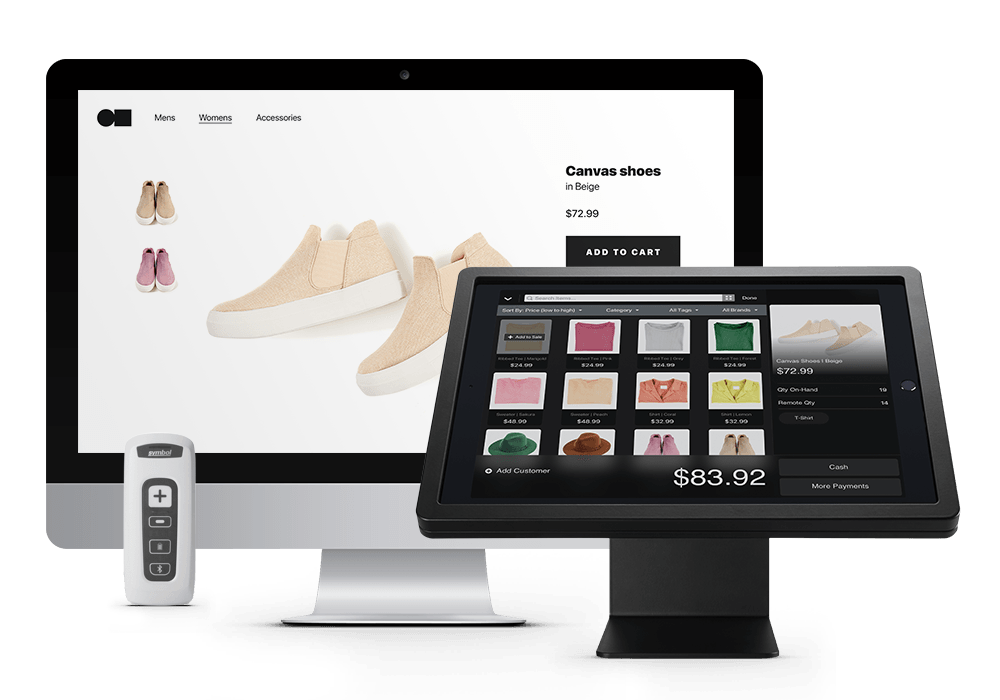

Founded in 2005 in Montreal, Lightspeed offers a cloud-based point of sale system for business, with its solutions allowing users to manage inventory, loyalty, sales, analytics and other related processes.

Tse’s analysis comes after Lightspeed reported fiscal first quarter 2022 financial results (quarter end June 30) that were ahead of his and consensus expectations.

“We reiterate our Outperform rating on LSPD and increase our price target to $120 (was $110) based on our multi-stage DCF that captures the Company’s longer-term outlook with growth from both new merchants and increasing ARPU care of products like Payments and eCommerce,” he said.

Lightspeed reported revenue of $115.9 million in the quarter, handily beating the consensus estimate of $92.8 million and the National Bank estimate of $94.1 million. Adjusted EBITDA figures also came in ahead of expectations, as the reported $6 million loss beat the consensus estimate of a $9.9 million loss and the NBF projection of a $10.1 million loss, producing a quarter-to-quarter margin improvement of 650 bps. (All figures in US dollars except where noted.)

Tse notes multiple contributors to the company’s successful quarter, including organic growth from economic recoveries and reopenings with a number of new clients including SpaceX and Telluride Ski Resort, a 453 per cent year-over-year growth in transaction-based revenue thanks to its Lightspeed Payment platform with further expansions imminent throughout Europe and a goal of 50 per cent penetration across its merchant base, as well as a partnership with OpenTable, a San Francisco-based online restaurant reservation platform, which will see OpenTable directly integrated into Lightspeed’s platform without needing an OpenTable device.

From a capital perspective, Lightspeed had 430 capital advances in the quarter to produce a 68 per cent quarter-to-quarter growth, with $3.6 million in advances still outstanding.

The company has also been busy from an acquisition standpoint, having acquired California-based eCommerce shopping cart platform Ecwid, as well as NuORDER, an eCommerce platform which counts COACH, Arc’Teryx, and Steve Madden among its clients.

“As economies reopen and new business creation accelerates, Lightspeed’s one-stop commerce platform is emerging as the technology of choice for retailers and restaurateurs the world over” said Dax Dasilva, Founder and CEO of Lightspeed in the company’s August 5 press release. “Our customers are entering into a new world of commerce forever altered by COVID-19 and they are turning to Lightspeed to help them simplify their operations, scale their businesses and deliver exceptional customer experiences.”

After reporting $221.7 million in revenues for the 2021 fiscal year, Tse projects that number to skyrocket going forward, estimating $530 million in revenues for 2022 for a projected 139.1 per cent year-over-year increase, with a further jump to $713 million forecast for 2023, which would represent a 34.5 per cent year-over-year increase if the 2022 estimate holds.

Tse forecasts adjusted EBITDA loss to be up and down over the next two years, predicting a $35.7 million loss (originally a $32.9 million forecasted loss) for 2022, then improving to a forecasted loss of $7.3 million (originally a $4.4 million loss) in 2023.

On multiples, Tse has evaluated LSPD using EV/Sales, which he thinks will drop from the 53.2x reported in 2021 to 22.3x for 2022, then dropping again to an estimated 16.5x for 2023.

Overall, Tse believes Lightspeed is still accelerating in the early phases of its growth.

“In our view, FQ2 provides a glimpse into what a ‘normalized environment’ would be for a name that’s gaining momentum (market share) through a combination of complementary organic and acquisition measures,” he said. “While Lightspeed has grown into a much bigger Company since its IPO in 2019, we still see this name at a very early stage in its growth trajectory, particularly given the potential upside from Payments as well as incremental growth drivers like the Company’s Supplier Network, Lightspeed Capital and recent technology partnerships with Google and OpenTable. The Company’s ability to strategically and tactically execute over the past 18 months gives us increasing confidence in a reopening market.”

At press time, Tse’s $120.00/share (C$150.10/share) target represented a projected 12-month return of 27 per cent. Overall, Lightspeed’s stock has increased by C$33.21/share (38.85 per cent) for the year to date.

Lightspeed announced on Friday the full exercise of an over-allotment option for its recent share offering, taking the initial off of 7.7 million shares to 8.855 million at $93.00 per share for aggregate gross proceeds of $823.5 million. The company plans on using the proceeds to strengthen its financial position and for strategic growth opportunities.

Earlier this month, the company announced a name change from Lightspeed POS to Lightspeed Commerce to reflect the company’s broader vision.

“We evaluated our company name in light of the full scope of solutions we offer today. Lightspeed is no longer simply a point of sale solution, and we’ve outgrown Lightspeed POS Inc,” said Dasilva in a press release. “We are the one-stop commerce platform for merchants around the world, and so our company name needs to align with our current offering and our long-term vision. Lightspeed Commerce Inc. achieves both.”

Geordie Carragher

Writer

Geordie Carragher is a staff writer for Cantech Letter