It may be closing in on a double for the past 12 months but you’d be wrong to worry about Alphabet (Alphabet Stock Quote, Charts, News, Analysts, Financials NASDAQ:GOOGL), says portfolio manager Paul Harris, who argues that even the threat of a regulatory shake-down likely won’t be a problem for this behemoth.

“I think it’s a great story,” says Harris, partner at Harris Douglas Asset Management, who spoke on BNN Bloomberg on Wednesday. “Alphabet only trades up to 26x, 27x earnings, where the market multiple is 22x. It has a free cash flow yield at three per cent, it has no debt and it has $57 billion in free cash flow this year.”

“I think this significant secular growth in advertising will continue. Internet advertising, it certainly will continue — there’s still strong growth in that. I think if you’re any company that wants to advertise, the internet is the place where we are all going and print is slowly collapsing on that side. I think that’s very important,” he said.

Google’s performance this year has been stellar, especially when comparing with its FAANG friends. Year-to-date, Alphabet is up 62 per cent versus 35 per cent for Facebook, 12 per cent for Apple and barely one per cent for both Netflix and Amazon.

And Harris says the strength of Alphabet’s assets is unassailable, starting with the company’s ad business.

“Alphabet’s market share on their core search business is huge: they have a 30 per cent market share and their ad revenue from that is very high. They’re very strong in mobile as well,” Harris said.

“You have to remember that YouTube is almost as big as Netflix,” he said. “I think there’s a lot of growth from those two areas.”

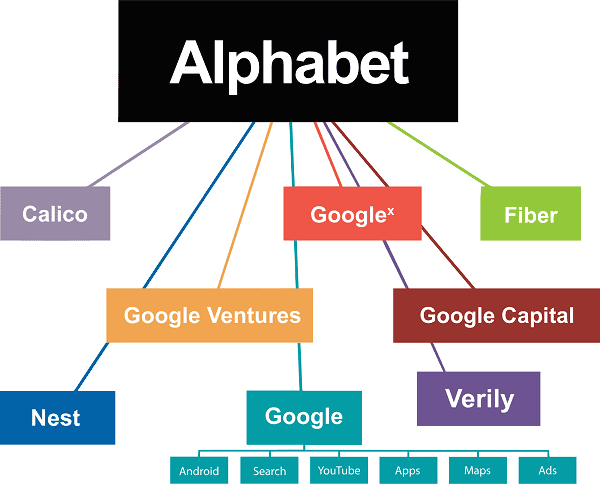

“Also, this is a company that’s really reinvested in themselves. I think they spent $93 billion over the last five years in capex and $90 billion in research and development,” Harris said. “There are a lot of parts of the businesses like Waymo that are not even included in their valuation. So, I think there’s a great opportunity with Google, and it’ll continue to do well. It’s got an incredibly strong balance sheet and they have a lot of growth still over the next little while.”

Alphabet is crushing it on a quarterly basis, with Exhibit A being its second quarter 2021 results delivered last month. There, Alphabet hit $61.88 billion in revenue, up a full 62 per cent from a year earlier and well ahead of analysts’ estimates at $56.16 billion. Advertising revenue from YouTube alone hit $7 billion, while the company’s Cloud revenue was $4.63 billion.

“In Q2, there was a rising tide of online activity in many parts of the world, and we’re proud that our services helped so many consumers and businesses,” said CEO Sundar Pichai in a press release. “Our long-term investments in AI and Google Cloud are helping us drive significant improvements in everyone’s digital experience.”

Earnings were also a strong beat at a whopping $27.26 per share compared to $10.13 per share a year earlier and compared to the consensus call for $19.34 per share.

After the quarter Raymond James analyst Aaron Kessler raised the price target on Alphabet from $2,750.00 to $3,200.00 and maintained his “Outperform” rating, saying in an update to clients that the results were solidly above consensus.

“Advertising revenues benefited from continued strong macro conditions, with particular strength in retail, travel, financials and media as well as strong omni-channel retail activity while Google Cloud also had another strong quarter,” Kessler said.

“While 2Q comps will start to get more difficult in the 2H, we continue to expect robust growth for Google across the board and meaningfully increased estimates (2021/2021 revenues increase by five per cent/eight per cent),” he said. “We maintain our Outperform rating and raise our price target to $3,200 given: 1) solid long-term advertising revenue growth driven by search and YouTube; 2) increasing Google Cloud momentum; 3) option value in other areas (e.g. Hardware, Other Bets); and 4) valuation remains attractive at ~23x 2022E.”

At the same time, Alphabet has come under increasing regulatory pressure, with a mounting number of lawsuits to contend with. The EU’s suits aside, where the company has been attacked for its search engine and Android mobile OS, Alphabet faces varied lawsuits in the US from the Department of Justice and from a bipartisan group of 36 state attorneys general and the District of Columbia.

Moreover, the US House Judiciary subcommittee on antitrust gave a report last fall saying that Google essentially functions “as an ecosystem of interlocking monopolies,” with the company maintaining its dominance through anticompetitive contracts.

But Harris says even if the end result is a forced break-up of the company, investors could very well win out when those smaller entities unleash their hidden value.

“They may face, like a lot of these tech companies, regulatory issues that may take a long time. People go on about these companies but even broken up sometimes their valuation may be even higher, because their individual parts are worth a lot more,” Harris said.

“The regulatory side, that’s a long process. And the market doesn’t seem to be concerned about it as much. Maybe that’s a wrong [approach], but they don’t seem to be concerned about it,” he said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment