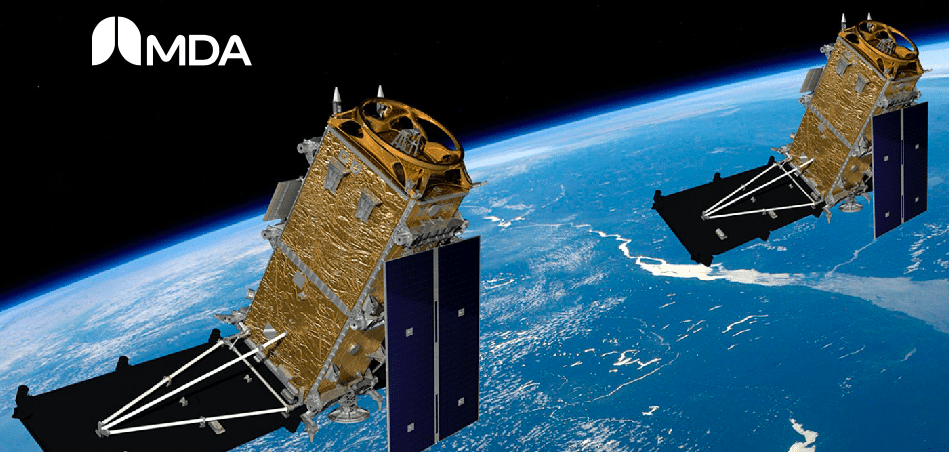

Investors looking for a promising play in the space tech sector don’t need to go south of the border, says portfolio manager John Zechner, who thinks newly IPO’d MDA Ltd (MDA Ltd Stock Quote, Chart, News, Analysts, Financials TSX:MDA) has some strong tailwinds behind it in the growing need for satellite imagery and data.

Investors looking for a promising play in the space tech sector don’t need to go south of the border, says portfolio manager John Zechner, who thinks newly IPO’d MDA Ltd (MDA Ltd Stock Quote, Chart, News, Analysts, Financials TSX:MDA) has some strong tailwinds behind it in the growing need for satellite imagery and data.

“The space race is in full flight right now, and we’re not talking about Virgin Galactic or Jeff Bezos and Elon Musk with SpaceX and all the billionaires wanting to get into space but more on an earthly level for us,” said Zechner, chairman of J. Zechner Associates, speaking on BNN Bloomberg on Thursday.

“What I’ve noticed is that the information for these low-Earth orbit satellites and the constellations that are getting launched, everybody wants harder data,” he said.

US space and satellite company Maxar Technologies emerged last year out of less-than-stellar period in part by selling off MDA, makers of the Canadarm, which gave Maxar a bit of breathing room when it comes to its balance sheet.

A Canadian-led group of investors including John Risley’s Northern Private Capital and former BlackBerry and Research and Motion chairman and co-CEO Jim Balsillie bought MDA, the former MacDonald, Dettwiler and Associates, for US$1 billion, with the deal closing in April 2020.

MDA launched as a public company on April 7 of this year, raising $400 million through its initial public offering, which nonetheless drew less attention than the company might have hoped — MDA was looking to raise $500 million with a share price between $16 and $20 but had to settle for selling 28.6 million shares at $14. The company closed on an over-allotment of another roughly 4.3 million shares at $14 for a further $60 million.

“With the rapid expansion of the global space economy over the next ten years, our world-leading expertise and capabilities are well aligned with the projected high growth sectors, such as space exploration, on-orbit servicing, space-based communications and Earth observation,” said Mike Greenley, CEO, in an April 7 press release.

“We have the agility of a new space company coupled with an impressive track record that makes us a partner of choice in the emerging commercial space market,” Greenley said.

MDA’s share price immediately shot up after the IPO, reaching the $18 mark before sliding in the ensuing weeks, with the stock currently trading around $16.

But Zechner says there’s likely upside to owning MDA.

“We had money in Maxar for a while and still have some and we met with Maxar. And Maxar sold the old MacDonald, Dettwiler to private equity back in [2020], and now this company has gone public again this year,” Zechner said.

“This is the old Canadarm, and they also have a little satellite system as well and they’ve got a government contract that should give them annualized earnings growth of about 25 per cent over the next five years, generating free cash flow,” he said. “The balance sheet is not in bad shape and, like I say, everybody is trying to get these simulated constellations, low-Earth orbit satellites, where they can garner information because they need it, whether it’s for urban planning, for defence, whatever the need is, there seems to be huge demand for collated data from outer space from satellites.”

“So, I think there’s great growth there and this is one of the few places in Canada that we have it in that [sector],” Zechner said.

By the numbers, MDA reported its first quarter 2021 financials in mid-May, showing revenue of $123.4 million, up 19.6 per cent year-over-year, and adjusted EBITDA of $22.0 million, up 129.6 per cent from a year ago. The company reported a backlog of $685 million at the quarter’s end, which was up 21.7 per cent year-over-year.

By segment, MDA’s GeoIntelligence revenue was up 10.6 per cent to $49.0 million, Robotics and Space Operations was up 31.4 per cent to $34.3 million and the company’s Satellite Systems business was up 21.9 per cent to $40.1 million. Overall gross margin was a much-improved 31.1 per cent compared to 22.5 per cent a year earlier, with the rise in EBITDA attributed mostly to an increase in gross profit of $15.2 million along with help in the form of government wage subsidies totalling $10.1 million for the quarter.

“Q1 2021 shows positive signs with strong financial performance across all three business areas over the same period last year,” said Greenley in a press release. “Our Satellite Systems segment in particular has returned to normal operating levels and that positions us well to deliver on our growth plans.”

In March, Lockheed Martin Canada awarded MDA with the initial contract for the Canadian Surface Combatant program which will equip ships with a laser warning and countermeasure system with a value of more than $60 million.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment