Research Capital remains bullish on Newtopia

Look for Newtopia (Newtopia Stock Quote, Chart, Analysts, Financials TSXV:NEWU) to come out swinging in the second half of the year, says Research Capital analyst Yue Ma, who delivered an update to clients on Monday. Yue stayed bullish on the stock by reasserting his “Speculative Buy” rating while saying Newtopia has the makings of a Livongo in the chronic disease management space.

Look for Newtopia (Newtopia Stock Quote, Chart, Analysts, Financials TSXV:NEWU) to come out swinging in the second half of the year, says Research Capital analyst Yue Ma, who delivered an update to clients on Monday. Yue stayed bullish on the stock by reasserting his “Speculative Buy” rating while saying Newtopia has the makings of a Livongo in the chronic disease management space.

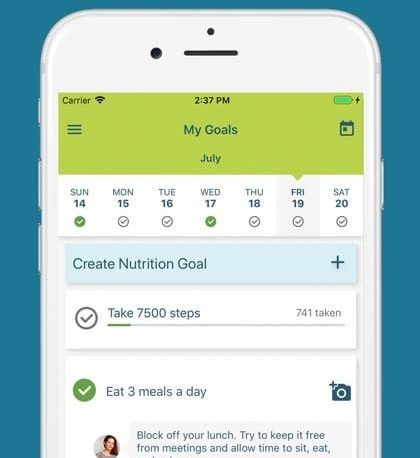

Toronto-based Newtopia is a tech-enabled provider of hyper-personalized habit-changing disease prevention and reduction programs focusing on type 2 diabetes, heart disease, stroke and weight. The company employs virtual care, digital tools, AI and connected devices to deliver outcomes for individuals as well as employers and healthcare plans.

Newtopia just passed the one-year mark on the TSX Venture Exchange, where it debuted last May at $0.69 per share and rose over 70 per cent to hit $1.19 by mid-October. The rest has been mostly downhill, however, with the stock more recently trading between $0.40 and $0.50 per share.

Newtopia released its first quarter 2021 financials on May 20, showing the impact of COVID-19 with Q1 revenue down to $2.6 million compared to $3.9 million a year earlier. Net income was a loss of $2.3 million or $0.02 per share compared to a loss of $1.5 million or $0.10 per share a year earlier.

“As a result of the COVID-19 pandemic, the Company underwent a delayed rollout of its products to some of its clients in Q1 2021,” Newtopia said in its Q1 press release. “As a result, Newtopia continues to anticipate revenue to hold relatively steady through the second quarter 2021, with an increase in topline growth in the third and fourth quarters. While new product rollouts may be softer in the first half of the year, the Company’s multi-year contracts with its clients and overall underlying business is very healthy with record levels of engagement.”

The company had a number of notable events over the quarter and subsequent months, including the debut of its Habit Change platform in Canada in April through a partnership with Eastern Health in Newfoundland and Labrador and diabetes management company Medtronic. The program will see Newtopia and its partners implement a 12-month type 2 diabetes prevention pilot program, recruiting several hundred participants at risk of type 2 diabetes, with the program representing Newtopia’s first outside of the United States.

Looking at Newtopia’s first quarter results, Ma said they were as good as could be expected. On the $2.6-million topline, Ma had been calling for $2.4 million and the consensus was $2.3 million. The Q1 gross margin of 50 per cent was in line with Ma’s estimate at 50 per cent, while the net income loss of $2.3 million compared to Ma’s negative $2.6-million estimate.

On the Newfoundland and Labrador launch, Ma noted that fees payable to Newtopia will come through government funding and are to be split with Medtronic.

“We expect Newtopia to leverage data generated from this pilot project to pitch product offerings to public healthcare organizations in other Canadian provinces,” Ma wrote.

On other events, Ma said Newtopia is looking to roll out its products over the second half of 2021 with one of its Fortune 500 clients, a project previously postponed due to COVID-19, while the company has now completed a 12-month JPMorgan Chase trial that tested the impact of Newtopia’s habit changing platform on clinical risk factors and healthcare expenses of at-risk JPMorgan employees. Results from this trial should be published shortly, Ma said.

“We believe the data of this trial (together with the results with the Aetna trial) should benefit Newtopia’s marketing to new potential clients,” Ma said. “Overall, management continues anticipating revenues to hold relatively steady in Q2, with growth expected in H2 2021.”

Ma is calling for NEWU to generate full 2021 revenue and fully diluted EPS of $15.4 million and negative $0.08 per share, respectively, and 2022 revenue and fully diluted EPS of $20.4 million and negative $0.01 per share, respectively. With his reiterated “Speculative Buy” rating the analyst has maintained a $1.10 target price, which at the time of publication represented a projected 12-month return of 178 per cent.

Ma said the company is focused on three pillars to growth: increasing participation rates from existing clients, cross-selling new products to existing clients and securing and launching new contracts with new clients.

“We View Newtopia as an Earlier-Stage Version of Livongo,” Ma wrote.

Earlier this year, Newtopia delivered a press release saying it is launching the category of habit change provider, which covers partners focused on using integrated, whole-person approaches to address chronic disease while enriching mental health, resilience and human performance.

“The world has changed, and managing employees’ health risks is no longer enough. It’s time to double down and significantly minimize these risks through primary prevention,” said Jeff Ruby, Newtopia’s founder and CEO, in a January 28 press release.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.