Is it time to invest in tech stocks again?

Tech investors wondering when the skies will clear might have to wait a bit longer, as now may not be the time to invest in growth stocks. That’s according to Brooke Thackray of Horizons ETF Management Canada who says a likely dip in interest rates over the second half of 2021 will favour dividend names over growth.

Tech investors wondering when the skies will clear might have to wait a bit longer, as now may not be the time to invest in growth stocks. That’s according to Brooke Thackray of Horizons ETF Management Canada who says a likely dip in interest rates over the second half of 2021 will favour dividend names over growth.

It’s been a rougher ride for tech investment so far this year, where both small cap companies and the large tech giants like Google and Facebook soared to incredible returns in 2020, only to see a sea change in 2021. Investment dollars have been moving out of growth stocks and into more cyclical names in sectors like energy and consumer discretionary as markets worldwide bet on a post-pandemic economic revival.

That movement has been beneficial to equities overall, where the S&P 500 Index has shot up almost 13 per cent year-to-date, but the impact on growth names has been less grand. The tech-heavy NASDAQ, for example, is up 6.5 per cent, half of the S&P 500’s gains, while in Canada, the S&P/TSX Capped Information Technology index is up a little over one per cent compared to the broader S&P/TSX Composite at ten per cent.

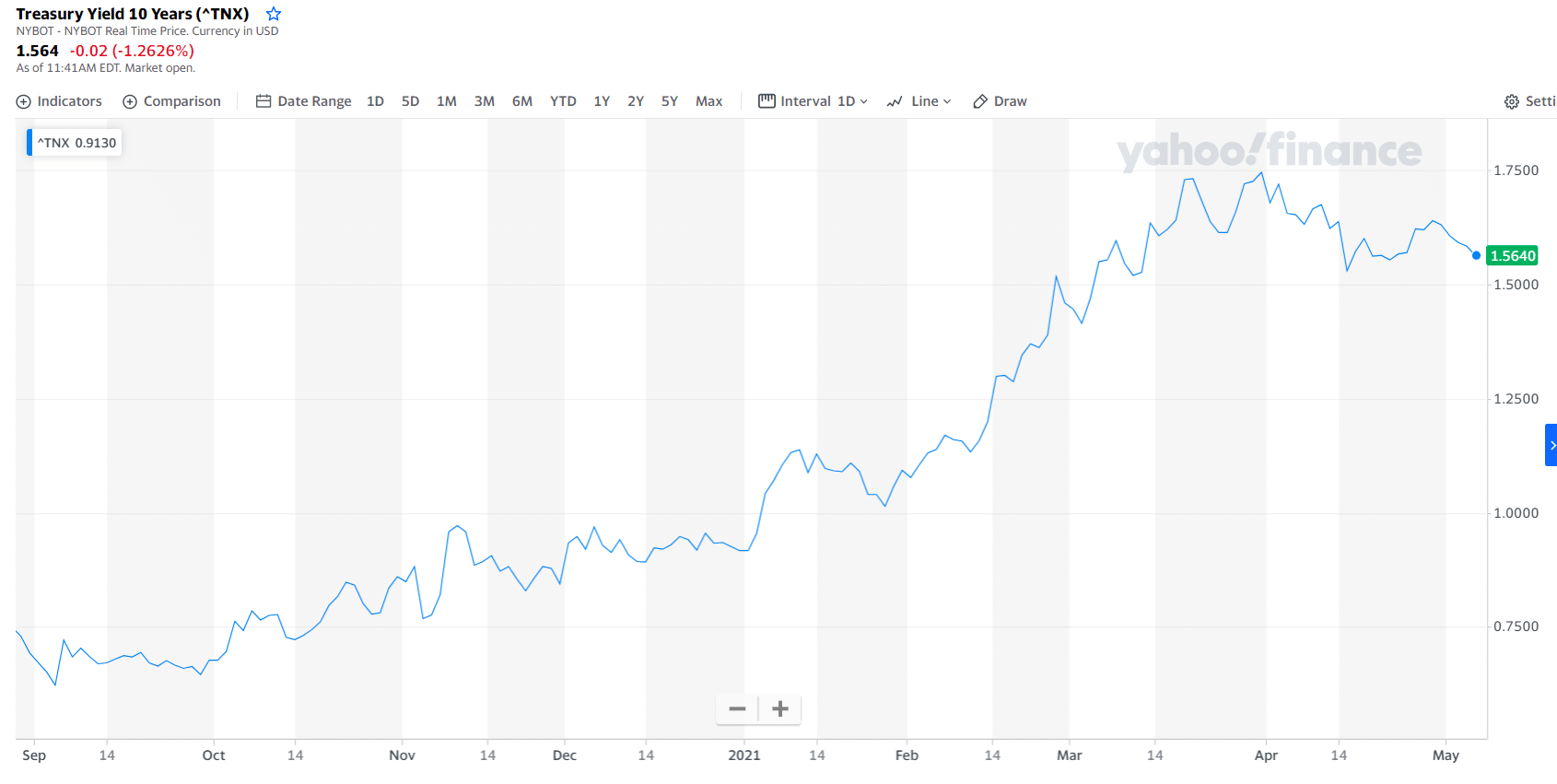

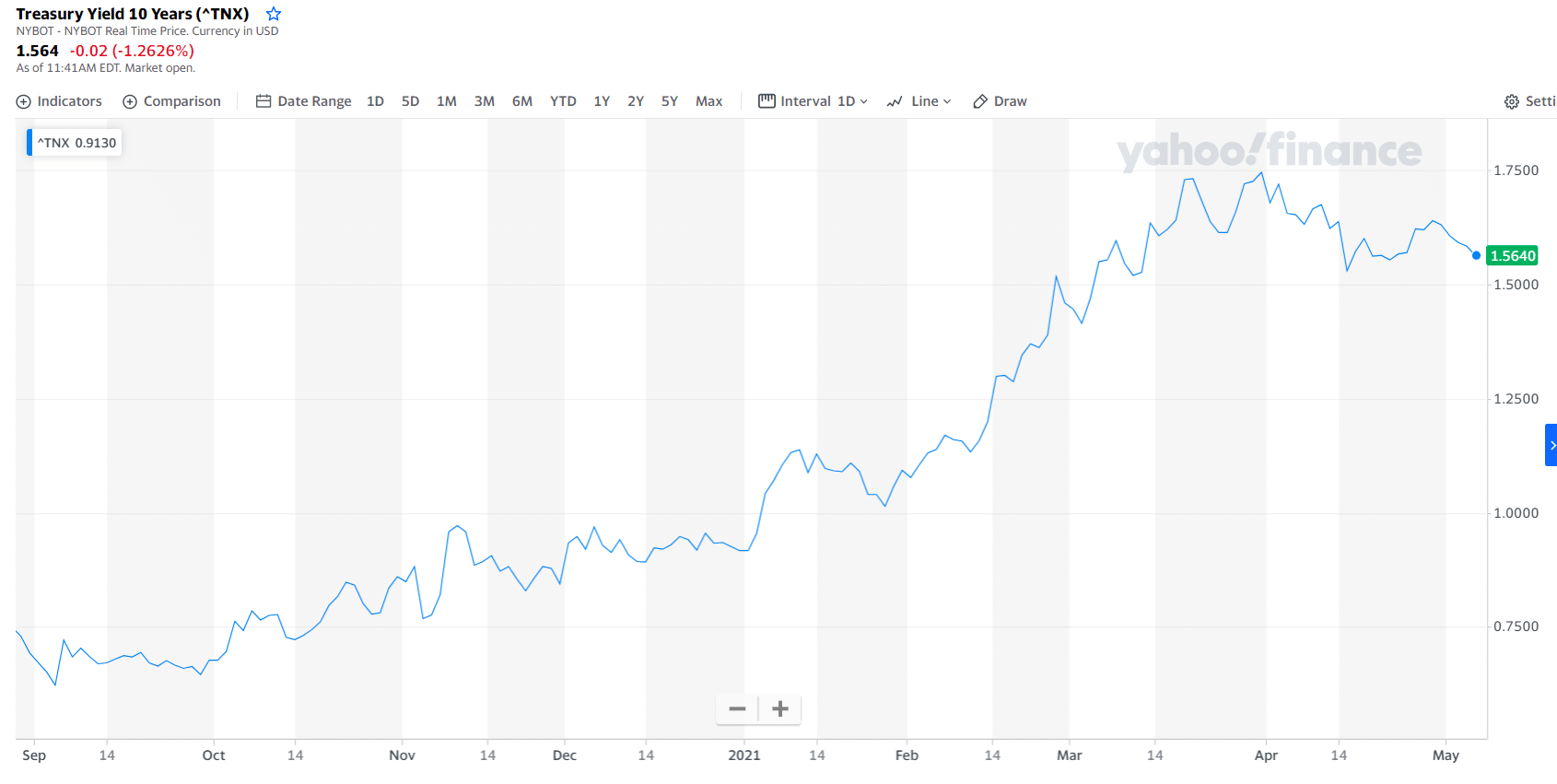

And interest rate movements have been top of mind for growth and value investors alike, with the current pause in rising rates has made for uncertain times. Are rates going up and consequently impacting negatively on more defensive, dividend-paying parts of the market or are central banks looking to give more juice to the economic recovery by slashing rates once again?

Last month, the Bank of Canada chose to keep its benchmark rate at the record low 0.25 per cent, while stating its intention to stay the course on rates possibly well into 2022 in order to keep the economy purring, although that forecast was updated from early 2023 as the potential time to raise rates to now the second half of 2022. The US Federal Reserve chose a similar approach in April by keeping its key interest rate near zero.

The lower rate environment should continue to be good for dividend stocks over growth stocks, says Thackray.

“It’s the direction of the interest rate movement that really counts, so if interest rates are moving up on a sustained basis, the dividend players usually underperform the market because investors are saying, ‘Well I can get this dividend from the stock or I can go into bonds, whose interest rates are now going up and represent a better relative deal.’” Thackray said, speaking on BNN Bloomberg on Wednesday.

“That’s really what drives the performance difference between dividend players in the market. When interest rates are rising dividend players typically don’t do as well,” Thackray said. “Now, I want to classify that a little bit and say that when interest rates are rising dividend growers —companies that are growing their dividends— tend to outperform companies that tend to have flat dividends, like for instance in a regulated utility that’s going to have static dividends. Those companies won’t perform as well with interest rates going up.”

In Canada, capital-intensive companies such as the telecoms like BCE and Telus often do well in lower rate environments, as debt loads weigh less heavily. The relatively high dividend yields from the telcos also look better in a low-rate environment compared to bonds. At the moment, BCE’s yield is a little under six per cent while Telus’ is at 4.8 per cent.

Of the two Canadian telcos, Thackray said the current environment might favour BCE over Telus.

“If you go back and take a look and see when Bell has outperformed Telus over the last three years and you plot that relative to the interest rate movement, when interest rates are going down Bell tends to do better and when interest rates are moving up Telus has tended to do better,” Thackray said.

“Obviously there are other variables impacting that but given that this time of year we expect interest rates to moderate here and the markets tend to be a little bit softer here I would actually go with BCE over Telus,” he said.

“Right now, I know we’ve seen interest rates move up since last August into the end of March but we’ve seen interest rates pull back here and I think that we’re going to see interest rates stabilize or even go down a little bit, so I think dividend players are actually a good place to be right now,” Thackray said.

“As far as sector allocation goes I prefer that over, for instance, the growth sector of the market. I think interest rates are flat or moving down slightly, so that’s a preferential environment for dividend players,” he said.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.