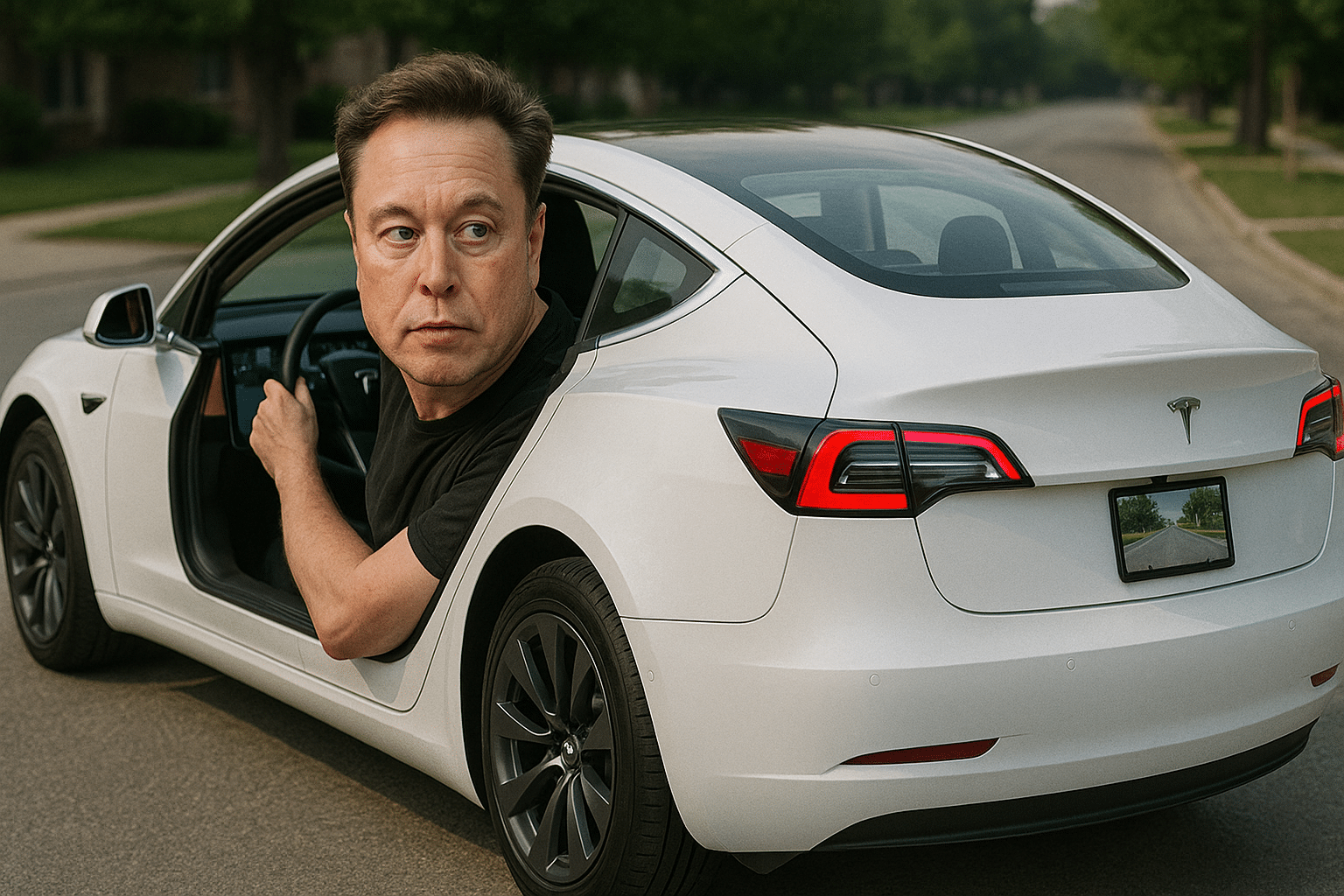

Should Tesla be worth as much as all other auto makers combined?

Which way is Tesla (Tesla Stock Quote, Chart, News, Analysts, Financials NASDAQ:TSLA) headed? With climate change and electrification becoming more front and centre, you’d think everyone would be on board with the industry’s current EV champion, but opinions continue to be very divided over Tesla as an investment proposition. Some say hold your nose and buy, even at these high prices, since you don’t want to miss out on the sea change in automotives. Others, including Stan Wong of Scotia Wealth Management, say Tesla may be a great company but the stock is just too expensive to warrant your hard-earned dollars.

Which way is Tesla (Tesla Stock Quote, Chart, News, Analysts, Financials NASDAQ:TSLA) headed? With climate change and electrification becoming more front and centre, you’d think everyone would be on board with the industry’s current EV champion, but opinions continue to be very divided over Tesla as an investment proposition. Some say hold your nose and buy, even at these high prices, since you don’t want to miss out on the sea change in automotives. Others, including Stan Wong of Scotia Wealth Management, say Tesla may be a great company but the stock is just too expensive to warrant your hard-earned dollars.

Tesla’s share price rose this week with the release of glowing production and delivery figures for the first quarter of 2021. The company reported delivering 184,800 vehicles and producing 180,338, up from the fourth quarter of 2020 where it delivered 180,570 vehicles and produced 179,757.

“We are encouraged by the strong reception of the Model Y in China and are quickly progressing to full production capacity. The new Model S and Model X have also been exceptionally well received, with the new equipment installed and tested in Q1 and we are in the early stages of ramping production,” Tesla said in an April 2 release.

The news bounced the stock upwards to take back some of the ground lost in recent weeks with the wider market pullback on tech and growth names. Tesla is now down five per cent for 2021, which follows on the stock’s incredible run in 2020 where it returned a whopping 749 per cent.

All those gains have shareholders celebrating and market watchers at odds over where the stock is headed from here.

Count Wong among the wary when it comes to Tesla.

“What you want to watch with Tesla is what’s happening with the rotation into value from growth,” said Wong, Director of Wealth Management at Scotia, who spoke on BNN Bloomberg on Wednesday. “It seems as though the last week or so, some of these higher growth names have started to pick up a little bit of steam and have stopped falling.”

“A lot of that has to do with the fact that long-term yields in the US have stopped moving higher so the growth stocks are not in so much danger given the fact that rates have not moved higher. Rising interest rates do have a negative effect generally speaking on high growth type of stocks, including technology names including names like Tesla,” Wong said.

“The other thing to watch out for is if Tesla breaks down below the 200-day moving average that could show a negative technical indicator,” Wong said. “Right now, that’s at about $527-$530.”

Part of the more recent buzz around companies like Tesla has to do with the huge infrastructure package introduced by US President Joe Biden at the end of March. The $2-trillion package would see investment in transportation, water systems, electric grids and broadband, with electric vehicles getting earmarked $174 billion for rebates on car sales, tax incentives as well as the build-out of electric charging stations across the country.

That should push Tesla even more into the forefront, says Morgan Stanley analyst Adam Jones, who argued in a note on Wednesday that Tesla’s lead over other car companies in the EV space will be a difference maker.

“It will likely be complicated by a labyrinth of national and local laws that will present advantages and disadvantages to various automakers, depending on the year that you choose to analyze,” Jones said. “Put it all together and we believe auto investors face greater risk not owning Tesla shares in their portfolio than owning Tesla shares.”

Wong is not convinced, however, that even the promise of future dominance in the EV space is enough to justify Tesla’s current share price.

“With Tesla you’re paying on a forward price-to-sales basis 13 times. To put that in perspective, the S&P 500 is trading at 3x price to sales,” Wong said. “So, absolutely, you’re paying for future growth and you’re paying for future revenues. The problem is if interest rates keep moving higher, those future revenues means less and less to investors today.

To put Tesla’s valuation into perspective, at a $664-billion market cap Tesla is currently worth more than the next half-dozen automakers combined, or roughly, the rest of the auto industry.

And while there is some catchup to be done on the part of legacy automakers, Wong says it will happen eventually.

“Tesla is absolutely a great company. The product is strong. But, from a fundamental level, is Toyota, is BMW, is Mercedes going to sit on the sidelines and let Tesla continue to take market share in the EV market? Probably not, so competition is also a concern,” he said.

“We don’t own [Tesla] in our portfolio [but] I think for investors who want to be more in the high growth/speculative part of the market […] you can hold a little bit depending on your time horizon, your risk objectives and so forth, but we just don’t have it in our portfolio,” Wong said.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.