Exro Technologies (Exro Technologies Stock Quote, Chart, News, Analysts, Financials TSXV:EXRO) may have weathered the storm of a recent short seller attack but questions remain, says Robert McWhirter of Selective Asset Management, who worries about the profitability down the line.

Exro Technologies (Exro Technologies Stock Quote, Chart, News, Analysts, Financials TSXV:EXRO) may have weathered the storm of a recent short seller attack but questions remain, says Robert McWhirter of Selective Asset Management, who worries about the profitability down the line.

“My understanding is Exro is working on a project in Mexico City to replace old internal combustion engines with electric motors, and the challenge at the moment is that this is a great technology but at the moment they’re expected to lose ten cents in 2021, nine cents in 2022 and 23 cents in 2023,” said McWhirter, president of Selective, who spoke on BNN Bloomberg on Tuesday.

“I am happy to end up investing in technology companies but I want ones that can end up being positive [in earnings]. Exro has a great technology, and I think there’s a big opportunity for them going forward. I’m just not comfortable with the current pricing based on analysts’ forecasts,” McWhirter said.

Exro has had a wild ride since arriving on the TSX junior board last September. Calgary-based Exro, which designs intelligent control solutions for power electronics, saw its share price climb from a buck and change to over $7.00 by February.

Then disaster struck in the form of a short-seller report in early March claiming that some of Exro’s partnerships in commercializing its technologies were with businesses of questionable stature, while the technology itself was said to be of unclear value.

Investors promptly dropped the stock like a hot potato, and even with a solid rebuttal from management and support from the analyst community , EXRO has had trouble making up that lost ground, currently trading in the $4-$5 range.

McWhirter says both management and the company’s technology have a lot going for them but the path to successful commercialization may not be a smooth as one would hope.

“The arrival of [CEO Sue Ozdemir] approximately a year and a half ago has made a dramatic difference in focusing the company,” said McWhirter.

“[Ozdemir’s] parents actually owned a electric motor rewinding business. Then she went on to General Electric and headed up a division and had huge growth there and then arrived Exro to end up saying, ‘Gee, this is great technology but we need to move it into the commercial frame.’ She has now done that and has had a variety of success particularly with bicycles and scooters and is now approaching the automotive sector.”

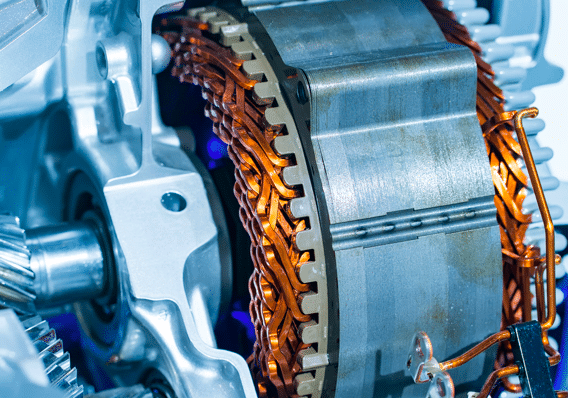

Exro, which last week released fourth quarter and full-year 2020 results, has two products in commercialization, the Coil Driver motor controller that expands the capabilities of powertrains and allows for multiple power settings in a single motor, thus leading to greater efficiency on lower energy consumption. Exro also has the Battery Control System (BCS) for optimizing second-life energy storage.

Exro recently signed a letter of intent with LAND Electric Motorcycles for up to 2,000 Coil Driver units while it has expanded its collaboration with SEA Electric on a fleet of Class 8 trucks for the Canadian market. Exro announced in February the completion of in-house testing of its 100 Volt Coil Driver with Mexican manufacturer Potencia Industrial for an electric car.

“We completed the engineering validation on the 100 Volt Coil Driver for electric cars and the technology validation for the BCS that demonstrated the principles of operation in second-life environments,” said Exro chief engineer Eric Hustedt in the company’s fourth quarter press release on April 6.

“In a very short time span, our engineers have been able to validate the Coil Driver technology for multiple platforms while continuing to develop the battery technology. We are excited to gear up for standard product designs and series production in the coming year,” Hustedt said.

For the 2020 year, Exro reported zero revenue and a comprehensive loss of $11.0 million or $0.12 per share. In mid-December, Exro closed on a public offering of about 13 million shares for gross proceeds of $42 million, leaving the company at the end of the fourth quarter with about $48.3 million in cash and accounts payable and accrued liabilities of about $1.8 million.

Part of Exro’s appeal comes with the rising swell of interest in electrification of vehicles as governments worldwide try to make good on their climate change pledges. In the United States, for example, President Joe Biden recently released details on his $2.25-trillion infrastructure plan which includes $174 billion in support for the electric vehicle sector. Biden’s plan calls for electrifying transit and school buses, for funding research and development and for building out a electric vehicle charging network across the country, all part of a plan for the US to “win the EV market,” according to the President.

McWhirter said Exro’s hitting the right note in its motor and battery tech. “[Exro has] wonderful technology, and certainly the world has a high need for improving the efficiency of electric motors and increasing battery life,” McWhirter said. “[Ozdemir] has had success in a variety of industries and she continues to broaden that now into the automotive sector,” he added.

Comment

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Since you have added absolutely zero value with this article to the company and simply regurgitated what the analyst said on a two minute phone call I hope you write a follow up article based on the CEO’s response. She was on Bloomberg radio this morning. Thank you.

Since when is taking someone else’s skewed/misinformed opinion on something and summarizing it journalism?

Go listen to Sue Ozdemir’s interview on BNN from today and do the same thing you did with this inept analysts opinion, except do it with Sue’s facts. Summarize it nicely for your audience to get the real perspective

Your headline is very misleading. Why call things a loss when it is a pre-revenue company. It is really an expenditure and the company has enough cash to get to when they will be earning money. Why a trashy headline and then comments praising Exro?

The guy doesn’t have a clue. Do your research and you will find that it is undervalued. This stock in 5 years will be over $50 a share, and I feel that my 5 year prediction is undervalued. Being conservative..

i bet you are shorting exro too. this article is weak!!! but if it causes the price to drop i will happily buy some more 🙂

I first purchased Exro about 2 years ago for as low as .23 US. Much to my regret I sold about 18,000 shares when it got in the 1.50 US range. After Sue came on board and others from top tier companies I realized just what the potential for this company was. The Mariner report gave me the opportunity (albeit at a much higher price) to restore some of my shares on the dip. I’m in for the long haul at this pont at an average share price of 2.58 US.