Expect 2021 to be a milestone year for medical tech company Perimeter Medical Imaging (Perimeter Medical Imaging Stock Quote, Chart, News, Analysts, Financials TSXV:PINK). That’s the scoop from Leede Jones Gable analyst Douglas W. Loe, who initiated coverage of Perimeter Medical on Monday with a “Speculative Buy” rating and $6.75 target price. Loe said Perimeter’s OTIS imaging system has the potential to transform breast cancer surgery through removing risk associated with repeat procedures.

Expect 2021 to be a milestone year for medical tech company Perimeter Medical Imaging (Perimeter Medical Imaging Stock Quote, Chart, News, Analysts, Financials TSXV:PINK). That’s the scoop from Leede Jones Gable analyst Douglas W. Loe, who initiated coverage of Perimeter Medical on Monday with a “Speculative Buy” rating and $6.75 target price. Loe said Perimeter’s OTIS imaging system has the potential to transform breast cancer surgery through removing risk associated with repeat procedures.

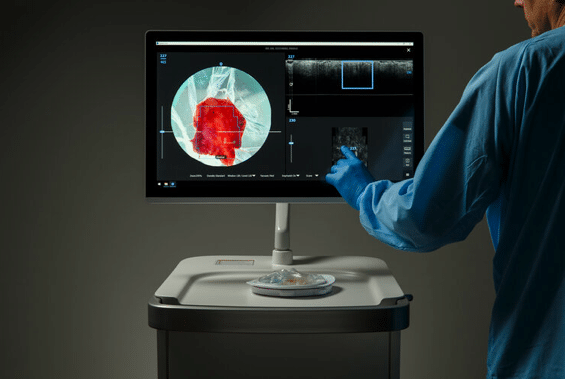

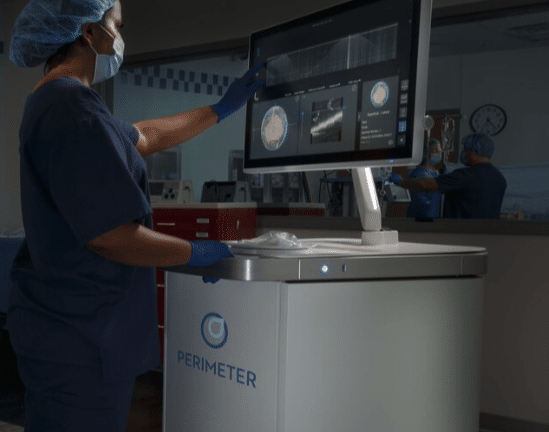

Toronto-based Perimeter, which has its headquarters in Dallas, Texas, is commercializing its point-of-care imaging system OTIS (Optical Tissue Imaging System) which received on March 1, 2021, US FDA-approval for the evaluation of excised human tissue microstructure. OTIS uses wide-field optical coherence tomography (OCT) to generate real-time, high-resolution images focusing on the margins of excised human tissue to help surgeons with decision-making regarding tissue removal.

Perimeter is currently focusing on breast cancer surgery, which commonly has high repeat rates due to the time required for lab analysis of tissue samples, with the result being that patients can be required to undergo repeat surgeries in the case of a positive lab result on the presence of tumour margins. OTIS allows for collaborative analysis of tumour margins at the time of surgery, potentially leading to reduced rates of repeat surgery.

On the FDA approval, Perimeter’s CEO Jeremy Sobotta said OTIS is now commercial ready for the US market.

“Throughout clinical development we listened to our users, and this clearance covers a product that delivers on their feedback, allowing for a streamlined integration into current intraoperative workflows,” Sobotta said in a press release. “We are thrilled to bring physicians our platform providing ‘real-time’ margin visualization to assist their decision making, and our goal is to help them create better long-term outcomes for patients while lowering costs to the healthcare system.”

“Our Perimeter OCT Imaging System is the foundational building block that allows us to continue developing ‘next-gen’ improvements, such as the artificial intelligence tools currently in development under our ATLAS AI project,” Sobotta said.

Founded in 2013, Perimeter completed a reverse take-over of New World Resource Corp in June of last year, with the company raising at the time its first major cash injection via the sale of 6.9 million share and one-half-warrant units at $1.45 each for $9.4 million.

The stock has done very well since its debut, returning 183 per cent since beginning trading on July 6, 2020.

But Loe thinks there’s further upside to be had with PINK, saying that the company’s OTIS platform has potential applications beyond breast cancer tumour margin assessment.

“As it relates to oncology, OCT remains relatively novel despite its potential to assist the surgeon with intraoperative decision- making pertaining to the detection of tumour margins. For now, surgeons rely on visualization and palpation for the decision-making process, relying on post-procedure histology/pathology to determine if re-excision is required,” Loe wrote. “Despite this, we observed that OCT offers a number of qualities that makes it well suited for use in oncology.”

Higher resolution, integration to other consumables and devices and being free of the need for additional, potentially toxic agents in the imaging process were all advantages of OCT pointed to by Loe.

On commercialization of the OTIS platform, Loe said this year should involve a number of catalysts for the stock.

“By mid-2021, we anticipate the firm to complete the first phase of its 400-patient image collection study and move forward with a pivotal 600-patient trial for the OTIS AI plugin ImgAssist AI, and with data expected imminently thereafter by FQ421,” Loe wrote.

“Importantly, our model assumes that most OTIS systems will be placed and not sold during initial launch quarters for the device, and we endorse this decision as a way to drive procedure adoption and thus to drive future sales to oncology-focused hospitals and cancer treatment centres,” he said.

Loe said Perimeter could do with more funding in order to complete its commercial launch.

“We have adjusted our pro forma cash balance to reflect the new warrant-derived capital, which when added to FQ320 cash of $12.0 million gives us pro forma cash of $20.3 million; we are mindful that current cash balance when formally reported will be lower than this, reflecting cumulative operating cash losses incurred in FQ420-to-FQ121. New capital is clearly advantageous for pending OTIC launch activities that are contemplated in our model,” Loe said.

By the numbers, Loe is expecting Perimeter to generate $0 revenue and a $5.1-million EBITDA loss in 2021, followed by revenue of $1.4 million and an EBITDA loss of $5.5 million in 2022. By 2026, Loe is forecasting revenue of $50.9 million and by 2030, he sees revenue hitting $162.8 million, with EBITDA going from $25.0 million in 2026 to $102.8 million by 2030.

At the same time, Loe noted that the ‘Speculative’ part of his “Speculative Buy” rating should not be taken as a reflection of uncertainties related to the OTIS platform, which the analyst said is “already well-validated both clinically and through regulatory review” but that it “solely reflects that we do not yet have sufficient revenue/EBITDA data from which to project commercial trendlines just yet,” Loe said.

At the time of publication, the analyst’s $6.75 target represented a projected 12-month return of 57 per cent.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment