Now’s a great time to pick up Cargojet (Cargojet Stock Quote, Chart, News, Analysts Financials TSX:CJT), says Beacon Securities analyst Ahmad Shaath, who reviewed the company’s latest quarter in an update to clients on March 1. Shaath said the stock’s recent pullback belies the strong Q4 numbers as well as Cargojet’s multi-year growth trajectory.

Now’s a great time to pick up Cargojet (Cargojet Stock Quote, Chart, News, Analysts Financials TSX:CJT), says Beacon Securities analyst Ahmad Shaath, who reviewed the company’s latest quarter in an update to clients on March 1. Shaath said the stock’s recent pullback belies the strong Q4 numbers as well as Cargojet’s multi-year growth trajectory.

Air cargo and domestic overnight freight company Cargojet delivered its fourth quarter 2020 financials on March 1, coming in with revenue of $187.1 million compared to $139.7 million a year earlier and with adjusted EBITDA of $81.9 million compared to $47.2 million for the fourth quarter 2019.

Altogether, 2020 saw CJT rake in $668.5 million in revenues, up from $486.6 million in 2019, as the company benefitted strongly from the boom in shipping related to the pandemic and its stay-at-home economic impacts. Adjusted EBITDA for the year hit $291.4 million compared to $156.0 million a year earlier.

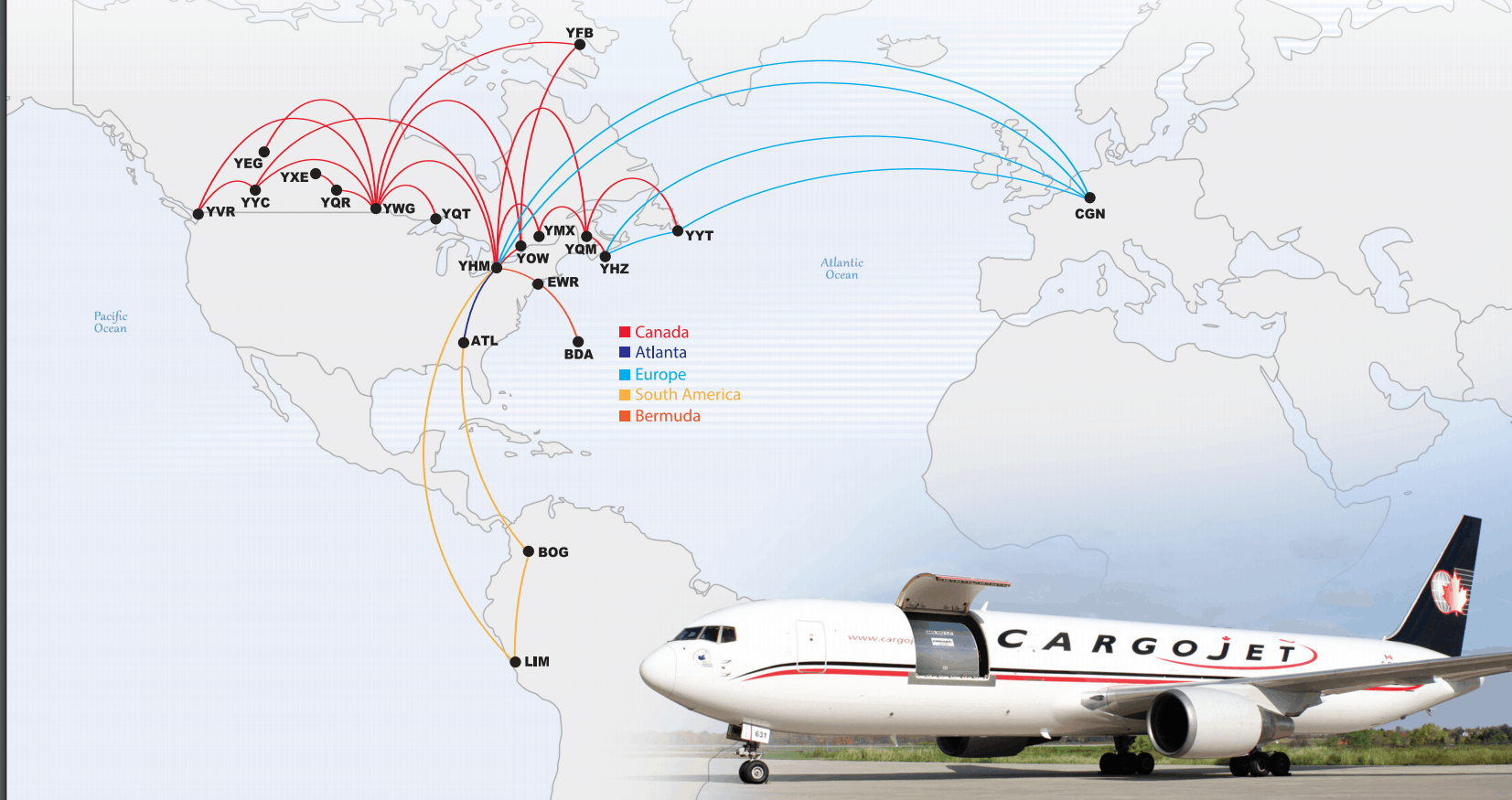

Cargojet, which along with its domestic overnight business has an aircraft, crew, maintenance and insurance (ACMI) segment as well as a charter plane business, saw revenue for the 2020 year break down into 45 per cent from Domestic overnight, 20 per cent from ACMI and 18 per cent from its All-in-Charters segment.

Cargojet management called 2020 a transformational year for the company, and with the sharp increase in demand for its services, President and CEO Dr. Ajay Virmani said its was “one of the most challenging times in our history.”

“Each one of our team members understood that with major parts of our economy under lock-down, Cargojet must rise to the challenge of meeting unprecedented demand in e-commerce volumes that our customers were expecting us to fly,” Virmani said in a press release.

In his report, Shaath said the Q4 2020 numbers were beats of both his own forecast and the consensus calls. The $187.1-million in revenue was ahead of his $178-million estimate and the consensus $179 million, while the $81.9-million in adjusted EBITDA was also better than Shaath’s call for $77 million and the Street’s $79 million.

Drilling down, Shaath noted Cargojet’s domestic network revenue was up a record 19.5 per cent year-over-year, driven by the shift towards e-commerce sales which Shaath said have established a new baseline of 12 per cent of total retail sales compared to seven per cent previous to the pandemic.

ACMI revenues for the Q4 came in at $43 million versus Shaath’s estimate of $37 million, while All-in-Charter revenue of $13 million was well under the analyst’s expected $22 million. Shaath said the underwhelming charter revenue was not concerning, however, as the segment has a traditionally ad-hoc nature, with there being an earlier than expected drop in demand for charters to carry time-critical COVID-related PPE and other supplies.

Cargojet saw its share price more than double in 2020 but the scene has been a little different so far in 2021, as the stock is currently down 19 per cent year-to-date, including a significant drop after the company’s fourth quarter was released.

Shaath said that makes for a fine time to buy CJT.

“Cargojet reported strong Q4/FY20 results that beat our forecast and consensus, with continued exceptional strength in the domestic network,” said Shaath in his report. “The stock however had a knee-jerk reaction, retreating about ten per cent on what we could only speculate might be driven by overemphasis of the weakness in the all-in-charter business and lack of belief in CJT’s growth initiatives post financing. We believe this represents a great buying opportunity.”

With the report, Shaath maintained his “Buy” rating for CJT but dropped his target from $325.00 to $290.00, saying the decrease was mainly due to share dilution as a result of the company’s recent $365-million equity offering. At the time of publication, Shaath’s $290.00 target represented a projected 12-month return of 70 per cent.

Shaath commented on CJT’s recent announcement that it would be expanding its operations, taking on five new Boeing 767s at a rate of one per quarter starting in Q3 2021, with three of the aircraft to serve current revenue generation needs and the other two to be focused on international opportunities.

“We continue to be bullish on CJT as we believe the company is on track for a multi-year growth period benefiting from the structural changes in both the retail industry and the international cargo markets,” Shaath wrote.

“Focusing on the latter, we view the company’s international growth plans very positively as CJT is poised to strengthen its position further with its Tier-1 partners such as DHL. Cargojet’s value to such partners will continue to increase as its network spreads further internationally and as structural shifts in their partners operational models continue,” he said.

“Specifically, operators such as DHL are becoming increasingly accustomed to the reliability and operational excellence of a dedicated partner such CJT (versus belly space tied to commercial airlines’ schedules and performance). We view this trend as overall positive for CJT’s long-term prospects and minimal-to-no-risk to its performance on the domestic network,” Shaath said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment