Is Newtopia the next Livongo? Mackie says it could be

Healthcare tech company Newtopia (Newtopia Stock Quote, Chart, News, Analysts, Financials TSXV:NEWU) received a coverage initiation from Mackie Capital analyst Yue Ma on Tuesday, where the stock was given a “Speculative Buy” rating and $1.10 price target.

Healthcare tech company Newtopia (Newtopia Stock Quote, Chart, News, Analysts, Financials TSXV:NEWU) received a coverage initiation from Mackie Capital analyst Yue Ma on Tuesday, where the stock was given a “Speculative Buy” rating and $1.10 price target.

Ma said Newtopia’s core business is built on an innovative platform for the rapidly growing market in chronic disease prevention.

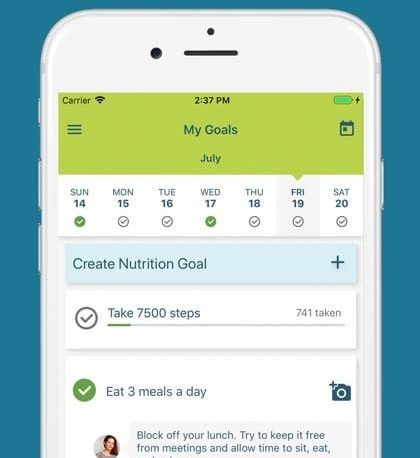

Toronto-based Newtopia is a tech-enabled disease prevention company with proprietary, hyper-personalized digital solutions for consumers at-risk for chronic diseases. The company’s approach involves genetic testing, virtual care, digital tools, smart devices and data science to not only personalize treatment but to focus on building confidence and changing habits of at-risk populations rather than, via the conventional approach, increasing knowledge and eduction to a general population.

Currently focusing on metabolic syndrome, Newtopia conducted a randomized controlled clinical trial in partnership with US insurance company Aetna and featuring 1,390 Aetna employees with an increased risk of metabolic syndrome, a cluster of conditions including high blood pressure, high blood sugar, excess body fat around the waist and abnormal cholesterol or triglyceride levels, which increase the risk of heart disease, stroke and type 2 diabetes.

The study found that Newtopia’s solution sustained employee engagement of 50 per cent over a one-year course and significantly reduced body weight by 4.3 per cent (ten pounds) in 76 per cent of participants. Three risk factors (waist circumference, triglycerides and cholesterol) significantly improved, as well, compared to the control group.

Overall, Newtopia found that improved clinical results were associated with a significant reduction in total health care costs of US$1,464 per participant per year, resulting in a positive return on investment within the first year. As Ma pointed out, an actuarial study based on an economic model estimated the Newtopia solution could save $1,700 per year for a Medicare Advantage member who engages with the solution for at least 12 months.

“[Newtopia’s] platform can potentially deliver sustainable clinical risk reductions and medical cost savings while enriching mental health, resilience and overall human performance,” Ma wrote. “Conventional chronic disease management programs typically only produce very short-term benefits. Based on its platform, Newtopia is currently offering a solution aimed at metabolic syndrome, which has proven to be effective in a randomized controlled clinical study conducted in partnership with Aetna.”

“Newtopia operates under a scalable enterprise sales model – for its solutions, the company has signed multi-year contracts with Fortune 500 companies that cover a total of 750,000 employees. The average recurring revenue of the metabolic syndrome solution is C$1,600 per participant across a three-year period, which should increase as Newtopia cross-sells complementary solutions,” Ma wrote.

Newtopia last reported its financials on November 12 where its third quarter 2020 numbers saw revenue grow by 99 per cent year-over-year to $2.4 million and gross profit grew by 182 per cent year-over-year to $1.2 million. Over the quarter, Newtopia closed on an oversubscribed and upsized $7.5-million bought deal offering, released a product suite, added a Fortune 50 innovator as a client and strengthened its analytics and outcomes measurement by adding multiple data science experts. (All figures in Canadian dollars except where noted otherwise.)

Founder and CEO Jeff Ruby called 2020 a monumental year for Newtopia.

“We’re continuing to see strong engagement levels as our client organizations and their employees recognize the value of our tech-enabled service and habit-changing platform throughout the pandemic, with over 90% of our revenue coming from engagement fees in the quarter,” Ruby said in a press release.

“With both an oversubscribed and upsized bought deal offering completed and a substantial new operating facility recently secured, Newtopia has bolstered its balance sheet with the financial resources to continue to innovate for our clients and their employees,” he said.

Newtopia has had an up-and-down tenure since debuting last May 4 at $0.69 per share. The stock climbed as high as $1.19 by mid-October before falling back to now the $0.60-$0.70 range.

Ma sees upside in the stock along with the potential for a takeout, with the analyst drawing comparisons between Newtopia and US healthcare company Livongo, which was bought last year by telemedicine company Teladoc for US$18.5 billion.

Ma said Teladoc was willing to pay such a hefty price for Livongo based on the cross-selling opportunity, where Livongo, which has a digital care product offering including smart devices and personalized coaching to consumers with chronic conditions, operates under an enterprise sales model and had signed contracts with employers, health plans, government and labour unions.

“The Livongo/Teladoc deal encouraged us to speculate that Newtopia could become attractive to larger digital health companies,” Ma wrote. “Newtopia has a similar business model as Livongo and offers similar digital habit-changing solutions for consumers in the broad chronic disease market. As Newtopia continues to grow its client base in the U.S., we believe the company should become a strategic and financial fit for digital health companies that seek to branch out into the virtual care market and expand product offerings.”

By the numbers, Ma thinks Newtopia will generate full 2020 revenue and fully diluted EPS of $11.4 million and negative $0.10 per share, 2021 revenue and EPS of $15.2 million and negative $0.04 per share and 2022 revenue and EPS of $20.3 million and negative $0.01 per share. At press time, Ma’s $1.10 target represented a projected 12-month return of 77 per cent.