BMO Capital Markets analyst Thanos Moschopoulos is holding steady on electronic manufacturing services company Celestica (Celestica Stock Quote, Chart, News TSX:CLS) after third quarter results this week.

BMO Capital Markets analyst Thanos Moschopoulos is holding steady on electronic manufacturing services company Celestica (Celestica Stock Quote, Chart, News TSX:CLS) after third quarter results this week.

In an update to clients on Thursday, Moschopoulos kept his “Hold” rating and $7.00 target price on the stock, which remains in the red for 2020.

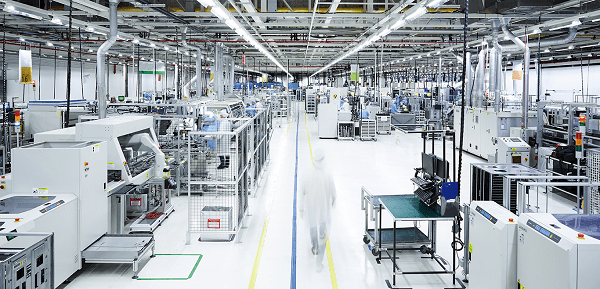

Toronto-headquartered Celestica, which manufactures hardware as well as supply chain solutions for enterprise customers in a range of industries from aerospace and defense to communications and healthcare, released its third quarter 2020 financials on Wednesday, showing revenue up two per cent year-over-year to $1.55 billion and adjusted EPS of $0.32 per share compared to a loss of $0.13 per share a year earlier. (All figures in US dollars.)

Management said the COVID-19 pandemic impacted the company’s commercial aerospace and industrial businesses in its Advanced Technology Solutions (ATS) segment, which saw a six per cent drop in quarterly revenue, while the company’s Joint Design and Manufacturing business propped up Celestica’s Connectivity & Cloud Solutions (CCS) segment, which saw revenue grow by seven per cent year-over-year and

altogether represent 66 per cent of the company’s total revenue for the quarter.

“In the third quarter, Celestica delivered sequential and year-over year revenue growth, as well as non-IFRS operating margin expansion,” said Rob Mionis, President and CEO, Celestica, in a press release.

“Our strong operating performance while managing a dynamic market environment reflects the strength of our portfolio and the progress we have made in executing our strategy. Our global team will continue to adapt to the evolving needs of our customers across the markets we serve, and we remain committed to generating sustainable long-term value for our customers and shareholders,” Mionis said.

The Q3 delivered free cash flow of $15.8 million, down from $66.2 million a year earlier, while Celestica ended the quarter with $451 million in cash and equivalents.

On the impact of COVID-19, the company said materials constraints were an issue, calculating $16 million in aggregate adverse revenue impact across its businesses during the quarter as a result. At the same time, the company says it had $11 million in government-related subsidies, credits and grants and customer recoveries which helped to mitigate the hit.

Celestica’s Q3 beat on the top and bottom numbers, where the $0.32 per share EPS was better than analysts’ consensus estimate at $0.24 per share and the topline of $1.55 billion beat the Street’s $1.50-billion estimate.

The market seemingly reacted negatively, however, dropping the stock on Wednesday by eight per cent. Celestica’s attempted rally this year from March lows has stalled and the stock currently remains down 28 per cent. Over a three-year time span, CLS is currently down 39 per cent.

Looking ahead, Celestica management guided for fourth quarter revenue of between $1.35 and $1.45 billion, which would represent at midpoint a six per cent year-over-year decrease and a ten-per-cent sequential drop.

Celestica is still in a restructuring period with its CCS segment, including a parting of ways with its biggest customer Cisco Systems. CLS made the call last year, saying returns had been lower than expected on its Cisco business, impacting overall profitability. Now a year into the Cisco separation, Celestica is estimating total restructuring costs for 2020 of about $30 million.

“We recorded a total of $19.0 million in restructuring charges during the first three quarters of 2020, including $3.7 million recorded in Q3 2020. Our restructuring charges for Q3 2020 consisted primarily of actions to adjust our cost base to address reduced levels of demand in certain of our businesses, including continued actions to right-size our commercial aerospace facilities as described above. We intend to implement restructuring actions in Q4 2020 in connection with the completion of the Cisco Disengagement, and to further adjust the cost base of our businesses undergoing continued demand pressures,” Celestica said.

The current analyst consensus on CLS is a “Hold” rating with an average target of $8.28, which would represent a one-year return of 29 per cent. For his part, Moschopoulos’ $7.00 target at press time represented a projected return of 19.5 per cent.

Earlier this year, Celestica announced a partnership with Canadian medical device company Starfish Medical to build 7,500 ventilators at Celestica’s Newmarket, Ontario, plant. The company said first delivery of the ventilators should come during the fourth quarter 2020.

“We are proud to partner with StarFish Medical in supplying the ventilators that healthcare professionals must have to treat COVID-19 patients who are in critical condition,” said Kevin Walsh, Vice President, HealthTech, Celestica, in a press release on May 20. “It’s a Canada-for-Canada alliance that will help to ensure our hospitals and healthcare workers have the equipment they need to save lives.”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment