The job done by Lightspeed POS (Lightspeed POS Stock Quote, Chart, News TSX:LSPD) to pivot through the pandemic is more reason to like the stock, says National Bank Financial analyst Richard Tse.

The job done by Lightspeed POS (Lightspeed POS Stock Quote, Chart, News TSX:LSPD) to pivot through the pandemic is more reason to like the stock, says National Bank Financial analyst Richard Tse.

In an update to clients on Tuesday, Tse maintained his “Outperform” rating while lifting his target price from US$50.00 to US$60.00, which at press time represented a projected 12-month return of 25.9 per cent.

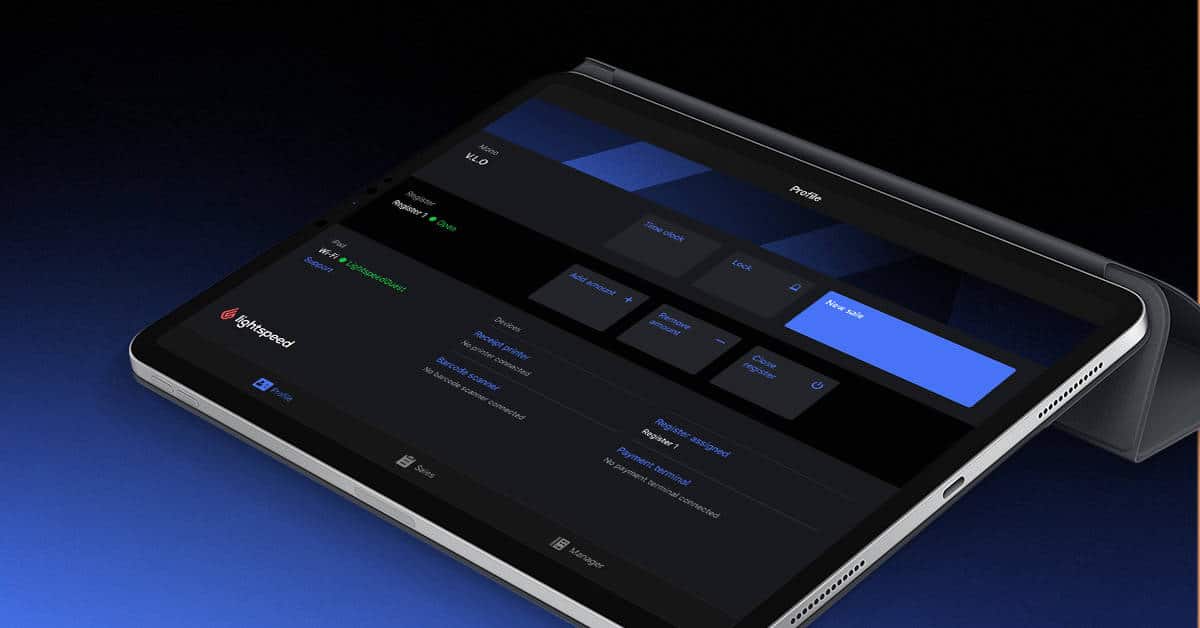

Montreal-based Lightspeed is a cloud-based point-of-sale platform for retailers and restaurants, with its products allowing users to manage end-to-end processes including inventory, loyalty, sales and analytics. The company, which had its IPO debut in March of 2019, has seen its share price rise over 2020, currently sitting up 80 per cent for the year.

On Tuesday, Tse attended an investors meeting with Lightspeed management —Dax Dasilva, CEO, Jean Paul Chauvet, President, and Brandon Nussey, CFO.

“While much of what we heard reinforced our investment thesis – the bigger takeaway was how those discussions underscored the potential size of this market and how Lightspeed’s strategy of using organic and acquisition measures is elevating their ability to fortify a growing leadership position within its targeted segments,” Tse wrote.

“Equally impressive has been the Company’s resilience and ability to pivot existing and prospective customers to relevant products under the current health backdrop. Looking ahead, while there remains uncertainty short-term with rotating global lockdowns, having shown its resilience at the height of the pandemic early this year – we’re confident in valuing this name beyond the short-term,” Tse said.

Tse said Lightspeed’s Payments segment is still early and scaling, with the company planning to roll out the service in all its core markets by the end of its fiscal year (March). The analyst is forecasting Payments revenue to go from the $11.2 million by the end of fiscal 2020 to about $127 million over the next three years, assuming a penetration rate of 18 per cent.

Tse also sees upside on Lightspeed’s average revenue per user, saying that by March of 2019, the number of LSPD’s customers using more than one module was about a third with an average ARPU of above $100, while today those numbers are 40 per cent and $175, respectively.

“As we look out, we think there continues to be considerable upside given a potential fully loaded ARPU of $500. While those increases and potential are obviously positive, what’s even more compelling is that it’s all occurred under a pandemic with a base of largely brick and mortar merchants. No doubt, the Company’s ability to adapt to the changing environment can’t be overlooked when it comes to assessing Management’s operating prowess – and it’s our view that if the Company can operate under the conditions of the past year, we think a normalized environment would amplify that ability to execute that much more,” Tse said.

Looking ahead, Tse thinks LSPD will generate fiscal 2021 revenue and adjusted EBITDA of $177.8 million and negative $25.0 million, respectively, and fiscal 2022 revenue and adjusted EBITDA of $223.4 million and negative $36.5 million, respectively.

Earlier this month, Lightspeed announced entering into a definitive agreement to buy New York-based cloud commerce platform provider ShopKeep in a $440-million deal to be funded by $145.2 million in cash and 9.5 million LSPD shares. Lightspeed said adding ShopKeep will immediately expand the company’s US market share, bringing the company to now over 100,000 customer locations worldwide at a time when businesses are replacing their legacy point-of-sale systems in order to adapt to evolutions in the consumer landscape.

“This acquisition will bring ShopKeep merchants, small and medium-sized businesses that make up the backbone of the U.S economy, into the Lightspeed family, providing them even more crucial product innovation and world-class support as they drive the reinvention of American commerce,” Dasilva said in a press release on November 5.

On the acquisition, Tse said in his report that it looks like ShopKeep has high merchant rankings much like Lightspeed and that along with broadening LSPD’s market, accretion from the deal will likely come from technology, people and a channel.

“The immediate impact will come from an additional 20,000 merchant locations in US retail with some obvious and considerable synergies coming from Lightspeed’s ability to sell modules like Loyalty into ShopKeep while ShopKeep’s early success with Capital should provide valuable data to scaling Lightpseed’s own offerings. In our view, the current market conditions should provide an opportunistic set of acquisition prospects over the next year,” Tse said.

Lightspeed’s share price saw a nice lift earlier this month with the release of the company’s fiscal second quarter 2021 results which featured revenue up 62 per cent year-over-year to $45.5 million and adjusted EBITDA at negative $2.8 million compared to negative $5.1 million a year earlier.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment