Docebo (Docebo Stock Quote, Chart, News TSX:DCBO) has been a clear winner of a stock during COVID-19 and it’s no wonder, says portfolio manager Kim Bolton, who sees the company as being in the right place at the right time.

Docebo (Docebo Stock Quote, Chart, News TSX:DCBO) has been a clear winner of a stock during COVID-19 and it’s no wonder, says portfolio manager Kim Bolton, who sees the company as being in the right place at the right time.

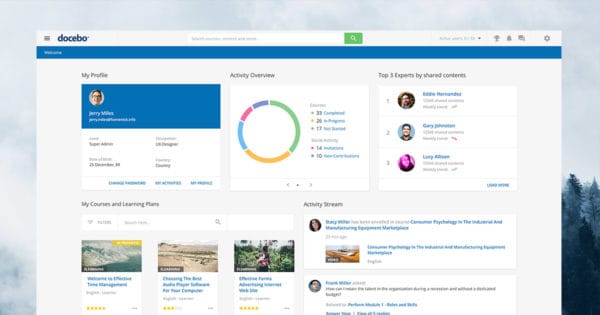

“Docebo is Latin for ‘I will teach,’ and what they develop is mobile learning Software asa Service, a cloud-based learning management platform. It’s somewhat like Pluralsight,” said Bolton, president of Black Swan Dexteritas, who spoke on BNN Bloomberg on Thursday.

“They’re out of the out of Toronto and they’ve been around for a long time, since 2006. It really strikes a chord during these COVID-19 times. They’ve got clients through North America and Europe and it really augments those traditional corporate learning management requirements out there and, certainly, in the work-from-home [environment].”

Docebo had its IPO last October, taking in $75 million with shares starting out at $16.00, and while the stock sort of trailed along over its first few months, once the initial pullback from the pandemic took its toll, DCBO started climbing and really hasn’t looked back since, now hitting $54.00 over the past week.

That share price appreciation came as the market spied a COVID winner: a company providing online learning tools to companies which in other circumstances might have been providing more in-office training but are now forced to do all of that work online, hence the benefit of Docebo’s offerings.

Docebo dubs itself as one of the first companies to adopt learning-specific AI algorithms in its e-learning platform, allowing its services to adapt to customer needs as they go along.

“With a customer base of more than 1600 organizations worldwide and millions of learners relying on the platform to enhance their professional development, the need for constant innovation is not only important to Docebo but to the organizations using the platform to empower their employees and grow their own operations,” said the company in a press release on its TSX debut.

And the company has had success in racking up significant clients wins, as evidenced earlier this month with Canadian insurer Economical Insurance choosing Docebo to modernize its training, which comes after last month’s announcement that Amazon Web Services (AWS) will be adopting Docebo’s platform to support training and certification to its users worldwide. As of its last reported quarter in August, Docebo had 2,046 customers worldwide, up from 1,651 customers a year earlier.

Docebo’s expansion plans were given a boost earlier this year with the successful closing in August of a financing round for $75 million, with the proceeds to be used to grow its customer base, expand its product offerings and support its M&A agenda. Altogether, Bolton says the company is doing great, although the share price may have gotten ahead of itself.

“We have a price target on this of $45.40 right now,” Bolton said. “There are some risks and this is a pretty competitive field. And they have high expectation of market adoption with this cloud based learning solution.”

“But they’re in the right place and that’s why the stock is especially done well of late,” he said.

National Bank analyst Richard Tse appears to agree with the sentiment, saying in a client update in August that Docebo combines a strong, differentiated product offering with a highly efficient sales and marketing model and shrewd capital allocation on the managerial side. And Tse thinks the company’s strengths go well beyond COVID-19.

While the focus today is on growth and capitalizing on the work-from-home trend brought about by the current health backdrop, we see a meaningful opportunity for operating leverage in this model as the company scales. In particular, we see that operating leverage coming across OPEX – R&D, G&A and S&M. And while it’s early, we think there could potentially be upwards of 2000 basis points in operating margin upside at scale,” Tse wrote on in his August 27 report.

Tse gave Docebo an “Outperform” rating and $60.00 target price, which at press time represented a projected 12-month return of 21.2 per cent.

Ahead of Docebo’s third quarter results due on November 12, the company last reported earnings in August where its second quarter 2020 featured revenue up 46.5 per cent year-over-year to $14.5 million, with subscription revenue making up the bulk of that at $13.4 million. Annual recurring revenue hit $57.0 million as of June 30 compared to $36.9 million a year earlier, while free cash flow was at break-even at negative $35,000.

“Now, more than ever, enterprises are realizing the importance of the LMS and the strength of our technology platform and responsiveness of our sales and support teams is allowing us to capitalize on the opportunities in the market,” said CEO Claudio Erba in a press release.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment