DraftKings stock is too hot to touch, this fund manager says

With the sports world up and running again, stocks like DraftKings (DraftKings Stock Quote, Chart, News NASDAQ:DKNG) in the US and Canada’s Score Media and Gaming are off to the races.

With the sports world up and running again, stocks like DraftKings (DraftKings Stock Quote, Chart, News NASDAQ:DKNG) in the US and Canada’s Score Media and Gaming are off to the races.

But investors looking to get in on the action should probably wait a bit, especially with DraftKings, says Brett Girard, portfolio manager and chief financial officer at Liberty International.

“DraftKings is sort of a microcosm of what’s going on in the broader market where we’re seeing the narratives come out about how day trading is taking the place of sports betting,” said Girard, speaking on BNN Bloomberg on Wednesday.

“Going forward now with the legalization of more betting in the United States, I think we’ll see DraftKings do well we’ll see a number of companies do well, even a homegrown company like the Score, which has in- app betting that’s definitely going to benefit from sports being back on,” Girard said.

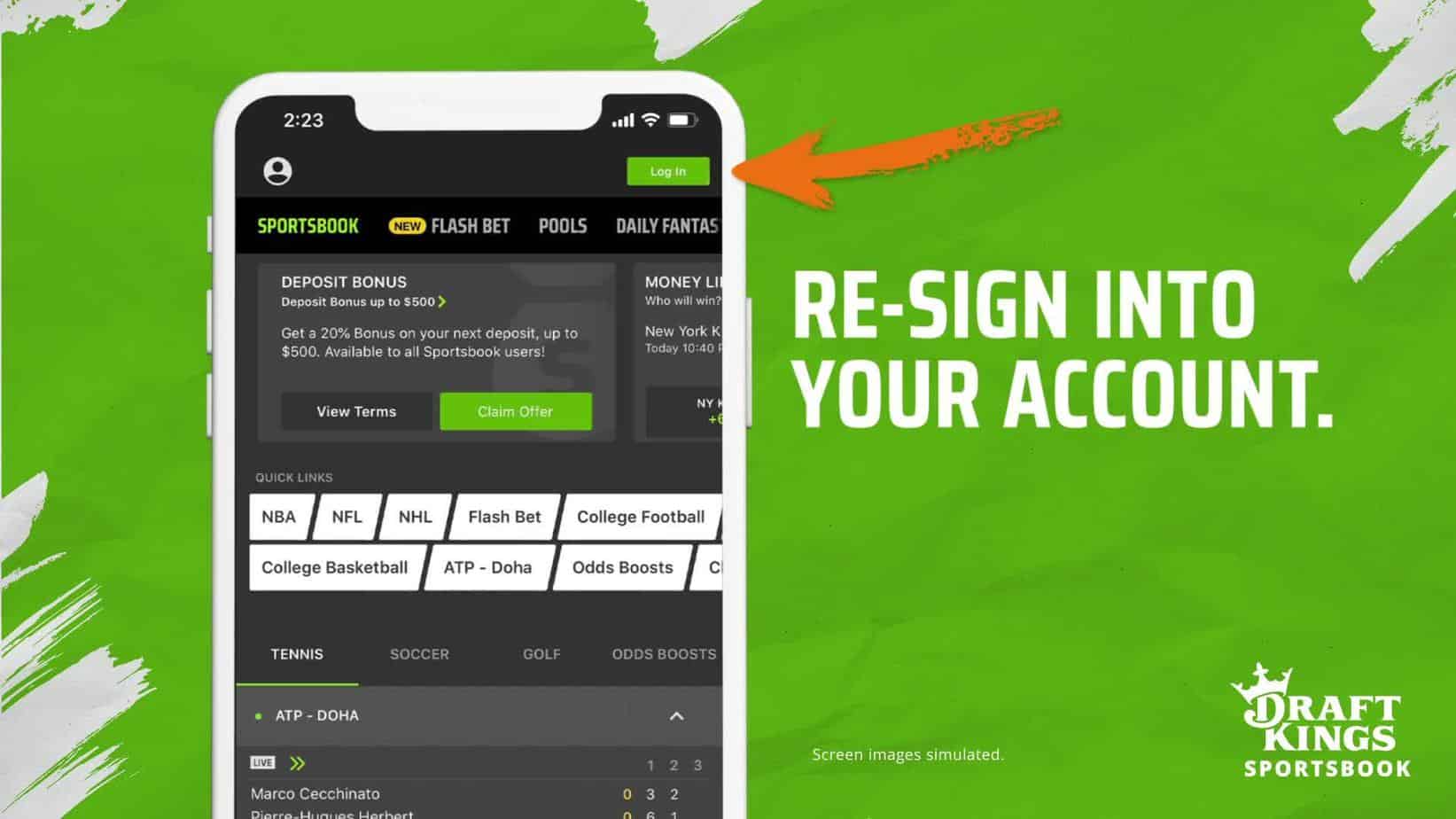

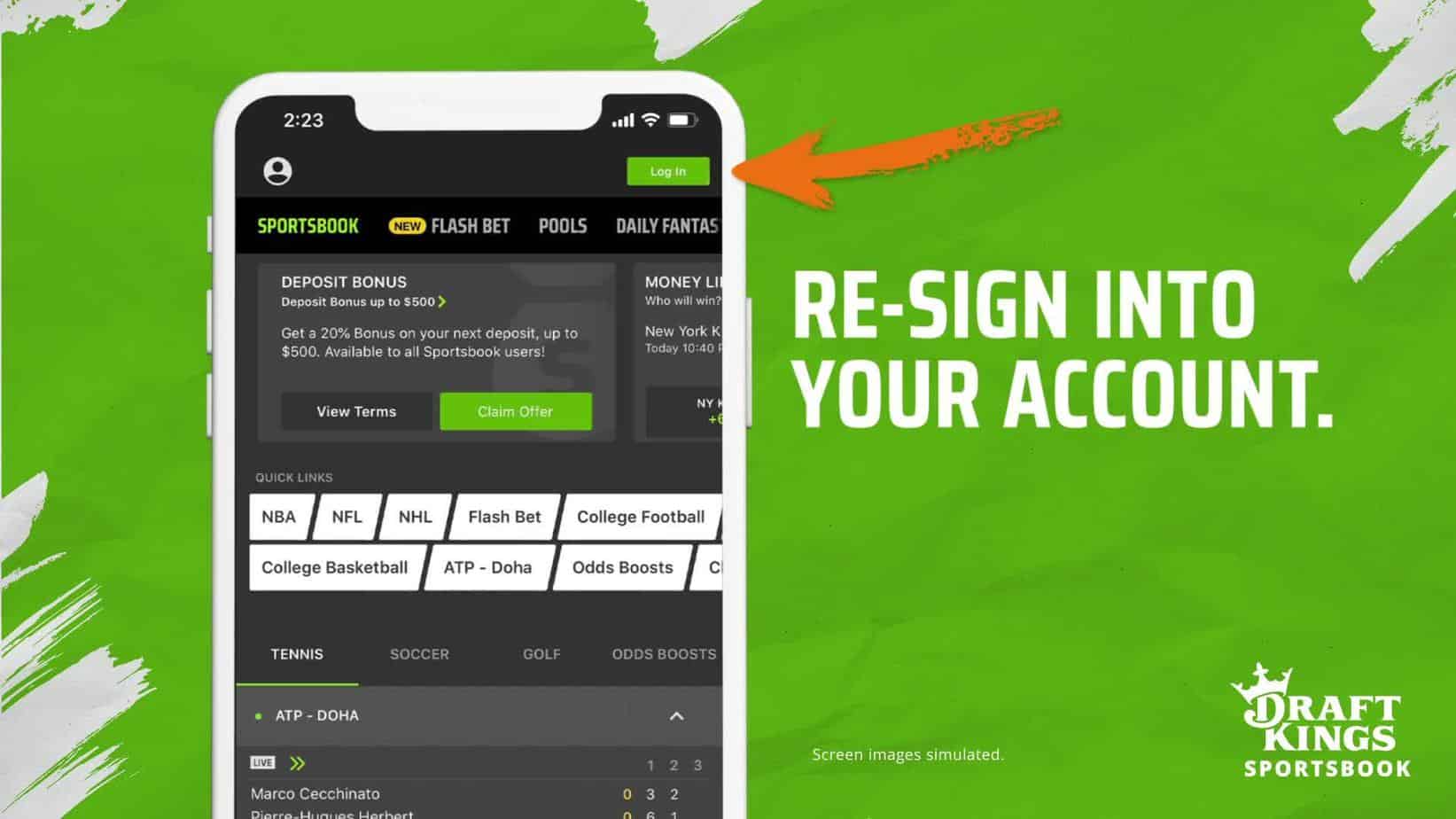

Boston-headquartered DraftKings, which has mobile sports betting in a number of US states starting with New Jersey in 2018, went public earlier this year via a reverse takeover, and the stock has been on fire ever since. DKNG more than doubled its value since April and has been a hot ticket in September, following news of a partnership with sports entertainment giant ESPN. The deal will see DraftKings become the exclusive provider of daily fantasy sports and co-exclusive partner for gambling with ESPN, with

DraftKings’ content to be integrated with ESPN’s online presence.

“ESPN helped revolutionize the 24/7 sports news cycle and continues to be the go-to source for many fans today on the latest and largest sports stories,” said Jason Robins, co-Founder, Chairman and CEO of DraftKings, in a press release. “We look forward to this collaboration to exclusively showcase DraftKings’ daily fantasy content and offerings while also advancing further visibility and mainstream adoption of our regulated sports betting products.”

Girard said while there’s nothing wrong with the online and mobile sports sector, investors might find a better entry point down the line for a name like DraftKings.

“I think longer term this is probably a trend that has a lot of legs, but it’s important that investors think about the price that they’re paying right now and what they’re getting for it,” Girard said.

“You don’t want to buy too much growth into the future because growth is not guaranteed —it’s not necessarily going to happen— so if you end up paying a really high price today, you can be challenged to see a return on that,” Girard said.

“What I may recommend though is if you’re really interested and you want to follow it, take a small position today and hang on to that cash and then wait for volatility down the road and potentially increase your position at maybe a more attractive price,” Girard said.

DraftKings saw its share price momentarily slip in August with the release of its second quarter earnings. The company posted a larger-than-expected loss of $0.55 per share or $161.4 million. Analysts had been expecting a loss of $0.20 per share. (All figures in US dollars.)