Appili Therapeutics gets new “Buy” rating at Industrial Alliance

Founded in 2015, Halifax-based Appili focuses on developing novel treatments to fight infectious diseases, targeting serious or life-threatening infections. The company also looks for near-to-market/revenue and commercial opportunities.

Appili currently has five programs: ATI-2307 (antifungal), ATI-1701 (biodefence), ATI-1503 (antibiotic), ATI-1501 (anti-infective) and Favipiravir (antiviral).

In May, Appili received approval from Health Canada to sponsor a Phase 2 clinical trial evaluating Favipiravir, a broad-spectrum antiviral discovered by FUJIFILM Toyama Chemical, as a treatment for SARS-CoV-2. The drug has already been approved in Japan and China for some types of influenza, while the US FDA has given Appili clearance to expand its Phase 2 trial into the US (along with the 16 long-term care facilities in Ontario).

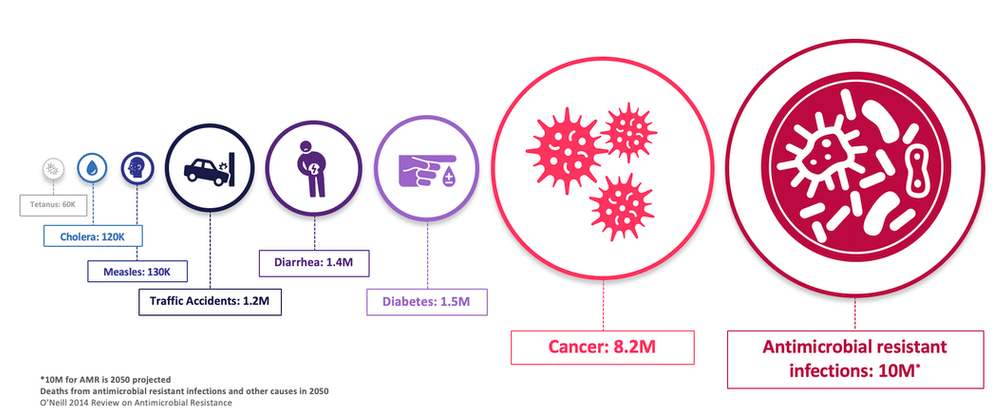

On the company’s pipeline, Stellick cited in her coverage initiation a report from the World Health Organization in January 2020 which stressed the lack of global efforts to contain drug-resistant infections, including a declining level of private investment and lack of innovation in the space.

“Antimicrobial resistant infections are becoming a major threat to global health, and with a heightened focus from governments and international health organizations, there are ample opportunities for federal support and funding. APLI is continuously identifying programs that can address unmet medical needs through in-licensing to add to its portfolio,” Stellick wrote.

Appili saw its share price spike in May to almost $1.90 but the stock has since fallen back and is trading in the $0.80 – $0.90 range. The company reported fiscal first quarter 2021 results on August 14, with zero revenue and a net loss of $2.6 million or $0.05 per share.

The company completed an equity financing round in June for $15.5 million and a concurrent private placement for $1.4 million. Appili said the funds will go primarily towards the Phase 2 trial with Favipiravir.

“Appili has entered the global effort to solve the COVID-19 pandemic, and our team, along with our partners, including Fujifilm Toyama Chemical and Sinai Health, are working diligently to advance this randomized controlled trial as quickly and as thoroughly as possible,” said Dr. Armand Balboni, CEO, in a June 10 press release.

Along with her “Buy” rating, Stellick has given a $3.00 price target, which at the time of publication represented a projected 12-month return of 275 per cent. The analyst’s target comes from a blend of DCF and EV/EBITDA valuation methods and features valuations of future cash flows from four of Appili’s five programs, excluding ATI-1503, for which a lead candidate has yet to be determined.

“Appili’s strong balance sheet ($25.5 million in cash on hand as of June 30) and recent public offering, position APLI to continue to grow its pipeline either via acquisitions or by advancing its current clinical trials for its five lead programs,” Stellick wrote.