PI Financial analyst David Kwan likes the look of Vecima Networks (Vecima Networks Stock Quote, Chart, News TSX:VCM) which just announced potentially their biggest contract win to date.

PI Financial analyst David Kwan likes the look of Vecima Networks (Vecima Networks Stock Quote, Chart, News TSX:VCM) which just announced potentially their biggest contract win to date.

In a corporate update to clients on Thursday, Kwan reasserted his “Buy” rating for Vecima but increased his target from $12.20 to $15.00, which as of press time represented a projected one-year return of

40.8 per cent.

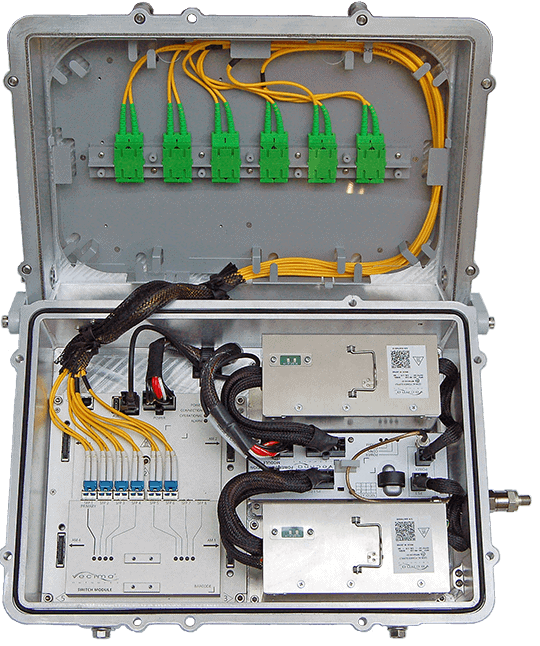

Victoria, BC-headquartered Vecima, which develops hardware and software solutions for broadband access, content delivery and telematics, announced on Tuesday the continued strategic partnership with a large, Tier 1 operator in the Asia Pacific region worth about $12 million in total. A long-time customer for Vecima, the company is upgrading via Vecima’s end-to-end, highly flexible and scalable MediaScaleX solution.

Vecima said the upgrade, which will take four to six quarters to complete, shows its position as a leader in video delivery and storage and should help the company’s expansion into high-growth markets, according to management.

“As we enter a new era of innovation in content delivery and storage built on high- performance, scalable solutions, we’re excited to continue to grow our 15-year partnership,” said Mr. Clay McCreery, Chief Operating Officer at Vecima, in a press release.

Looking at the contract, Kwan called the event a positive for VCM.

“Although it was the incumbent, VCM still had to beat out key competitors for this marquee win with a Tier 1 customer it has worked with for 15 years. This major upgrade will enable its +5M subscribers to have a superior video experience aided by increased capacity, resiliency and monitoring of their existing system,” Kwan said.

Commenting on Vecima’s operations, Kwan said its Content Delivery & Storage business, acquired in early 2018, is now performing very well and makes the acquisition look to be in retrospect at a great price: revenues have grown about 30 per cent year-over-year over the last year and up to almost 50 per cent from pre-acquisition levels, with good margins of 8.7 per cent net so far in fiscal 2020.

“While a lot of the focus is on the enormous upside from its Entra DAA platform (which should begin to ramp in the coming quarters), the CD&S business has continued to deliver strong growth and profitability, which has been further bolstered by this big contract win,” Kwan said.

The analyst left his forecasts unchanged for fiscal 2020 and 2021 but wrote that the contract win provides additional comfort to his estimates. Kwan is calling for fiscal 2020 revenue and adjusted EBITDA of $92.3 million and $16.7 million, respectively, and for fiscal 2021 revenue and EBITDA of $123.4 million and $23.6 million, respectively.

VCM dropped a long way during the market pullback earlier this year but the stock has since recovered and now sits up six per cent for the year.

On Monday, Vecima announced management changes including the promotion of Clay McCreery from CRO to COO and Colin Howlett to CTO, a newly created position, from VP of Architecture. The company said the moves will better position it for future growth.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment