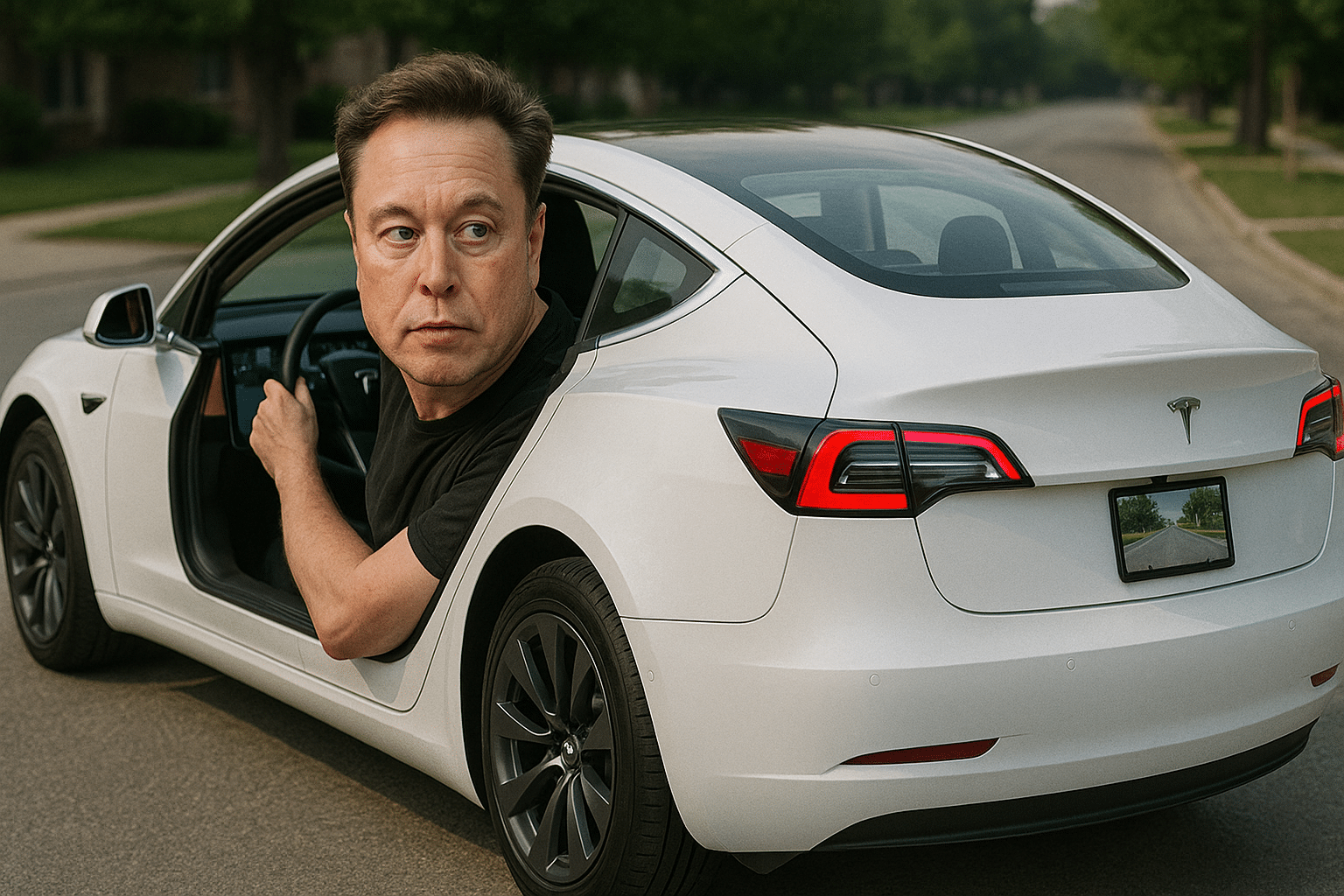

Is Elon Musk a positive or negative for Tesla?

Pat yourself on the back if you bought Tesla (Tesla Stock Quote, Chart, News NASDAQ:TSLA) at the right time to take advantage of its incredible run. But going forward you should be careful, partly because the company’s unpredictable leader is a wildcard, says one investor.

Pat yourself on the back if you bought Tesla (Tesla Stock Quote, Chart, News NASDAQ:TSLA) at the right time to take advantage of its incredible run. But going forward you should be careful, partly because the company’s unpredictable leader is a wildcard, says one investor.

Scotia Wealth’s Stan Wong says Tesla is priced for the kind of perfection that might not be possible to achieve with Musk at the helm.

Tesla’s share price took another big leap on Friday to round out a fortnight of huge gains as investors can’t seem to get enough of the electric car maker whose delivery numbers released on July 2 beat analysts’ estimates.

“Elon Musk’s erratic behaviour, let’s call it, adds some uncertainty for me to the stock price…”

Tesla’s share price is currently up 37 per cent since the start of July and up a monstrous 255 per cent year-to-date.

The company said it delivered 90,650 vehicles during its second quarter, up from 88,400 deliveries in the first quarter, even as its main factory in Fremont, California, was closed for six weeks starting the end of March due to the COVID-19 pandemic. Tesla produced 82,272 vehicles over the quarter versus 102,672 vehicles during the first quarter.

Wong says while the stock looks unstoppable, it’s also vulnerable to severe pullbacks if the company experiences any kind of hitch in its progress.

“Tesla has really been such a mover and shaker and you can’t deny the momentum behind this stock,” said Wong, director of wealth management at Scotia, who spoke to BNN Bloomberg on Thursday. “With that being said, you’re paying 150x on a forward basis with them for a 35 per cent growth rate, so it’s expensive. It’s also a high beta stock at almost 1.5x the beta of the market.”

“The market has high expectations for the company so any slowdown in growth or any execution problems which really haven’t happened just yet could lead to a correction in this share price,” said Wong.

“So, it’s a stock that I’ve stayed away from just because I think we can buy high growth companies with a better valuation that can give us a little bit more of a buffer zone in case anything goes wrong,” he added.

As for potential causes for a pullback, Wong pointed to CEO Elon Musk, whose unpredictability has been a drag on the stock in the past, even as Musk stands as a icon of sorts to many Tesla fans.

“Elon Musk’s erratic behaviour, let’s call it, adds some uncertainty for me to the stock price and looking forward on the long term basis there’s certainly a lot of competition from companies like Audi, BMW, General Motors and Mercedes. Those are things that I think about when I look at Tesla,” Wong said. “I think the product is good from what I’m seeing and hearing. I just think the valuation is just not quite there.”

Tesla delivered a profit of $16 million in its first quarter 2020, reporting revenue of $5.99 billion and EPS of $1.24 per share with free cash flow of negative $895 million. Analysts had been expecting revenue of $5.9 billion and an adjusted loss of $0.36 per share. Tesla reports its second quarter financials on July 22.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.