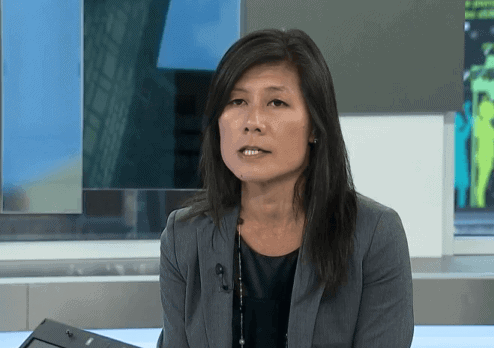

You should be buying CGI Group at these prices, says Christine Poole

If you’re looking for names ready to flourish in a post-COVID world, you should be thinking about Canadian IT consulting giant CGI Group (CGI Group Stock Quote, Chart, News TSX:GIB.A), says Christine Poole, who argues businesses will be looking to beef up their digital platforms coming out of the current crisis.

If you’re looking for names ready to flourish in a post-COVID world, you should be thinking about Canadian IT consulting giant CGI Group (CGI Group Stock Quote, Chart, News TSX:GIB.A), says Christine Poole, who argues businesses will be looking to beef up their digital platforms coming out of the current crisis.

“We’ve owned CGI for quite a while in our client portfolios, but at this price level, we’d be buying it,” says Poole, CEO of GlobeInvest Capital Management, who spoke to BNN Bloomberg on Wednesday.

Montreal-based CGI is one of the largest IT services companies in the world, employing 78,000 consultants and professionals worldwide and with half of its business in outsourcing and managed services and the other half in systems integration and consulting.

The company is a serial acquirer, which most often works through long-term service contracts in both the private and public sectors, and these contracts give a level of stability to its business, says Poole.

The managed services side of the business is long-term outsourcing contracts, so a very high recurring revenue stream, which is nice, especially when you’re going into a soft economic environment,” says Poole.

“With the lockdown and the pandemic, for a lot of businesses their proposal pipeline has slowed because companies are now focusing on their internal business, but we think going after this fact and even now talking to CGI they are having a lot more discussions with companies who are realizing how important it is to build out their digital platforms (as those are the companies that are doing well) and how important it is to have a cybersecurity strategy in place to protect your businesses,” Poole said.

“As well, with the economic slowdown everyone is looking for productivity enhancements and improvements, so they’re looking at outsourcing solutions,” Poole said. “So CGI is well positioned to benefit from those ongoing trends and given what’s happened in the last few months it kind of highlights to companies and enterprises how important that is.”

CGI has been as solid as they come over the past decade, supplying positive returns year after year. The stock was on a great run, having delivered 33.6 per cent over 2019, but GIB.A hit a bump when it delivered quarterly results at the end of January.

CGI’s fiscal first-quarter 2020 profit dropped from $311.5 million a year ago to $290.2 million or $1.06 per share, with management pointing to one-time restructuring costs and integration expenses.

The Q1 results pulled the stock down about ten per cent, which ended up being small potatoes compared to the more than 35 per cent drop which came in late February and early March as a result of COVID-19. So far, CGI has made up about half of that ground but still remains well off its recent highs.

CGI reported its fiscal second quarter on April 29, where revenue grew by two per cent to $3.13 billion while net earnings fell by $3.4 million to $314.8 million.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.