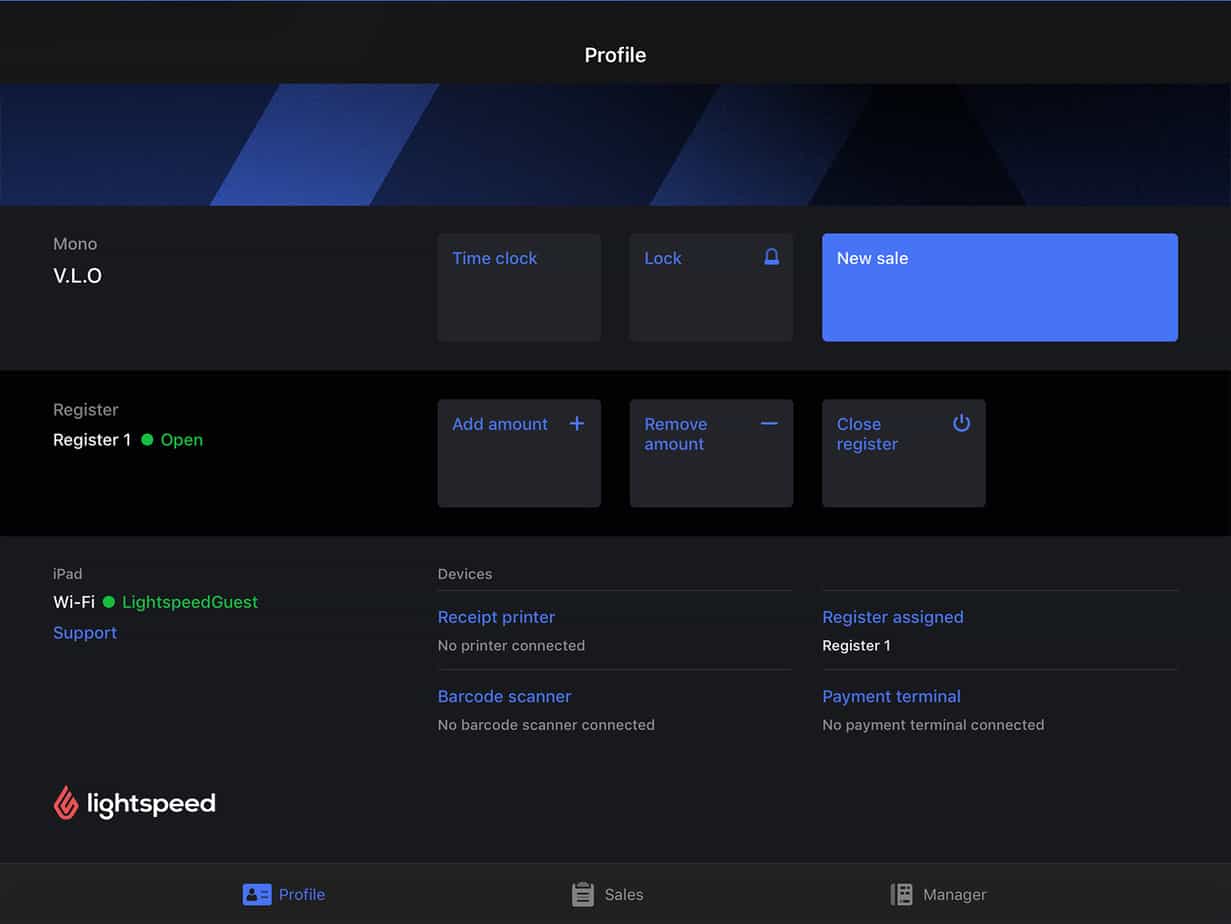

Lightspeed POS is overvalued, this fund manager says

Is the success of Lightspeed POS (Lightspeed POS Stock Quote, Chart, News TSX:LSPD) deserved?

Is the success of Lightspeed POS (Lightspeed POS Stock Quote, Chart, News TSX:LSPD) deserved?

As Canadians we have a tendency to disparage home-grown talent until they’ve made their mark elsewhere, particularly in the States, but the opposite may be true when it comes to stocks, says Darren Sissons, portfolio manager at Campbell, Lee & Ross, who thinks cloud-based point-of-sale platform Lightspeed is a prime case where Canadians are giving too much love to one of their own.

“What I what I would say on Lightspeed is it's actually growing very quickly, but the challenge is obviously valuation,” said Sissons, speaking on BNN Bloomberg on Thursday.

“It doesn't really make a profit, so what you're effectively bidding on is continuation of the growth and at some point maybe a conversion to profitability or ultimately an acquisition. So, I'm troubled by the valuation on the stock,” he said.

Lightspeed came on the scene last March as the biggest Canadian tech IPO in almost a decade, and the stock didn’t disappoint, doubling in value by the close of 2019. But while the past six months have been less rosy, so much could be said for a great many stocks which got pasted in February and March and have yet to regain all of that lost ground.

Still, LSPD is sitting at about break-even for the past 12 months and showed impressive gains since the start of April, buoyed at least in part by better-than-expected results last month, impressive for a company whose bread and butter, small and medium-sized businesses in retail and restaurants, was hit hard by COVID-19.

For the quarter ended March 31, the company delivered a 70 per cent year-over-year increase in revenue to $36.3 million with a loss of $18.6 million compared to a loss of $96.1 million a year ago.

“In the month of March, Lightspeed saw record uptake of Lightspeed eCommerce, Lightspeed Delivery and Lightspeed Payments platforms as retailers and hospitality businesses worldwide adopted new sales channels to continue reaching customers amidst the outbreak of COVID-19. The need for an omni-channel cloud solution coupled with modern, integrated payment solutions is no longer a competitive differentiator, but a business imperative,” read Lightspeed’s fiscal fourth quarter release on May 21.

Still, Sissons thinks the stock has gotten ahead of itself, making it a risky purchase at this time.

“One of the challenges of buying high-priced stocks once they've had a run is whether or not you're going to be the one holding the bag at the end of the day,” Sissons said. “If you do like the company and you think its offering is good, then I would say lower your weight in terms of getting an allocation. That would be one strategy.”

“But I would caution that Canadians tend to have a love affair or home bias and buy stocks and push valuations up significantly and I think this is happening in this particular case,” Sissons said.

“If the valuation came back down to Earth a little bit further then I'd probably be interested in taking a closer look. Good company, good offering but the valuation is just too rich for us,” he said.