FONE stock is a beaten down pot stock worth owning: Mackie Research

Mackie Research analyst Greg McLeish likes the look of US cannabis play Flower One (Flower One Stock Quote, Chart, News CSE:FONE) after the company latest quarterly results.

Mackie Research analyst Greg McLeish likes the look of US cannabis play Flower One (Flower One Stock Quote, Chart, News CSE:FONE) after the company latest quarterly results.

McLeish reviewed FONE’s fourth quarter 2019 and year-end results in an update to clients on Wednesday and

maintained his “Buy” rating with the new price target of C$1.65 per share.

Calling 2019 a transformational year for Flower One, the company reported its Q4 results on Monday, featuring revenue up sequentially by 132 per cent to $5.8 million with gross margins of 44 per cent up from 25 per cent for the previous quarter. (All figures in US dollars except where noted otherwise.)

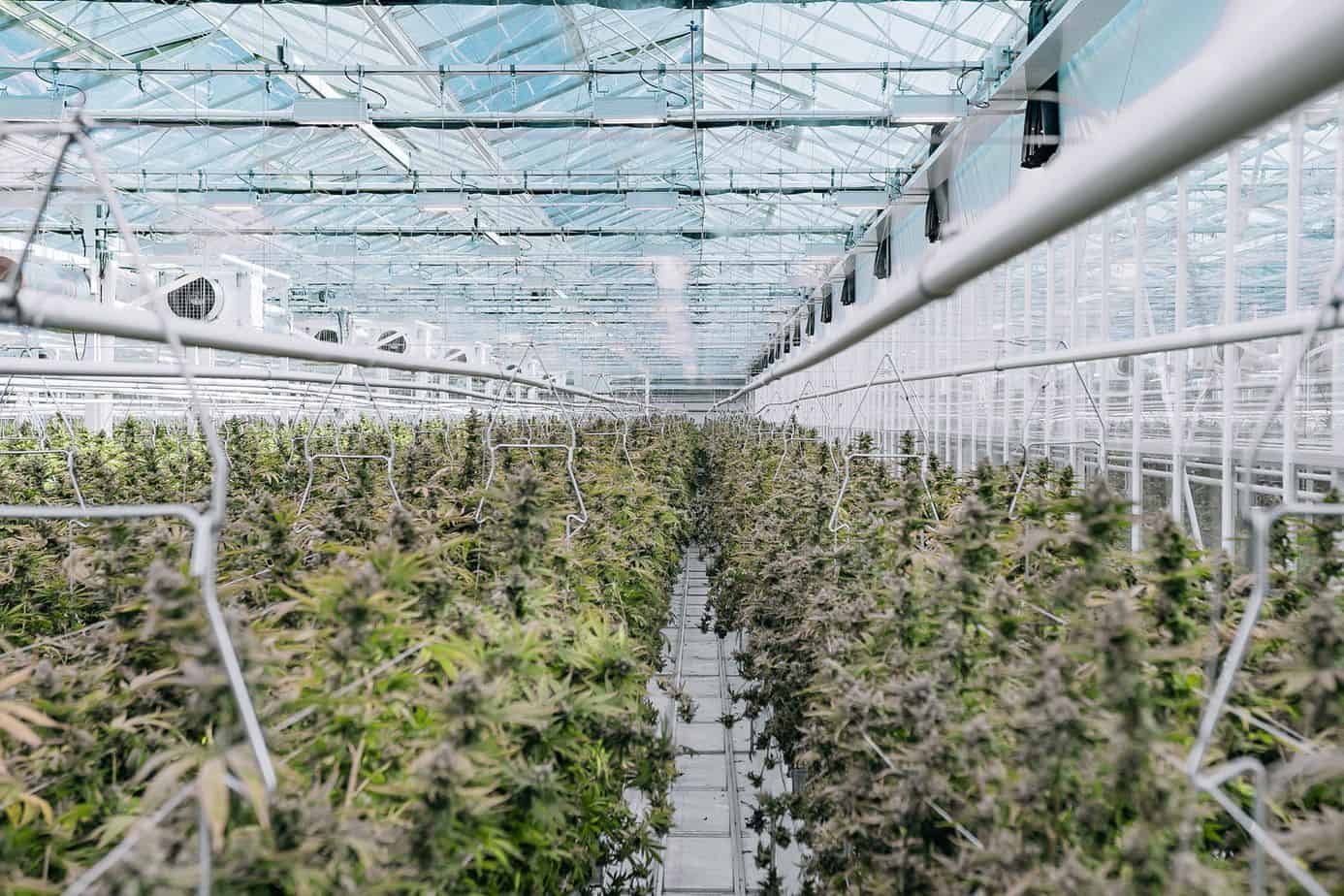

Vertically integrated cannabis company Flower One targets the medical and rec markets in Nevada and has a 400,000 sq. ft. greenhouse and 55,000 sq. ft. production facility in the state. FONE started flower sales from the greenhouse in August of last year, with cannabis extraction and production coming online in September. Highlights of the Q4 included the launching of three brands and obtaining two new partnerships, both of which should be launched in upcoming weeks, according to Flower One.

“Our average harvested cash cost of $0.40 per gram in the fourth quarter represented a ten per cent reduction to Flower One’s previously reported industry-leading cash cost per gram achieved in the third quarter,” said president and CEO Ken Villazor in a press release. “Importantly, the strong sales momentum generated in the last several months of 2019 following the initial launch of flower sales from our flagship greenhouse in August, carried into the first quarter of 2020, culminating in record sales of $3.9 million in the month of March.”

FONE’s fourth quarter revenue of $5.8 million was ahead of McLeish’s $5.2 million estimate, while the company’s EBITDA loss of $5.6 million was larger than the analyst’s forecasted loss of $3.1 million. McLeish said the earnings miss came down to an unrealized fair value adjustment on growth of biological assets which negatively affected the quarter’s pretax income.

McLeish wrote that FONE has been focusing on cultivating specific strains for brand launches through the first half of 2020, resulting in the accumulation of inventory, a large portion of which is likely to be shifted to extraction for the launch of Flower One’s derivatives lineup.

On its production, the analyst noted that costs could fall if the company is able to maintain its currently high production yields at its Nevada greenhouse, thus making it more challenging for FONE’s competitors to match Flower One’s scale and low cost structure. In fact, McLeish estimated it would take up to three years for a competitor in the Nevada market to build up to the formidable scale of Flower One’s NV production.

“Flower One’s initial focus on a single state market (Nevada) has allowed it to focus on tight execution of its strategy and do so without being asset‐heavy across multiple state markets,” McLeish wrote. “This initial single state focus also allowed the company to be revenue generating with its flagship assets in the Nevada within 16 months of starting construction.”

Looking ahead, McLeish’s forecast calls for FONE to generate fiscal 2020 revenue and EBITDA of $31.3 million and negative $4.5 million, respectively, and fiscal 2021 revenue and EBITDA of $71.1 million and $15.6 million, respectively.

At press time, McLeish’s C$1.65 target represented a projected return of 184 per cent.