Cisco Systems is a buy, this fund manager says

It may be a name more reminiscent of the dot-com bubble than today’s much-changed tech scene but Cisco Systems (Cisco Systems Stock Quote, Chart, News NASDAQ:CSCO) is a solid buy for today and beyond the COVID-19 pandemic.

It may be a name more reminiscent of the dot-com bubble than today’s much-changed tech scene but Cisco Systems (Cisco Systems Stock Quote, Chart, News NASDAQ:CSCO) is a solid buy for today and beyond the COVID-19 pandemic.

So says portfolio manager Gordon Reid who advises investors to look past the near-term turbulence.

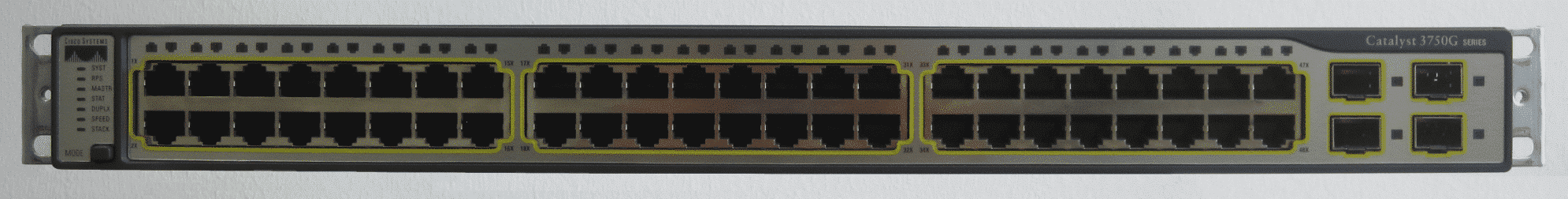

“We own Cisco Systems and [CEO] Chuck Robbins took over from John Chambers in 2015 and took what was at the turn of the century the leader in computer internet hardware routers, switches, and so on and has turned that ship,” said Reid, CEO of Goodreid Investment Counsel, who spoke about Cisco on BNN Bloomberg on Tuesday.

Investors will be paying particular attention to Cisco’s fiscal third quarter earnings scheduled to drop after market close on Wednesday. Cisco is expected to report a major decline in revenue due to the pandemic-caused economic contraction, as businesses look to trim costs and forego spending on things like new routers and switches, Cisco’s bread and butter.

Analysts are calling for revenue of $11.88 billion, down year-over-year from $13 billion, and EPS of $0.71 per share versus $0.78 per share a year earlier.

Cisco had been a rare example of a relatively poor performer in 2019 compared to the rest of the market and the stock took another hit earlier this year on the company’s second quarter earnings delivered on February 12. Those numbers showed year-over-year declines for both of Cisco’s major segments, Infrastructure Platforms and Applications, which both fell eight per cent from the previous year.

At the time, management was calling for a slight decline in revenue for the third quarter, but that was before the full brunt of COVID-19 was made plain, with Cisco at the time basing its lowered predictions on the impact from a slowdown in China. How a worldwide economic malaise will come through in Cisco’s third quarter will be watched closely, as spending on Cisco’s products often portends purchases of more pricey buys like software.

But Reid says the pivot Cisco has made towards software products like security services and video conferencing will bear more fruit as time goes by.

“They’re positioning themselves now to be a leader in the new technology age of 5G. So, we were quite excited about owning Cisco,” Reid said. “The stock has suffered a little bit with COVID-19, but you might have seen some of the video that is being used for interviews, being shot through Cisco equipment, their WebEx system, which has been a very big boon for them during this time.”

“So I would say Cisco which is going to have a kind of a mixed bag of results [in the quarter]. But I think there’s a lot to like there,” Reid said.

Cisco had a great first half to 2019, climbing almost 28 per cent between January and the end of June. But the stock fell over the latter half and finished the year up a little under 11 per cent.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.